Nc Form E 536r 2017

What is the Nc Form E 536r

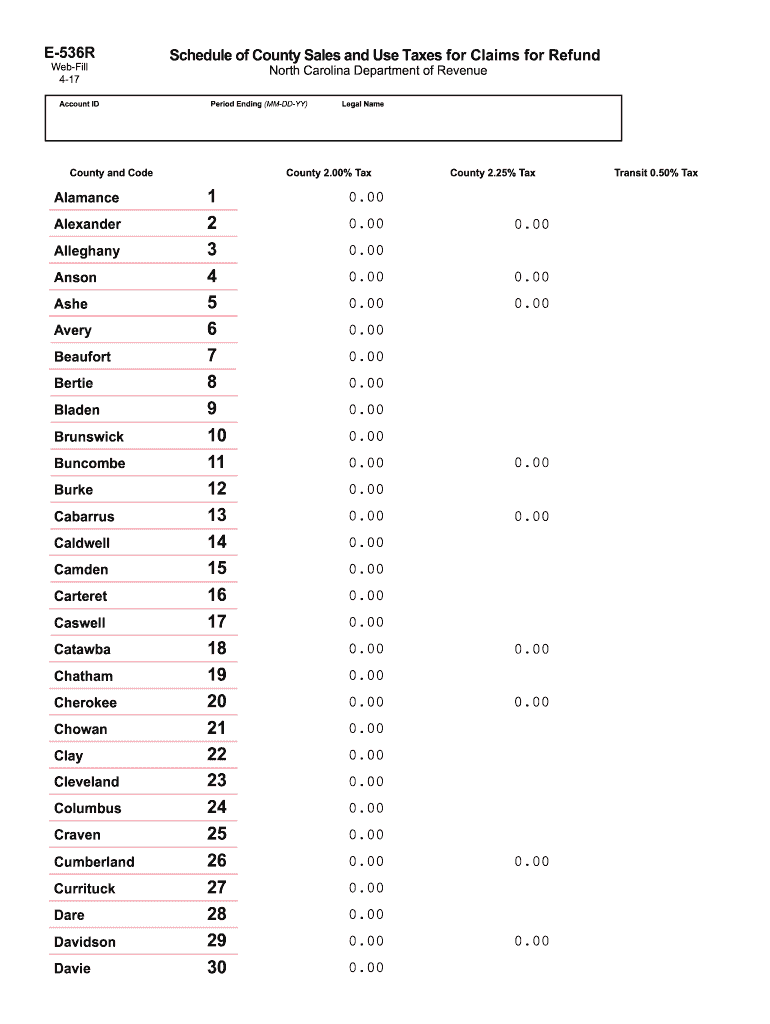

The Nc Form E 536r is a tax-related document used primarily in North Carolina. This form is essential for individuals and businesses who need to report specific tax information to the state. It serves as a means to ensure compliance with state tax regulations and is a crucial part of the tax filing process for residents and entities operating within North Carolina.

How to use the Nc Form E 536r

Using the Nc Form E 536r involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial data relevant to the tax year. Next, fill out the form accurately, ensuring that all sections are completed as required. After filling out the form, review it for any errors before signing. Finally, submit the completed form to the appropriate state tax authority, either electronically or by mail.

Steps to complete the Nc Form E 536r

Completing the Nc Form E 536r requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including previous tax returns and financial statements.

- Access the Nc Form E 536r online or obtain a physical copy.

- Fill in personal information, such as name, address, and Social Security number.

- Provide accurate financial data as requested in the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the specified submission methods.

Legal use of the Nc Form E 536r

The Nc Form E 536r is legally recognized by the state of North Carolina for tax reporting purposes. It must be completed accurately to avoid penalties and ensure compliance with state tax laws. The form is designed to meet the requirements set forth by the North Carolina Department of Revenue, making it a critical document for taxpayers in the state.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Nc Form E 536r. Typically, the form must be submitted by the state’s tax deadline, which aligns with the federal tax filing date. Taxpayers should check for any specific deadlines that may apply to their situation, including extensions or special circumstances that could affect their filing timeline.

Form Submission Methods (Online / Mail / In-Person)

The Nc Form E 536r can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the North Carolina Department of Revenue's website.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete nc form e 536r 2017

Your assistance manual on how to prepare your Nc Form E 536r

If you’re curious about how to generate and send your Nc Form E 536r, here are a few brief guidelines on how to simplify tax submission.

To start, you just need to set up your airSlate SignNow account to transform your online document management. airSlate SignNow is a very intuitive and powerful document solution that enables you to modify, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to amend details whenever necessary. Streamline your tax organization with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Nc Form E 536r in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Nc Form E 536r in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Be aware that submitting physically can increase return errors and delay refunds. Certainly, before e-filing your taxes, review the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct nc form e 536r 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the IGNOU exam form DEC 2017 online?

First u deposit your respective subject assignments at your concerning study center in september and then u can fill up your exam form through official website of IGNOU for Dec17 .IGNOU - The People's University

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

When will we fill out the CAT 2017 exam form?

