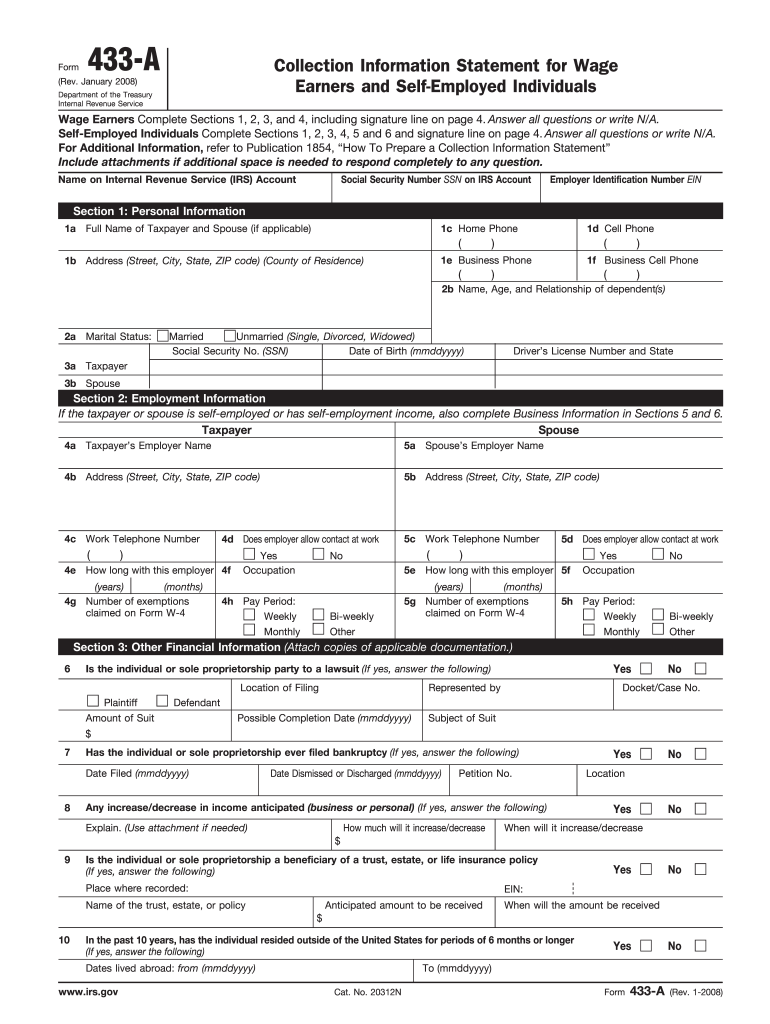

Irs Form 433a 2008

What is the IRS Form 433A

The IRS Form 433A is a financial disclosure form used by individuals to provide the Internal Revenue Service (IRS) with detailed information about their financial situation. This form is typically required when a taxpayer is seeking to set up an installment agreement or settle a tax debt for less than the full amount owed. It helps the IRS assess the taxpayer's ability to pay and determine a reasonable payment plan.

How to Use the IRS Form 433A

To effectively use the IRS Form 433A, begin by gathering all necessary financial documents. This includes information about income, expenses, assets, and liabilities. The form requires detailed disclosures about your monthly income, living expenses, and any assets you may own. Once completed, submit the form to the IRS as part of your request for a payment plan or an offer in compromise.

Steps to Complete the IRS Form 433A

Completing the IRS Form 433A involves several key steps:

- Gather financial information: Collect documentation for income, expenses, assets, and debts.

- Fill out personal information: Provide your name, address, and Social Security number.

- Detail your income: List all sources of income, including wages, self-employment income, and other earnings.

- List your expenses: Include necessary living expenses such as housing, utilities, food, and transportation.

- Report assets: Document all assets, including bank accounts, real estate, and vehicles.

- Review and sign: Ensure all information is accurate before signing and dating the form.

Legal Use of the IRS Form 433A

The IRS Form 433A is legally binding when completed and submitted correctly. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties or rejection of your application. The form must be signed by the taxpayer, affirming that all provided information is correct to the best of their knowledge.

Key Elements of the IRS Form 433A

Several key elements are crucial when filling out the IRS Form 433A:

- Personal Information: This includes your name, address, and Social Security number.

- Income Details: A comprehensive list of all income sources, including wages and self-employment earnings.

- Monthly Expenses: Detailed breakdown of necessary living expenses.

- Asset Information: Disclosure of all assets owned, such as properties and vehicles.

- Liabilities: Information regarding debts and obligations.

Form Submission Methods

The IRS Form 433A can be submitted through various methods. Taxpayers may choose to mail the completed form directly to the IRS or submit it electronically if applicable. It is important to check the IRS guidelines for the specific submission process related to your tax situation, as this can vary based on the reason for filing the form.

Quick guide on how to complete irs form 433a 2008

Complete Irs Form 433a effortlessly on any device

Online document management has become popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Irs Form 433a on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The most efficient way to modify and eSign Irs Form 433a without stress

- Locate Irs Form 433a and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and eSign Irs Form 433a and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 433a 2008

Create this form in 5 minutes!

How to create an eSignature for the irs form 433a 2008

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is Irs Form 433a?

Irs Form 433a is a form used by the IRS to gather financial information from individuals or businesses to evaluate their ability to pay tax debts. This form is essential for anyone looking to request a payment plan or settle tax debts with the IRS.

-

How can airSlate SignNow help with Irs Form 433a?

airSlate SignNow allows you to fill out and electronically sign Irs Form 433a easily and securely. With its user-friendly platform, you can streamline the submission process and ensure your form is completed accurately.

-

Is there a cost associated with using airSlate SignNow for Irs Form 433a?

Yes, airSlate SignNow offers several pricing plans to suit different business needs. These plans provide you with access to all features required to complete and eSign forms like Irs Form 433a efficiently.

-

What features does airSlate SignNow offer for Irs Form 433a?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure cloud storage, making it ideal for managing Irs Form 433a. These tools simplify the completion and submission process, ensuring compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software to manage Irs Form 433a?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage Irs Form 433a alongside your other business solutions. This capability enhances your workflow and helps maintain organized documentation.

-

What are the benefits of using airSlate SignNow for Irs Form 433a?

Using airSlate SignNow for Irs Form 433a enhances efficiency and accuracy in filling out forms. Its electronic signature capabilities speed up the approval process and help you focus on resolving your tax issues faster.

-

How secure is airSlate SignNow when handling Irs Form 433a?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures when handling documents like Irs Form 433a. You can rest assured that your sensitive information is protected throughout the signing process.

Get more for Irs Form 433a

- Employment or job termination package idaho form

- Newly widowed individuals package idaho form

- Employment interview package idaho form

- Employment employee personnel file package idaho form

- Assignment of mortgage package idaho form

- Assignment of lease package idaho form

- Lease purchase agreements package idaho form

- Satisfaction cancellation or release of mortgage package idaho form

Find out other Irs Form 433a

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple