California Sales and Use Tax Rates by County and City CDTFA 95; State, County, Local, and District Taxes 2021

Understanding California Sales and Use Tax Rates by County and City

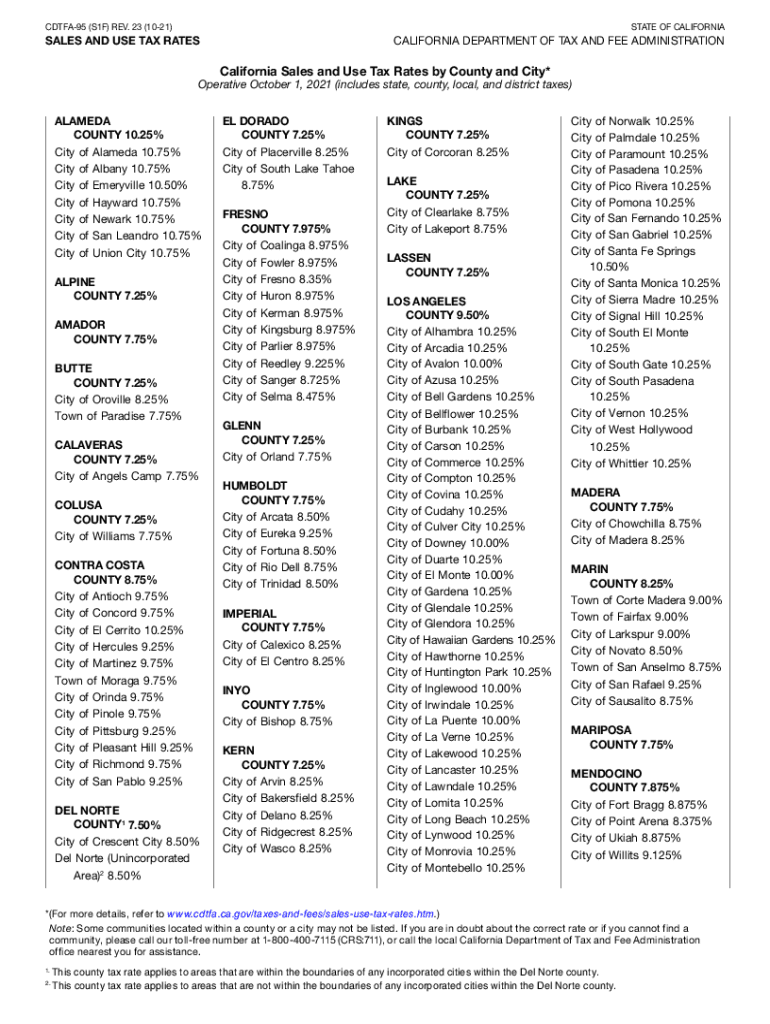

The California sales tax rates include state, county, local, and district taxes, which can vary significantly across different regions. The California Department of Tax and Fee Administration (CDTFA) provides a comprehensive breakdown of these rates. The base state sales tax rate is currently set at seven and a quarter percent, but local jurisdictions can impose additional taxes, leading to total rates that can exceed ten percent in some areas. For example, cities like Los Angeles and San Francisco have higher local taxes, reflecting their unique economic conditions.

Steps to Complete the California Sales and Use Tax Rates Form (CDTFA 95)

Completing the CDTFA 95 form requires a few straightforward steps to ensure accuracy. First, gather all necessary information, including your business details and the specific sales tax rates applicable to your area. Next, fill out the form by entering the required data in the designated fields. Be sure to double-check your entries for any errors. Once completed, you can submit the form either online or by mail, depending on your preference. Keeping a copy for your records is advisable for future reference.

Legal Use of the California Sales and Use Tax Rates Form (CDTFA 95)

The CDTFA 95 form is legally binding when completed correctly and submitted in accordance with California tax laws. It serves as a declaration of the sales and use tax rates applicable to your business operations. To ensure its legal standing, you must comply with all relevant eSignature laws and regulations. Using a reliable eSignature solution can enhance the legitimacy of your submission, as it provides a digital certificate that verifies the authenticity of your signature.

Obtaining the California Sales and Use Tax Rates Form (CDTFA 95)

You can obtain the CDTFA 95 form directly from the California Department of Tax and Fee Administration's website. The form is available in both digital and printable formats, making it accessible for various filing preferences. If you prefer a physical copy, you can also request it through mail or visit a local CDTFA office. Ensuring you have the latest version of the form is crucial, as tax rates and regulations can change frequently.

Examples of Using California Sales and Use Tax Rates

Understanding how to apply the California sales tax rates can be illustrated through practical examples. For instance, if a retailer in San Diego sells a product priced at one hundred dollars, they must calculate the total sales tax based on the local rate, which might be eight and a quarter percent. This means the total cost for the customer would be one hundred eight dollars and twenty-five cents. Such calculations are essential for businesses to ensure compliance and accurate pricing for their customers.

Filing Deadlines and Important Dates for California Sales Tax

Filing deadlines for sales tax in California are typically quarterly or annually, depending on the volume of sales. Businesses with higher sales volumes may be required to file monthly. It is essential to keep track of these deadlines to avoid penalties. The CDTFA provides a calendar of important dates, which can help businesses stay informed about when their sales tax returns are due. Missing a deadline can lead to late fees and interest charges, so timely filing is crucial.

Quick guide on how to complete california sales and use tax rates by county and city cdtfa 95 state county local and district taxes

Complete California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes effortlessly on any device

Online document handling has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes on any device using airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest way to edit and eSign California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes with ease

- Find California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california sales and use tax rates by county and city cdtfa 95 state county local and district taxes

Create this form in 5 minutes!

How to create an eSignature for the california sales and use tax rates by county and city cdtfa 95 state county local and district taxes

How to generate an e-signature for your PDF document in the online mode

How to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What are the current California sales tax rates?

California sales tax rates vary by city and county. Generally, the statewide base sales tax rate is 7.25%, but local jurisdictions can add their own rates, which may result in higher totals. It's essential to stay updated on California sales tax rates to ensure compliance and accurate pricing in your business.

-

How can airSlate SignNow help me with California sales tax documentation?

airSlate SignNow provides businesses with tools to easily create and send documents that include California sales tax information. By utilizing our eSignature solutions, you can streamline your transaction processes while ensuring that all necessary tax rates are clearly stated and agreed upon. This results in a smoother experience for both you and your clients.

-

Does airSlate SignNow support integrating California sales tax plugins?

Yes, airSlate SignNow can integrate with various accounting and tax software that helps track California sales tax rates. This integration allows for seamless calculation and application of sales tax in your transactions. By ensuring accurate sales tax rates, you can maintain better compliance and financial management.

-

What features does airSlate SignNow offer for managing sales tax documents?

airSlate SignNow offers features like custom templates and automated workflows that can help you manage sales tax-related documentation efficiently. You can automatically include the most current California sales tax rates in your documents, reducing the chances of errors during transactions. This feature enhances the overall accuracy and professionalism of your business agreements.

-

Is airSlate SignNow cost-effective for small businesses dealing with California sales tax?

Absolutely! airSlate SignNow is designed to be a cost-effective solution that can benefit small businesses, particularly those that need to manage California sales tax rates efficiently. With various pricing plans, you can choose the one that fits your budget and enables you to streamline your document handling and sales tax management without breaking the bank.

-

Can I track my sales and California sales tax rates using airSlate SignNow?

While airSlate SignNow primarily focuses on document management and eSigning, it can be integrated with other financial tools that allow you to track sales and California sales tax rates. This enables you to have a comprehensive overview of your transactions and ensure compliance with local tax regulations. Coupling our solution with tracking software will enhance your business’s operational efficiency.

-

What are the benefits of using airSlate SignNow for California-based businesses?

Using airSlate SignNow can signNowly benefit California-based businesses by simplifying the eSigning process and ensuring compliance with California sales tax rates. Our platform is user-friendly, allowing for quick turnaround on document processing, which is vital in managing sales transactions effectively. By adopting our solution, you prioritize customer satisfaction and operational efficiency.

Get more for California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land form

- Contract for deed sellers annual accounting statement alaska form

- Notice of default for past due payments in connection with contract for deed alaska form

- Final notice of default for past due payments in connection with contract for deed alaska form

- Assignment of contract for deed by seller alaska form

- Notice of assignment of contract for deed alaska form

- Ak contract form

- Buyers home inspection checklist alaska form

Find out other California Sales And Use Tax Rates By County And City CDTFA 95; State, County, Local, And District Taxes

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation