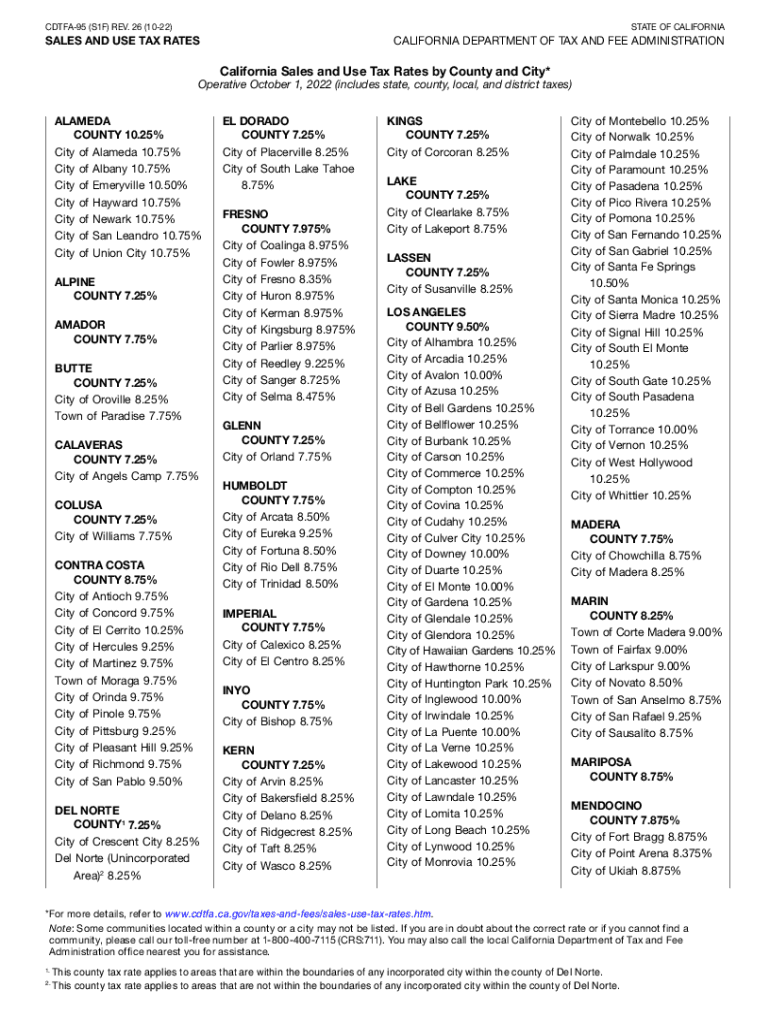

CDTFA 95, California Sales and Use Tax Rates by County and City CDTFA 95; State, County, Local, and District Taxes 2022

What is the CDTFA 95?

The CDTFA 95 is an essential document that outlines California's sales and use tax rates by county and city. This form is crucial for businesses operating within the state, as it details the various state, county, local, and district taxes applicable to transactions. Understanding the CDTFA 95 helps ensure compliance with California tax regulations and assists businesses in accurately calculating the taxes owed on sales.

How to Use the CDTFA 95

Using the CDTFA 95 involves referencing the document to determine the correct sales tax rate for specific locations within California. Businesses should consult the form when making sales to customers in different counties or cities, as tax rates can vary significantly. It is advisable to keep the CDTFA 95 readily accessible for quick reference when processing transactions, ensuring that the correct tax amount is applied to sales invoices.

Steps to Complete the CDTFA 95

Completing the CDTFA 95 requires a few straightforward steps:

- Identify the location of the sale, as tax rates differ by county and city.

- Locate the corresponding tax rate on the CDTFA 95 for that specific area.

- Apply the identified tax rate to the total sale amount to calculate the sales tax due.

- Document the transaction, including the tax rate applied, for record-keeping and compliance purposes.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of filing deadlines related to sales tax in California. Typically, sales tax returns must be filed quarterly, but some businesses may be required to file monthly or annually, depending on their sales volume. Keeping track of these deadlines helps avoid penalties and ensures timely compliance with California tax regulations.

Required Documents

When dealing with the CDTFA 95 and sales tax in California, businesses should prepare certain documents to support their filings. These documents may include:

- Sales invoices that detail the items sold and the corresponding sales tax charged.

- Receipts for any purchases made that may be subject to use tax.

- Previous tax returns to ensure consistency and accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with California sales tax regulations, including the proper use of the CDTFA 95, can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential audits. Understanding the importance of accurate tax reporting and timely filings can help mitigate these risks and maintain compliance with state laws.

Quick guide on how to complete cdtfa 95 california sales and use tax rates by county and city cdtfa 95 state county local and district taxes

Effortlessly prepare CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes on any device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Handle CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

Steps to modify and electronically sign CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes with ease

- Locate CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes and then click Get Form to begin.

- Employ the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your edits.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced papers, tedious form navigation, or mistakes necessitating new printed copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Alter and electronically sign CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 95 california sales and use tax rates by county and city cdtfa 95 state county local and district taxes

Create this form in 5 minutes!

People also ask

-

What is the current California income tax rate?

The California income tax rate varies based on income levels, with rates ranging from 1% to 13.3%. This progressive structure means higher earners pay a higher percentage. Understanding the California income tax rate is essential for accurate financial planning.

-

How does airSlate SignNow help with California income tax documentation?

With airSlate SignNow, you can easily create, send, and sign documents needed for California income tax filings. Our platform ensures all documents are legally binding and securely stored. This streamlines your process, allowing you to focus on understanding your California income tax rate without administrative delays.

-

Are there any discounts or pricing options available for airSlate SignNow users?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. We aim to provide an affordable solution that does not compromise on features related to managing documents, helping you navigate your California income tax rate efficiently.

-

Can airSlate SignNow integrate with accounting software to help manage tax documents?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software platforms, making it easier to manage taxes related to the California income tax rate. These integrations enhance productivity by allowing for smoother data transfer and document management.

-

What are the key features of airSlate SignNow for tax-related documents?

Key features include customizable templates, advanced security, and multiple signing options. These tools help ensure that your tax documents, relevant to the California income tax rate, are completed accurately and efficiently. This makes managing your tax obligations much less daunting.

-

Is airSlate SignNow compliant with California tax regulations?

Yes, airSlate SignNow is designed to comply with state regulations, including those concerning the California income tax rate. Our legal team continuously monitors changes to ensure documents meet compliance standards, making it a reliable choice for your tax-related needs.

-

How secure is airSlate SignNow for sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure storage options to protect sensitive information related to the California income tax rate. Your documents remain confidential and secure through every step of the signing process.

Get more for CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes

Find out other CDTFA 95, California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template