Schedule of County Sales and Use Taxes for Claims NC Gov 2020

Understanding the Schedule of County Sales and Use Taxes for Claims

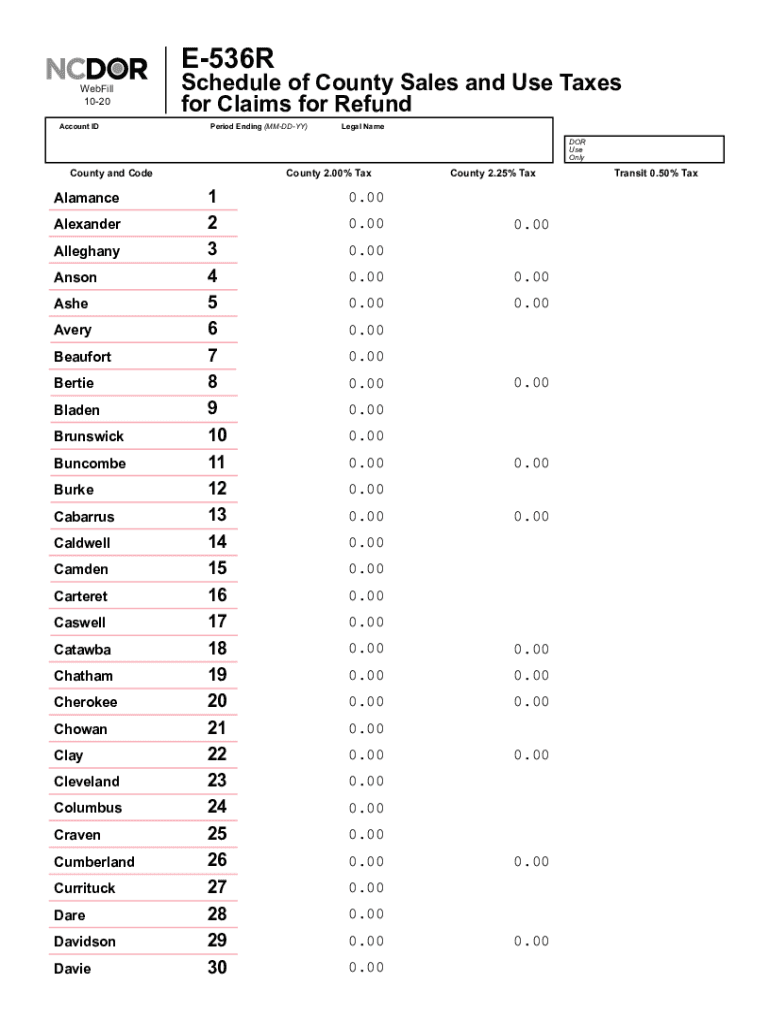

The Schedule of County Sales and Use Taxes for Claims is a crucial document for businesses in North Carolina. It outlines the specific sales and use tax rates applicable in various counties, which is essential for accurate tax reporting and compliance. Understanding this schedule helps businesses determine the correct amount of tax to collect from customers and report to the state.

Steps to Complete the Schedule of County Sales and Use Taxes for Claims

Completing the Schedule of County Sales and Use Taxes for Claims involves several key steps:

- Gather all necessary sales data, including total sales and applicable tax rates for your county.

- Calculate the total sales tax collected based on the rates specified in the schedule.

- Fill out the form accurately, ensuring all figures are correct and match your sales records.

- Review the completed form for any errors before submission.

Legal Use of the Schedule of County Sales and Use Taxes for Claims

The Schedule of County Sales and Use Taxes for Claims must be used in accordance with North Carolina tax laws. This means businesses must ensure they apply the correct tax rates as outlined in the schedule and comply with all filing requirements. Misuse of the schedule can lead to penalties, making it essential to understand its legal implications.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Schedule of County Sales and Use Taxes for Claims. Typically, businesses must submit their claims on a quarterly basis. Missing these deadlines can result in late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Required Documents for Filing

When filing the Schedule of County Sales and Use Taxes for Claims, certain documents are necessary to support your submission. These may include:

- Sales records that detail total sales and tax collected.

- Previous tax returns for reference.

- Any supporting documentation that may be required by the state.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule of County Sales and Use Taxes for Claims can result in significant penalties. These penalties may include fines, interest on unpaid taxes, and potential audits. It is crucial for businesses to adhere to the guidelines to avoid these consequences.

Eligibility Criteria for Filing

To file the Schedule of County Sales and Use Taxes for Claims, businesses must meet certain eligibility criteria. Generally, this includes being registered to collect sales tax in North Carolina and having a valid business license. Understanding these criteria ensures that only qualified entities submit claims.

Quick guide on how to complete schedule of county sales and use taxes for claims ncgov

Complete Schedule Of County Sales And Use Taxes For Claims NC gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can find the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Schedule Of County Sales And Use Taxes For Claims NC gov on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest way to edit and eSign Schedule Of County Sales And Use Taxes For Claims NC gov seamlessly

- Find Schedule Of County Sales And Use Taxes For Claims NC gov and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Schedule Of County Sales And Use Taxes For Claims NC gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule of county sales and use taxes for claims ncgov

Create this form in 5 minutes!

How to create an eSignature for the schedule of county sales and use taxes for claims ncgov

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is e 536r and how does it work with airSlate SignNow?

The e 536r is a specific document type that can be effectively managed and signed using airSlate SignNow. This platform streamlines the eSigning process, allowing users to send, sign, and store documents securely in one place. With airSlate SignNow, e 536r documents are processed efficiently, ensuring quick turnaround times and improved productivity.

-

What are the pricing options for using airSlate SignNow with e 536r?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for e 536r management. Pricing tiers vary based on features and usage, allowing businesses to choose a plan that best fits their document signing requirements. You can visit our pricing page to find detailed information about our competitive rates.

-

What features does airSlate SignNow offer for e 536r documents?

airSlate SignNow provides a range of features tailored for managing e 536r documents, including customizable templates, real-time tracking, and advanced security options. The platform ensures that your documents are not only legally compliant but also secure and easily accessible. These features enhance the efficiency of the eSigning process.

-

Can I integrate airSlate SignNow with other software for e 536r management?

Yes, airSlate SignNow offers seamless integrations with numerous software solutions to enhance the management of e 536r. This includes compatibility with popular CRMs, document management systems, and cloud storage services. These integrations simplify workflows and ensure that your e 536r documents sync effortlessly across platforms.

-

What are the benefits of using airSlate SignNow for e 536r?

Using airSlate SignNow for e 536r documents offers several benefits, including faster turnaround times, reduced paper usage, and increased security. The platform simplifies the signing process and helps businesses streamline document workflows, ultimately saving time and resources. This ease of use translates to better customer satisfaction.

-

Is airSlate SignNow secure for handling e 536r documents?

Absolutely! airSlate SignNow employs top-notch security measures to ensure the safety of your e 536r documents. This includes encryption, secure cloud storage, and compliance with industry standards, such as GDPR and SOC 2. You can trust that your sensitive information is protected while using our platform.

-

How can I get started with airSlate SignNow for e 536r?

Getting started with airSlate SignNow for handling e 536r is easy! Simply sign up for an account on our website, choose a pricing plan, and begin uploading your documents. Our user-friendly interface will guide you through the eSigning process, allowing you to send and receive signed e 536r documents in no time.

Get more for Schedule Of County Sales And Use Taxes For Claims NC gov

Find out other Schedule Of County Sales And Use Taxes For Claims NC gov

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure