Form it 2102 6 Certificate of Income Tax Withheld Tax Year 2022

What is the Form IT-2102 Certificate of Income Tax Withheld?

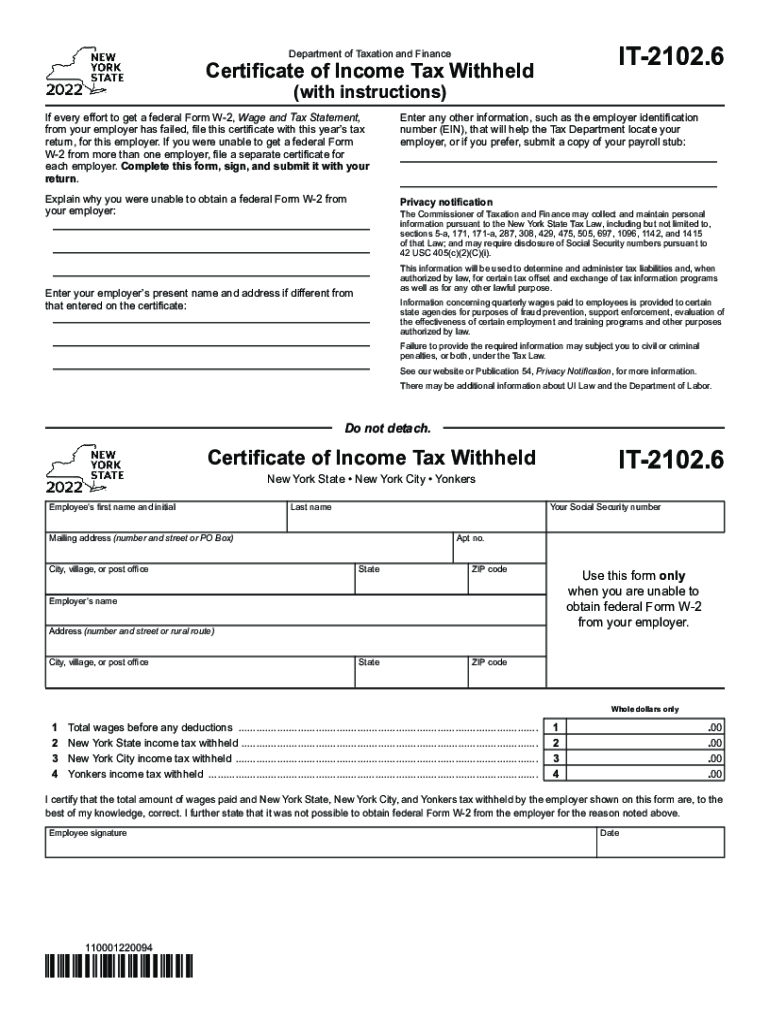

The Form IT-2102 is a certificate used to report income tax withheld from payments made to individuals or entities in the United States. This form is particularly important for employers and businesses that need to document the amount of tax withheld for their employees or contractors. It serves as an official record for both the payer and the payee, ensuring compliance with federal and state tax regulations.

How to Use the Form IT-2102 Certificate of Income Tax Withheld

Using the Form IT-2102 involves several key steps. First, the payer must accurately fill out the form with the necessary details, including the recipient's name, address, and the total amount of income paid. Next, the payer should indicate the total amount of tax withheld. Once completed, the form should be provided to the recipient for their records. This documentation is essential for the recipient when filing their tax returns, as it verifies the amount of tax already paid on their behalf.

Steps to Complete the Form IT-2102 Certificate of Income Tax Withheld

Completing the Form IT-2102 requires attention to detail. Here are the steps to follow:

- Begin by entering the payer's information, including name and address.

- Fill in the recipient's details, ensuring accuracy in spelling and numbers.

- Document the total amount of income paid to the recipient during the tax year.

- Specify the total amount of tax withheld from the payments.

- Review the completed form for any errors before submission.

Legal Use of the Form IT-2102 Certificate of Income Tax Withheld

The Form IT-2102 is legally recognized as an official document for reporting withheld income tax. It is essential for maintaining compliance with IRS regulations. The form helps ensure that both the payer and recipient meet their tax obligations. Proper use of the form can prevent legal issues related to tax reporting and withholding discrepancies.

Key Elements of the Form IT-2102 Certificate of Income Tax Withheld

Several key elements must be included in the Form IT-2102 for it to be valid:

- Payer's name and address

- Recipient's name and address

- Total income paid

- Total tax withheld

- Signature of the payer or authorized representative

Who Issues the Form IT-2102 Certificate of Income Tax Withheld

The Form IT-2102 is typically issued by employers or businesses that make payments subject to income tax withholding. This includes corporations, partnerships, and sole proprietors. It is the responsibility of the payer to ensure that the form is completed accurately and provided to the recipient in a timely manner.

Quick guide on how to complete form it 21026 certificate of income tax withheld tax year 2022

Complete Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year effortlessly on any device

Web-based document management has become prevalent among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year without hassle

- Find Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 21026 certificate of income tax withheld tax year 2022

Create this form in 5 minutes!

People also ask

-

What is it2102 and how does it work with airSlate SignNow?

It2102 refers to a specific feature set within airSlate SignNow that is designed to streamline document signing and management. This feature facilitates the electronic signing process, making it easy for users to send, sign, and manage their documents securely and efficiently.

-

What pricing options are available for airSlate SignNow using the it2102 feature?

airSlate SignNow offers a range of pricing plans that include access to the it2102 feature. Plans are designed to accommodate businesses of all sizes, providing cost-effective solutions for electronic signatures without compromising on functionality.

-

What are the key benefits of using it2102 with airSlate SignNow?

The key benefits of the it2102 feature in airSlate SignNow include enhanced efficiency, reduced turnaround times for document processing, and the convenience of digital signatures. Users can expect a seamless experience that increases productivity and ensures secure transactions.

-

Is it2102 compatible with other applications?

Yes, the it2102 feature in airSlate SignNow integrates seamlessly with various third-party applications. This compatibility allows users to enhance their existing workflows and ensure that data can move smoothly between platforms, improving overall efficiency.

-

How does it2102 improve the document signing process?

The it2102 feature enhances the document signing process by providing intuitive tools for users to send and eSign documents effortlessly. With features like real-time notifications and tracking, it2102 ensures that all parties are informed and engaged throughout the signing process.

-

Can I customize the documents I send using it2102 in airSlate SignNow?

Absolutely! The it2102 feature allows you to customize your documents with branding, fields, and templates. This flexibility ensures your documents not only meet your specific needs but also reflect your brand identity.

-

What security measures are in place for it2102 within airSlate SignNow?

airSlate SignNow prioritizes security with high standards for data protection in the it2102 feature. Measures include SSL encryption, two-factor authentication, and a comprehensive audit trail to ensure that all signed documents are secure and tamper-proof.

Get more for Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year

- Mutual wills or last will and testaments for man and woman living together not married with minor children oklahoma form

- Non marital cohabitation living together agreement oklahoma form

- Bondsmen form

- Oklahoma change venue form

- Oklahoma application public form

- Witness fee form

- Claim exemption garnishment form

- Collection child support form

Find out other Form IT 2102 6 Certificate Of Income Tax Withheld Tax Year

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast