CDTFA 95 S1F REV 33 1 25 STATE of CALIFORNIA 2025

Understanding the CDTFA 95 S1F REV 33 1 25

The CDTFA 95 S1F REV 33 1 25 is a form used by the California Department of Tax and Fee Administration (CDTFA) to report sales and use tax information. This form is essential for businesses operating in California as it helps ensure compliance with state tax laws. It captures various details about sales transactions, including taxable sales, exempt sales, and any applicable tax rates. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to Complete the CDTFA 95 S1F REV 33 1 25

Completing the CDTFA 95 S1F REV 33 1 25 involves several key steps. First, gather all necessary financial records, including sales receipts and invoices. Next, accurately fill out each section of the form, ensuring that you report total sales, deductions, and the applicable sales tax rates. It is important to double-check all entries for accuracy, as errors can lead to compliance issues. Finally, submit the form by the designated deadline to avoid late fees.

Required Documents for the CDTFA 95 S1F REV 33 1 25

Before filling out the CDTFA 95 S1F REV 33 1 25, ensure you have all required documents at hand. These typically include:

- Sales invoices and receipts

- Records of exempt sales

- Previous tax returns, if applicable

- Any relevant correspondence from the CDTFA

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your reporting.

Filing Deadlines for the CDTFA 95 S1F REV 33 1 25

It is important to be aware of the filing deadlines for the CDTFA 95 S1F REV 33 1 25 to avoid penalties. Generally, businesses must file this form on a quarterly or annual basis, depending on their sales volume. The specific deadlines vary, but they typically fall at the end of the month following the reporting period. For example, if you are filing for the first quarter, the due date would be April 30. Always check the CDTFA website for the most current deadlines and any changes to filing requirements.

Penalties for Non-Compliance with the CDTFA 95 S1F REV 33 1 25

Failure to comply with the requirements of the CDTFA 95 S1F REV 33 1 25 can result in significant penalties. Common penalties include:

- Late filing fees, which can accumulate over time

- Interest on unpaid tax amounts

- Potential audits by the CDTFA

To avoid these consequences, it is crucial to file the form accurately and on time, ensuring all tax obligations are met.

Digital Submission of the CDTFA 95 S1F REV 33 1 25

The CDTFA allows for digital submission of the CDTFA 95 S1F REV 33 1 25, which can streamline the filing process. To submit online, you must create an account on the CDTFA website. Once registered, you can fill out the form digitally, attach any necessary documents, and submit it electronically. This method not only saves time but also provides immediate confirmation of submission, reducing the risk of errors associated with mail-in forms.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 95 s1f rev 33 1 25 state of california

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 95 s1f rev 33 1 25 state of california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

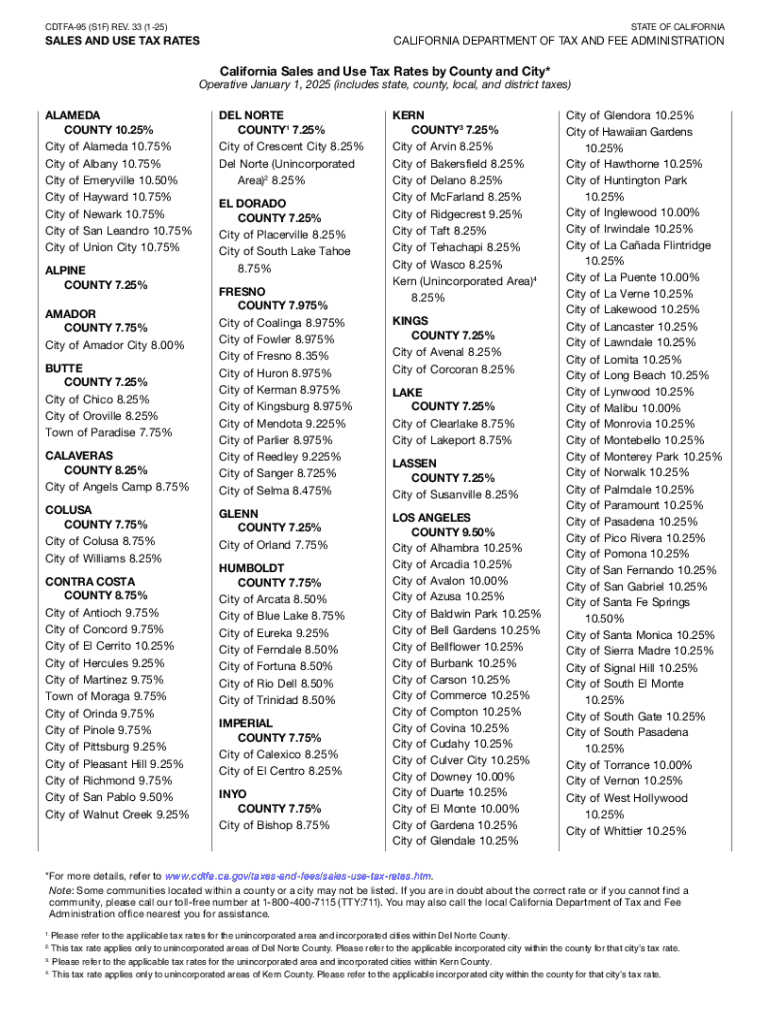

What are the current CA sales tax rates?

CA sales tax rates vary by location and can change frequently. It's essential to check the California Department of Tax and Fee Administration for the most up-to-date rates. airSlate SignNow can help you manage documents related to sales tax compliance efficiently.

-

How can airSlate SignNow help with CA sales tax documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to CA sales tax. Our platform allows you to create, send, and store tax-related documents securely, ensuring compliance with CA sales tax regulations. This saves time and reduces the risk of errors.

-

Are there features in airSlate SignNow that assist with tax calculations?

While airSlate SignNow primarily focuses on document management and eSigning, it integrates with various accounting software that can calculate CA sales tax rates. This integration ensures that your documents reflect accurate tax calculations, making your workflow more efficient.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers several benefits, including enhanced security, ease of use, and cost-effectiveness. You can quickly send and receive signed documents, ensuring that your CA sales tax filings are completed on time and accurately.

-

Can I customize documents for CA sales tax purposes in airSlate SignNow?

Yes, airSlate SignNow allows you to customize documents specifically for CA sales tax purposes. You can create templates that include necessary tax information, ensuring that all your documents are compliant with CA sales tax regulations and tailored to your business needs.

-

Is airSlate SignNow suitable for small businesses dealing with CA sales tax?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses managing CA sales tax. Our platform simplifies the eSigning process, allowing small business owners to focus on growth while ensuring compliance with CA sales tax rates.

-

What integrations does airSlate SignNow offer for tax management?

airSlate SignNow integrates with various accounting and tax software, which can help you manage CA sales tax rates effectively. These integrations allow for seamless data transfer, ensuring that your tax documents are accurate and up-to-date, enhancing your overall tax management process.

Get more for CDTFA 95 S1F REV 33 1 25 STATE OF CALIFORNIA

- Wpf ps 497430289 form

- Parenting plan child form

- Response child support form

- Wa parenting plan form

- Parenting plan form

- Wpf ps 160100 petition for establishment of parentage pursuant to rcw 2626 washington form

- Wpf ps 160200 summons petition for establishment of parentage pursuant to rcw 2626 washington form

- Washington law form

Find out other CDTFA 95 S1F REV 33 1 25 STATE OF CALIFORNIA

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement