CA FTB 3537 Fill Out Tax Template Online 2023-2026

Understanding the CA FTB 3537 Tax Template

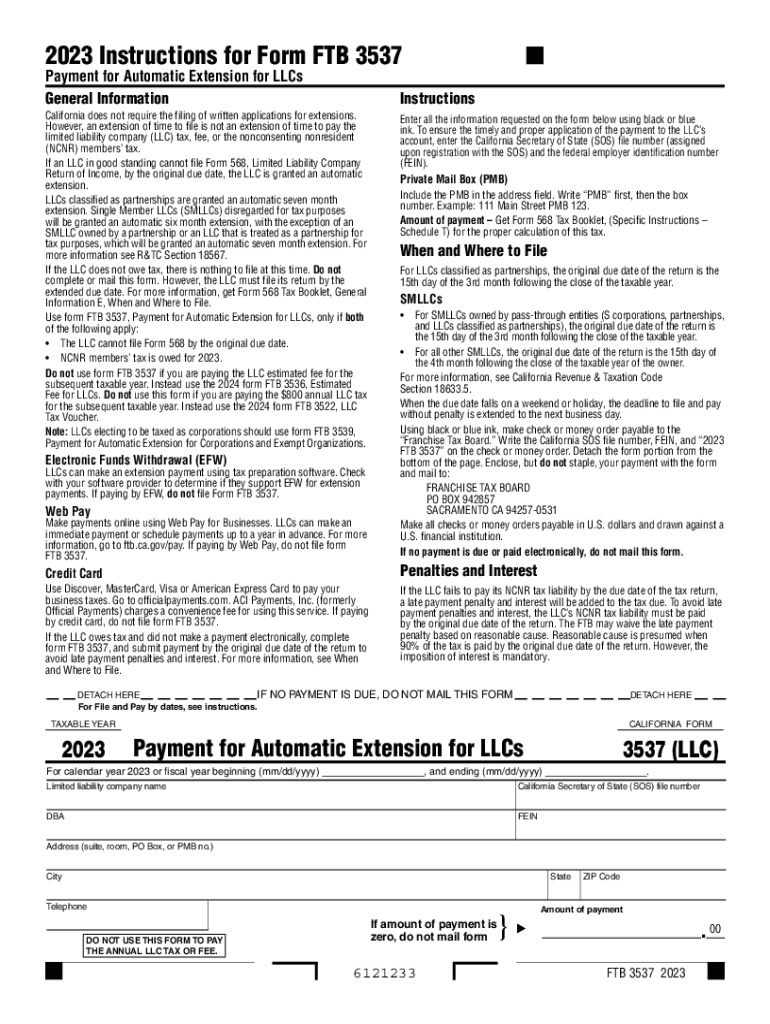

The CA FTB 3537 is a crucial form for California LLCs, specifically designed for those who need to make estimated tax payments. This form allows businesses to report and pay their California income tax obligations in a streamlined manner. It is particularly relevant for LLCs that have a tax liability, ensuring compliance with state regulations. Understanding the purpose and requirements of the CA FTB 3537 is essential for maintaining good standing with the California Franchise Tax Board.

Steps to Complete the CA FTB 3537 Tax Template

Completing the CA FTB 3537 involves several key steps:

- Gather necessary information, including your LLC's name, address, and federal employer identification number (FEIN).

- Determine your estimated tax liability for the year based on your expected income.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Choose your payment method, whether online, by mail, or in person.

Filing Deadlines for the CA FTB 3537

Timely filing of the CA FTB 3537 is critical to avoid penalties. The form is typically due on the 15th day of the fourth month after the close of your taxable year. For most LLCs operating on a calendar year, this means the deadline is April 15. If you are unable to meet this deadline, you may qualify for an extension, but it is important to file the extension request on time.

Legal Use of the CA FTB 3537 Tax Template

The CA FTB 3537 is legally binding and must be used in accordance with California tax laws. It is essential for LLCs to adhere to the guidelines set forth by the California Franchise Tax Board to ensure compliance. Failure to use the form correctly can result in penalties and interest on unpaid taxes. Understanding the legal implications of submitting this form is vital for all business owners.

Required Documents for the CA FTB 3537

When preparing to complete the CA FTB 3537, certain documents are necessary:

- Your LLC's federal tax return or other relevant income documentation.

- Previous year’s CA FTB 3537 form for reference.

- Any supporting documentation that validates your estimated tax calculations.

Obtaining the CA FTB 3537 Tax Template Online

The CA FTB 3537 can be easily obtained online through the California Franchise Tax Board's official website. The form is available for download in a fillable PDF format, allowing users to complete it digitally. This accessibility simplifies the process for business owners, enabling them to manage their tax obligations efficiently.

Create this form in 5 minutes or less

Find and fill out the correct ca ftb 3537 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the ca ftb 3537 fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 California 3537 form?

The 2022 California 3537 form is a tax-related document that businesses in California must file. It is essential for ensuring compliance with state tax regulations. Understanding how to complete this form accurately can help avoid penalties and streamline your tax processes.

-

How can airSlate SignNow assist with the 2022 California 3537?

airSlate SignNow provides an efficient platform for electronically signing and sending the 2022 California 3537 form. With its user-friendly interface, you can easily manage your documents and ensure they are submitted on time. This helps in maintaining compliance and reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow for the 2022 California 3537?

airSlate SignNow offers various pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while ensuring you can manage the 2022 California 3537 efficiently. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing forms like the 2022 California 3537. By utilizing these features, businesses can enhance their document workflow and improve efficiency.

-

Are there any integrations available with airSlate SignNow for the 2022 California 3537?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software. This allows for a streamlined process when handling the 2022 California 3537 form and other documents. Integrations help in automating workflows and reducing manual data entry.

-

What are the benefits of using airSlate SignNow for the 2022 California 3537?

Using airSlate SignNow for the 2022 California 3537 offers numerous benefits, including time savings and enhanced accuracy. The platform simplifies the signing process, ensuring that documents are completed quickly and correctly. Additionally, it provides a secure environment for sensitive information.

-

Is airSlate SignNow compliant with California regulations for the 2022 California 3537?

Absolutely, airSlate SignNow is designed to comply with California regulations, ensuring that your use of the platform for the 2022 California 3537 is secure and legally valid. This compliance helps businesses avoid legal issues and maintain trust with their clients and stakeholders.

Get more for CA FTB 3537 Fill Out Tax Template Online

- Form k 40pt ampquotkansas property tax relief claim for low income seniors

- Enhanced form it 213 claim for empire state child credit

- K 210 underpayment of individual estimated tax rev 7 22 if you are an individual taxpayer including farmer or fisher use this form

- Dr 0204 tax year ending computation of penalty due based form

- Form it 2 summary of federal form w 2 statements tax year 2022

- Colorado severance tax booklet book 0021 booklet includes dr 0021 dr 0021d dr 0021s form

- Ifta inc 4thq2022 gasoline kansas department of revenue form

- Get summary of federal form 1099 r statements department of

Find out other CA FTB 3537 Fill Out Tax Template Online

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter