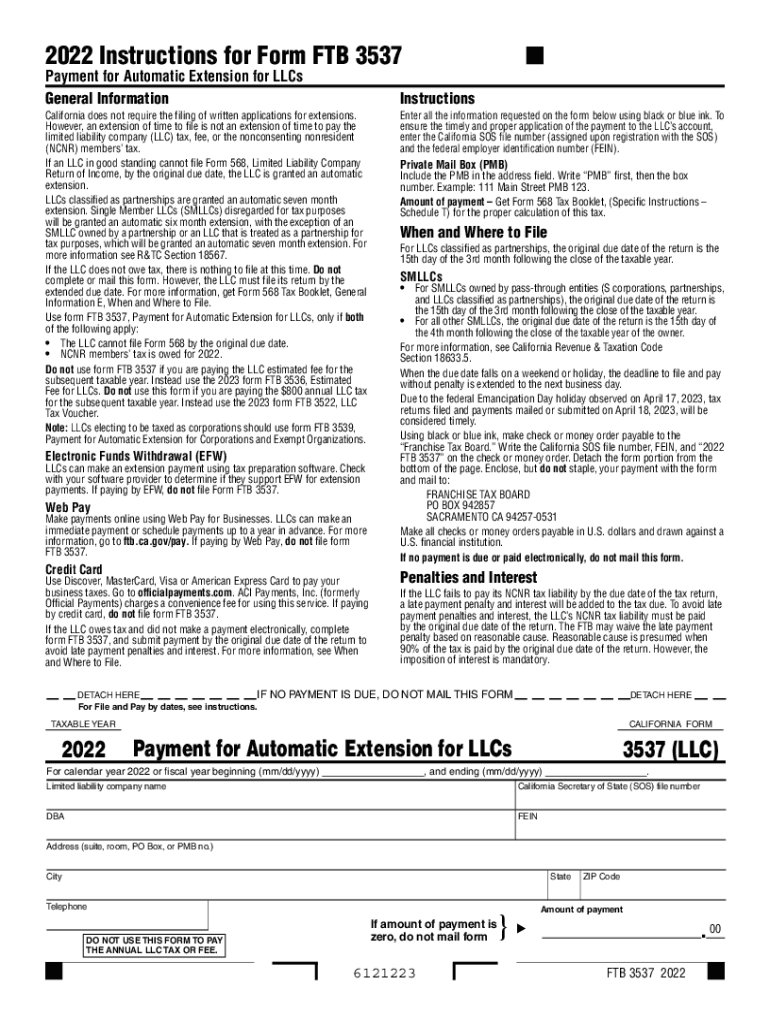

Form FTB3537 "Payment for Automatic Extension for Llcs" California 2022

What is the Form FTB 3537 for California?

The Form FTB 3537, also known as the Payment for Automatic Extension for LLCs, is a document used by Limited Liability Companies (LLCs) in California to request an automatic extension for filing their tax returns. This form allows LLCs to extend their filing deadline by six months, ensuring they remain compliant with state tax regulations. It is essential for LLCs to submit this form to avoid late penalties and maintain good standing with the California Franchise Tax Board (FTB).

Steps to Complete the Form FTB 3537

Completing the Form FTB 3537 involves several straightforward steps:

- Gather Required Information: Collect your LLC's name, address, and California Secretary of State entity number.

- Determine the Payment Amount: Calculate the estimated tax payment due based on your LLC's income.

- Fill Out the Form: Enter the required information accurately, ensuring all details match your official records.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to processing delays.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Form FTB 3537

The legal use of the Form FTB 3537 is crucial for LLCs seeking to comply with California tax laws. By submitting this form, LLCs can officially request an extension, which protects them from late filing penalties. It is important to note that the extension applies only to the filing of the tax return, not to the payment of taxes owed. LLCs must ensure that they pay any estimated taxes by the original due date to avoid interest and penalties.

Filing Deadlines and Important Dates

For the 2023 tax year, the deadline to file the Form FTB 3537 is typically the 15th day of the fourth month after the end of your LLC's tax year. This means that for most LLCs operating on a calendar year, the deadline will be April 15. It is essential to submit the form on or before this date to qualify for the automatic extension.

Form Submission Methods

LLCs can submit the Form FTB 3537 through various methods:

- Online: Use the California Franchise Tax Board's online services to submit the form electronically.

- By Mail: Send a completed paper form to the address specified on the form instructions.

- In Person: Deliver the form directly to a local FTB office, if preferred.

Penalties for Non-Compliance

Failure to file the Form FTB 3537 by the deadline can result in significant penalties for LLCs. These penalties may include late fees and interest on any unpaid taxes. It is vital for LLCs to adhere to the filing requirements to avoid unnecessary financial burdens and maintain compliance with California tax regulations.

Quick guide on how to complete form ftb3537 ampquotpayment for automatic extension for llcsampquot california

Complete Form FTB3537 "Payment For Automatic Extension For Llcs" California effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Form FTB3537 "Payment For Automatic Extension For Llcs" California on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and eSign Form FTB3537 "Payment For Automatic Extension For Llcs" California seamlessly

- Locate Form FTB3537 "Payment For Automatic Extension For Llcs" California and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form FTB3537 "Payment For Automatic Extension For Llcs" California and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ftb3537 ampquotpayment for automatic extension for llcsampquot california

Create this form in 5 minutes!

People also ask

-

What is the CA Form 3537?

The CA Form 3537 is a tax-related document used by businesses in California to report and make payments for various taxes. airSlate SignNow simplifies the process of eSigning the CA Form 3537, ensuring that your documents are completed quickly and securely.

-

How can airSlate SignNow help with the CA Form 3537?

airSlate SignNow provides an easy-to-use platform for managing the CA Form 3537 by allowing users to fill out and eSign the document online. This streamlines the process and helps you stay compliant with California tax requirements without paper clutter.

-

Is there a cost associated with using airSlate SignNow for the CA Form 3537?

Yes, airSlate SignNow offers various pricing plans that are cost-effective and designed to fit different business needs. With these pricing options, you can efficiently manage your CA Form 3537 along with other essential documents at an affordable rate.

-

What features does airSlate SignNow offer for handling the CA Form 3537?

airSlate SignNow includes features like customizable templates, secure eSigning, and document sharing, which are particularly useful for the CA Form 3537. These features enhance the overall efficiency and security of your document management process.

-

Can I integrate airSlate SignNow with other software for CA Form 3537 processing?

Absolutely! airSlate SignNow easily integrates with a variety of popular applications, allowing smooth data flow and management of the CA Form 3537. This feature helps you work within the tools you already use, improving efficiency.

-

What are the benefits of using airSlate SignNow for CA Form 3537 eSigning?

The benefits of using airSlate SignNow for CA Form 3537 include enhanced document security, reduced turnaround times, and improved workflow efficiency. It allows you to focus more on your business while reducing the hassles associated with traditional paperwork.

-

Is the CA Form 3537 eSigning process secure with airSlate SignNow?

Yes, the eSigning process for the CA Form 3537 is highly secure with airSlate SignNow, which employs advanced encryption and authentication methods. This ensures that your sensitive tax documents remain confidential and protected against unauthorized access.

Get more for Form FTB3537 "Payment For Automatic Extension For Llcs" California

- Oklahoma letter tenant form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services oklahoma form

- Temporary lease agreement to prospective buyer of residence prior to closing oklahoma form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497323045 form

- Letter from landlord to tenant returning security deposit less deductions oklahoma form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return oklahoma form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return oklahoma form

- Letter from tenant to landlord containing request for permission to sublease oklahoma form

Find out other Form FTB3537 "Payment For Automatic Extension For Llcs" California

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online