Form it 2102 6 Certificate of Income Tax Withheld IT21026 Tax Ny 2009

What is the Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny

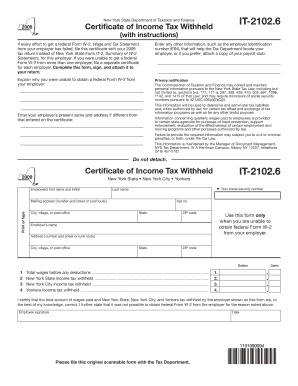

The Form IT 2102 6, also known as the Certificate of Income Tax Withheld IT21026, is a crucial document used in New York for reporting income tax withheld from payments made to individuals or entities. This form is primarily utilized by employers and payers to provide information regarding the amount of state income tax withheld from employees or contractors. It plays a significant role in ensuring compliance with state tax regulations and helps recipients accurately report their income during tax filing.

How to use the Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny

Using the Form IT 2102 6 involves several straightforward steps. First, the payer must accurately fill out the form, indicating the total amount of income paid and the corresponding tax withheld. Once completed, the form should be distributed to the recipient and submitted to the New York State Department of Taxation and Finance as required. Recipients can then use the information provided on the form to complete their personal income tax returns, ensuring they report the correct amount of income and tax withheld.

Steps to complete the Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny

Completing the Form IT 2102 6 requires attention to detail. Here are the essential steps:

- Gather all relevant information, including the recipient's name, address, and taxpayer identification number.

- Input the total income paid to the recipient during the tax year.

- Indicate the total amount of New York state income tax withheld from the payments.

- Review the form for accuracy to avoid any errors that could lead to compliance issues.

- Sign and date the form before distributing it to the recipient and submitting it to the appropriate tax authority.

Legal use of the Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny

The legal use of the Form IT 2102 6 is vital for both payers and recipients. For payers, it serves as proof of tax withholding, which is essential for compliance with New York state tax laws. Recipients rely on the form to accurately report their income and tax withheld when filing their state tax returns. Failure to properly complete and submit this form can lead to penalties and issues with tax compliance, making it crucial for all parties involved to understand its legal implications.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2102 6 are essential for compliance. Typically, the form must be submitted to the New York State Department of Taxation and Finance by the end of January following the tax year in which the payments were made. Recipients should also be aware of their own tax filing deadlines to ensure they include the information from the form in their tax returns. Keeping track of these dates helps avoid penalties and ensures timely compliance with state tax regulations.

Digital vs. Paper Version

The Form IT 2102 6 can be completed in both digital and paper formats. The digital version offers convenience, allowing for easier storage and submission. Electronic forms can be filled out using various software tools and eSignature platforms, ensuring compliance with legal standards for electronic documents. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is crucial to ensure that all information is accurate and submitted on time.

Quick guide on how to complete form it 21026 2009 certificate of income tax withheld it21026 tax ny

Effortlessly Prepare Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny on any device with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to Edit and Electronically Sign Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny with Ease

- Find Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 21026 2009 certificate of income tax withheld it21026 tax ny

Create this form in 5 minutes!

People also ask

-

What is Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny?

Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny is a document used by New York State taxpayers to report income tax withheld by their employers. This certificate is vital for claiming tax credits and ensuring proper tax filings. Understanding this form can help you manage your tax returns effectively.

-

How can airSlate SignNow help with Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny?

airSlate SignNow provides an efficient way to electronically sign and send your Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny. With its user-friendly interface, you can streamline the process of obtaining signatures and managing documents, making tax preparation easier. This can save your business time and ensure compliance with state regulations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs, starting from a basic plan for individuals to comprehensive plans for teams and enterprises. Each plan allows for the signing and management of documents like the Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny. You can choose a plan based on your usage, ensuring cost-effectiveness.

-

Are there features specifically for tax document management in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax document management, including templates for forms like Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny. Users can easily customize these templates, share them with others, and track the status of signings. This enhances organization and efficiency during tax season.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, allowing you to manage your Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny alongside your financial records. This integration enhances collaboration and ensures that all relevant documents are easily accessible.

-

What benefits does electronic signing provide for Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny?

Electronic signing through airSlate SignNow speeds up the process of signing Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny while maintaining security and compliance. It reduces the hassle of printing, scanning, and physically sending documents. This convenience leads to faster tax processing and peace of mind for users.

-

Is airSlate SignNow secure for managing sensitive tax information?

Yes, airSlate SignNow employs top-notch security measures to protect sensitive information, including your Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny. With advanced encryption techniques and secure data storage, you can trust that your tax documents are safe and confidential. Compliance with regulatory standards further enhances data security.

Get more for Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny

- Box is for administrator use only form

- Electrical foundation certificate full timebcit form

- Wwwrevenueieenpersonal tax credits reliefsspecial assignee relief programme sarp form

- Towing dispute online form roads and maritime services

- Form ss 5 10 2021 uf

- Family doctor services registration nhs form

- Forms for the affordable child care benefit province of

- Ci windcrest tx pdffiller on line pdf form filler

Find out other Form IT 2102 6 Certificate Of Income Tax Withheld IT21026 Tax Ny

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed