Form E 536R Fillable Schedule of County Sales and Use Taxes for Claims 2022-2026

What is the Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

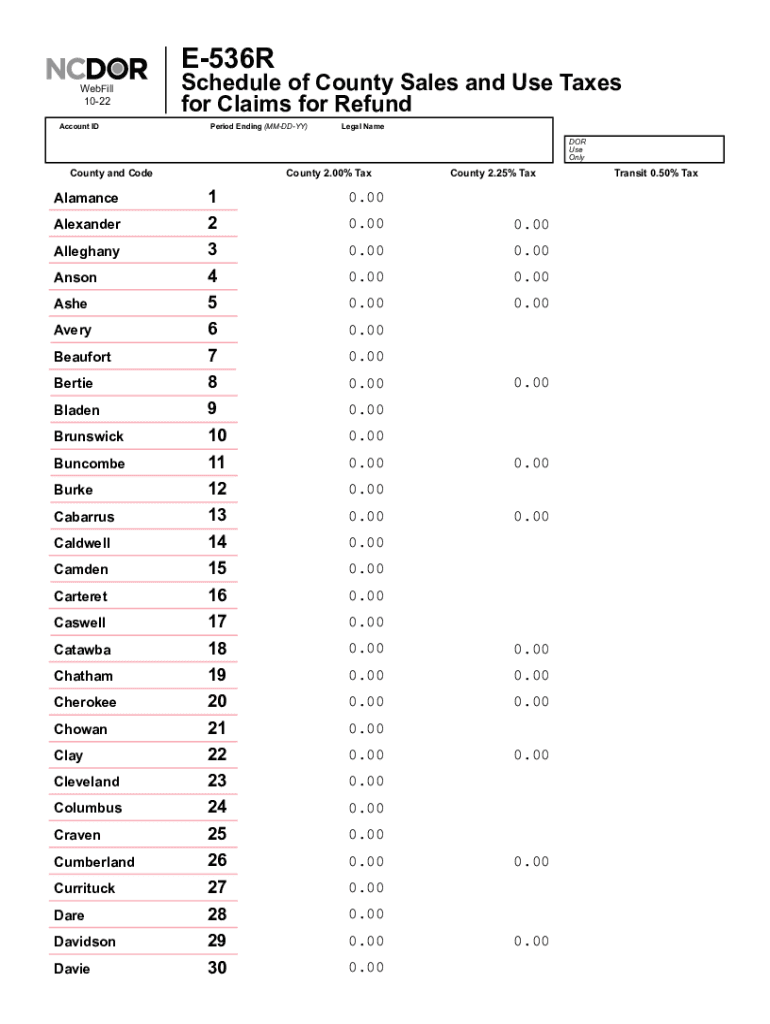

The Form E 536R is a fillable schedule used in North Carolina for reporting county sales and use taxes. This form is essential for businesses and individuals seeking to claim refunds on sales and use taxes paid to counties. It provides a structured format for detailing the amounts claimed, ensuring compliance with state tax regulations. Utilizing this form correctly can facilitate smoother transactions and accurate reporting for tax purposes.

How to use the Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

To use the Form E 536R effectively, begin by downloading the fillable version from the appropriate state resources. Fill in the required fields, including your personal or business information, the total sales and use taxes paid, and the specific amounts you are claiming for refund. Ensure that all entries are accurate and complete to avoid delays in processing. Once completed, the form can be submitted according to the guidelines provided by the North Carolina Department of Revenue.

Steps to complete the Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

Completing the Form E 536R involves several key steps:

- Download the fillable form from the North Carolina Department of Revenue website.

- Enter your name, address, and other identifying information at the top of the form.

- Detail the sales and use taxes you have paid, specifying the amounts for each county.

- Include any supporting documentation that verifies your claims, such as receipts or invoices.

- Review the form for accuracy before submission.

Key elements of the Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

The Form E 536R includes several key elements that must be addressed to ensure proper processing. These elements include:

- Taxpayer Information: This section captures the name and address of the individual or business filing the claim.

- Claim Amounts: Clearly outline the total sales and use taxes paid, broken down by county.

- Supporting Documentation: Attach necessary receipts or invoices that substantiate your claims.

- Signature: The form must be signed to validate the claim, confirming the information provided is accurate.

Legal use of the Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

The legal use of the Form E 536R is governed by North Carolina tax laws. It is designed to ensure that taxpayers can claim refunds for overpaid sales and use taxes in compliance with state regulations. Proper completion and submission of this form protect the rights of taxpayers to receive refunds while maintaining transparency and accountability in tax reporting.

Form Submission Methods (Online / Mail / In-Person)

The Form E 536R can be submitted through various methods, depending on the preferences of the filer. Options include:

- Online Submission: If available, submitting the form electronically can expedite processing.

- Mail: The completed form can be printed and mailed to the designated address provided by the North Carolina Department of Revenue.

- In-Person: Filers may also have the option to submit the form in person at local tax offices, ensuring immediate receipt and confirmation.

Quick guide on how to complete form e 536r fillable schedule of county sales and use taxes for claims

Effortlessly Prepare Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims with Ease

- Obtain Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form e 536r fillable schedule of county sales and use taxes for claims

Create this form in 5 minutes!

People also ask

-

What is e536r and how does it relate to airSlate SignNow?

e536r is an innovative feature within airSlate SignNow that enhances your document signing experience. It provides users with advanced functionality for sending and managing documents securely. With e536r, you can streamline your workflow, making it easier to collect electronic signatures.

-

What are the pricing options for using e536r with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that include e536r features at competitive rates. You can choose from monthly or annual subscriptions depending on your business needs. There are also customized plans available for enterprises that require additional support and features.

-

What features does e536r include in airSlate SignNow?

e536r includes a variety of features, such as document templates, advanced user permissions, and real-time tracking of document status. These features ensure that the document signing process is efficient and transparent. Users can also access integrations with other software platforms to enhance their workflow.

-

How can e536r benefit my business?

Utilizing e536r with airSlate SignNow can signNowly enhance your document management processes. By simplifying e-signatures and automating workflows, your team can save time and reduce errors. This leads to increased productivity and allows you to focus on your core business activities.

-

Is e536r easy to integrate with other platforms?

Yes, e536r is designed to seamlessly integrate with various software platforms such as CRM systems and cloud storage. This compatibility allows for a more cohesive workflow, enabling users to manage documents effectively. Integration enhances the overall functionality of airSlate SignNow.

-

What security measures does e536r have in place?

e536r includes robust security features that protect your sensitive documents during the signing process. AirSlate SignNow employs encryption protocols and secure cloud storage to ensure your data is safe. Regular backups and compliance with e-signature regulations further enhance document security.

-

Can I customize the e536r experience for my team?

Absolutely! airSlate SignNow allows businesses to customize the e536r experience according to specific team needs. Administrators can set up unique workflows, permissions, and notifications to tailor the signing process. This customization helps ensure that your team operates effectively and efficiently.

Get more for Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

- Grant deed individual to individual oklahoma form

- Oklahoma mineral form

- Warranty deed from an individual to a limited liability company oklahoma form

- Mineral deed from a corporation to a limited liability company oklahoma form

- Oklahoma lien form

- Ok child support form

- Oklahoma support form

- Request for address of record oklahoma form

Find out other Form E 536R Fillable Schedule Of County Sales And Use Taxes For Claims

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free