Hello,Highlights:Registration process for CAT 2017 has commenced from August 9, 2017.MBA aspirants looking forward to appearing for CAT 2017 can now register for the exam.Once the registration is successfully completed, candidates can fill the application form.The registration process for CAT 2017 has commenced from August 9, 2017. MBA aspirants looking forward to appearing for the Common Admission Test (CAT) 2017 will now be able to register for the exam and fill the application form.Registration can be done by filling the information asked in the registration form on the official CAT 2017 website. Once the CAT 2017 registration is successfully completed, candidates will be able to fill the application form for CAT 2017.Steps to Register for CAT 2017:You will be required to register for CAT 2017 online. Since registration is mandatory, you will not be able to proceed to the application form without registration.For registering online, enter your personal details including Name, Date of Birth (DOB), Mobile Number, Email Address and Country.Once you have registered successfully, you will receive a unique username and password on the registered mobile number and email address through SMS and email respectively.The username and password provided in the email/SMS will be your login credentials.Note: Make sure that the email id and mobile number that you have entered are valid as all further information will be communicated to you through the same.Steps to fill the Application Form of CAT 2017:1. Fields and Details: The application form of CAT 2017 will comprise the following five fields:Personal DetailsAcademicsWork ExperienceProgrammesPaymentYou will be required to fill in all the details asked in the fields mentioned above.2. Photograph and Signature: Apart from that, you will have to upload a recent passport size photograph and signature in either .jpg or .jpeg format. The dimensions must be as follows:For Photograph: 35mm x 45mmFor Signature: 80mm x 35mmThe size of the photograph, as well as the signature, must not exceed 80 KB.Also Read: MBA Programme in Insurance Introduced by Jamia Hamdard Launched; Admission through CAT & MAT Scores3. Documents: Candidates applying under reserved categories (NC-OBC/ SC/ ST/ PWD-DA) will also have to upload the attested documents (as mentioned by the organising authority).4. Colleges and Course: Before submitting the application form, candidates will also be required to select the IIMs and corresponding programmes that they wish to apply for. Location preference must also be entered for the personal assessment and interview rounds.5. Exam Centre: For selecting the city where the candidate wants to appear for CAT 2017, four cities must be entered in order of preference. Before submitting the application form, make sure that all the details entered as well as the preferences are in order.Note: Candidates will not have to apply for admission to the flagship programmes offered by the IIMs separately. For all other B-Schools that take admission on the basis of CAT scores, candidates will have to fill in separate application forms.Application/ Registration Fee of CAT 2017:Also Read: IIFT Postpones Exam to December 3; Check Important Dates HereCAT is one of the toughest and most sought after management entrance exams that opens the gates to the premier management institutes of the country including the prestigious IIMs. Securing a good percentile in CAT 2017 can get you several steps closer to securing a seat at the IIMs and other top b-schools for the session 2018-19.All The Best!!

Create this form in 5 minutes!

How to create an eSignature for the nc form e 536r 2017

How to make an electronic signature for your Nc Form E 536r 2017 in the online mode

How to make an electronic signature for your Nc Form E 536r 2017 in Chrome

How to make an eSignature for putting it on the Nc Form E 536r 2017 in Gmail

How to generate an eSignature for the Nc Form E 536r 2017 right from your smartphone

How to make an electronic signature for the Nc Form E 536r 2017 on iOS

How to generate an eSignature for the Nc Form E 536r 2017 on Android

People also ask

-

What is the Nc Form E 536r used for?

The Nc Form E 536r is a specific document utilized in North Carolina for various legal and administrative purposes. It is essential for businesses needing to comply with state regulations. By using airSlate SignNow, you can easily fill out, sign, and send the Nc Form E 536r without hassle.

-

How can airSlate SignNow help with Nc Form E 536r?

airSlate SignNow provides a straightforward platform for managing the Nc Form E 536r. Our eSignature solution ensures that you can securely sign and send this document, streamlining your workflow. This efficiency helps you meet deadlines and maintain compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for Nc Form E 536r?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for handling the Nc Form E 536r. Our plans are designed to be cost-effective, providing signNow value for businesses looking to manage their documents efficiently. You can choose a plan that fits your usage and budget.

-

What features does airSlate SignNow offer for signing Nc Form E 536r?

airSlate SignNow includes a range of features for signing the Nc Form E 536r, such as a user-friendly interface, the ability to add multiple signers, and customizable templates. Additionally, our platform ensures document security and compliance with legal standards, making it ideal for handling important forms like the Nc Form E 536r.

-

Can I integrate airSlate SignNow with other applications when using Nc Form E 536r?

Absolutely! airSlate SignNow offers seamless integration with various applications, such as CRM platforms, cloud storage services, and project management tools. This allows you to easily incorporate the Nc Form E 536r into your existing workflows and enhance document management across your organization.

-

How secure is the signing process for Nc Form E 536r with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. When signing the Nc Form E 536r, we use advanced encryption methods and secure storage solutions to protect your data. You can trust that your information is safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for Nc Form E 536r?

Using airSlate SignNow for the Nc Form E 536r offers numerous benefits, such as increased efficiency, reduced turnaround times, and enhanced document tracking. Our platform simplifies the entire signing process, allowing you to focus on your business while ensuring compliance with necessary regulations.

Get more for Nc Form E 536r

- Tattoobrandingearlobe gauging screening usarec army form

- Smpe ukm form

- Brochureca fbx commercial inc form

- G7 quarterly return for monthly payer form

- Starbucks application canada working 09 05doc oakbay public sd61 bc form

- Tc 843 utah bill of sale form

- Idaho form 39r

- Douglascounty oregon usdocumentcenterviewdouglas county land department 1036 se douglas justice form

Find out other Nc Form E 536r

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document