Form it 2102 6Certificate of Income Tax Withheld 2016

What is the Form IT 2102 6Certificate Of Income Tax Withheld

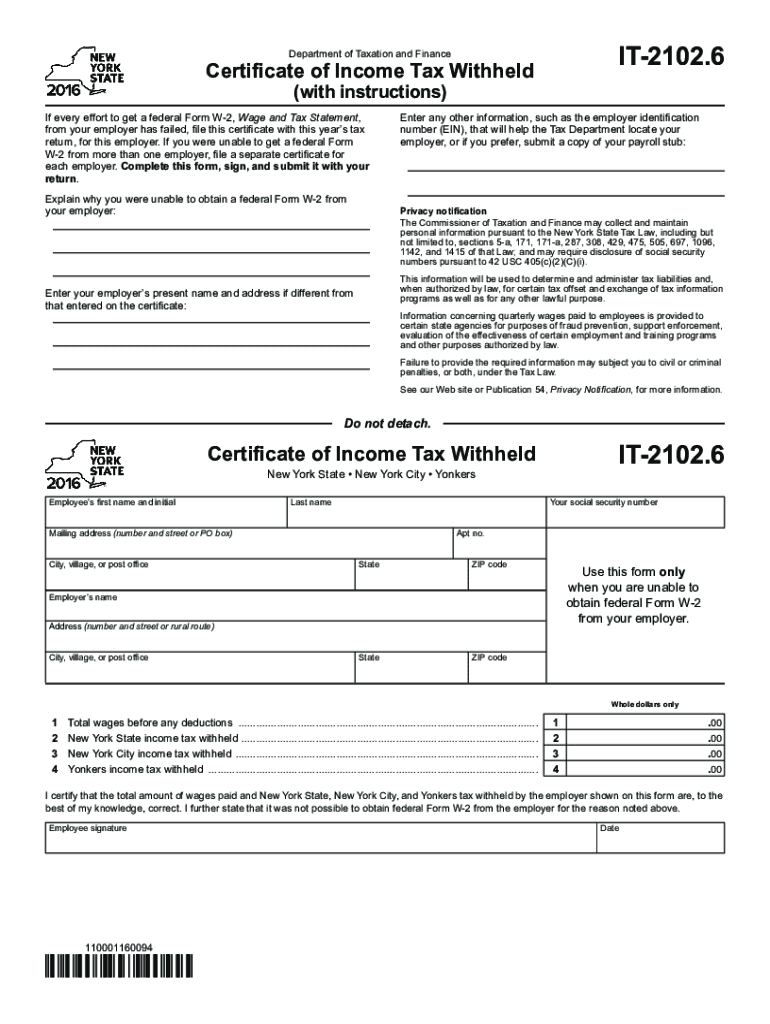

The Form IT 2102 6Certificate Of Income Tax Withheld is a tax document used in the United States to report income tax withheld from payments made to individuals or businesses. This form is essential for both employers and employees, as it provides a record of the amount of tax that has been deducted from wages or payments. It is typically issued by employers to their employees and is used to ensure compliance with federal and state tax regulations.

How to use the Form IT 2102 6Certificate Of Income Tax Withheld

Using the Form IT 2102 6Certificate Of Income Tax Withheld involves several key steps. First, employers must accurately complete the form by entering the total amount of income tax withheld for the reporting period. Employees should then receive a copy of this form to use when filing their annual tax returns. It is important for both parties to retain copies for their records, as this documentation may be required for future reference or audits.

Steps to complete the Form IT 2102 6Certificate Of Income Tax Withheld

Completing the Form IT 2102 6Certificate Of Income Tax Withheld requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the employee's name, Social Security number, and total wages paid.

- Calculate the total amount of income tax withheld during the reporting period.

- Fill in the appropriate sections of the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Provide a copy of the form to the employee and retain one for your records.

Legal use of the Form IT 2102 6Certificate Of Income Tax Withheld

The legal use of the Form IT 2102 6Certificate Of Income Tax Withheld is governed by tax laws and regulations in the United States. This form must be completed accurately and submitted in accordance with IRS guidelines. Failure to provide this document can result in penalties for both employers and employees. It is crucial to understand the legal implications of withholding taxes and to maintain compliance with all applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2102 6Certificate Of Income Tax Withheld are critical for compliance. Employers are typically required to submit this form by specific dates, which may vary based on the tax year and the frequency of payroll. It is essential to stay informed about these deadlines to avoid potential penalties. Employees should also be aware of when they can expect to receive this form from their employers, as it is necessary for their tax filings.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 2102 6Certificate Of Income Tax Withheld can be submitted through various methods. Employers may choose to file the form online, which can streamline the process and ensure timely submission. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated locations. It is important to select the method that best suits the needs of the business while ensuring compliance with filing requirements.

Quick guide on how to complete form it 210262016certificate of income tax withheld

Effortlessly Prepare Form IT 2102 6Certificate Of Income Tax Withheld on Any Device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Form IT 2102 6Certificate Of Income Tax Withheld on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Form IT 2102 6Certificate Of Income Tax Withheld with Ease

- Obtain Form IT 2102 6Certificate Of Income Tax Withheld and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or hide sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 2102 6Certificate Of Income Tax Withheld and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 210262016certificate of income tax withheld

Create this form in 5 minutes!

People also ask

-

What is Form IT 2102 6Certificate Of Income Tax Withheld?

Form IT 2102 6 is used to report the amount of income tax withheld from employees in New York City. This form is essential for employers to accurately document and submit tax information to the state. Utilizing the airSlate SignNow platform simplifies the process of completing and submitting Form IT 2102 6Certificate Of Income Tax Withheld.

-

How can airSlate SignNow help with Form IT 2102 6Certificate Of Income Tax Withheld?

airSlate SignNow offers an efficient way to prepare, sign, and send Form IT 2102 6Certificate Of Income Tax Withheld electronically. Our platform ensures all necessary signatures are gathered quickly and securely, streamlining the tax reporting process for your business. Additionally, it maintains a clear audit trail for compliance purposes.

-

What are the pricing options for using airSlate SignNow for Form IT 2102 6Certificate Of Income Tax Withheld?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various businesses looking to process Form IT 2102 6Certificate Of Income Tax Withheld. Our pricing is competitive and offers cost-effective solutions whether you are a small business or a large enterprise. You can choose a plan that fits your budget and user requirements.

-

Is airSlate SignNow secure for submitting Form IT 2102 6Certificate Of Income Tax Withheld?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that any data shared, including Form IT 2102 6Certificate Of Income Tax Withheld, is encrypted and stored securely. We utilize advanced security measures to protect sensitive information during signing and transmission. Your data security is our top priority.

-

Can I integrate airSlate SignNow with other tools for Form IT 2102 6Certificate Of Income Tax Withheld?

Absolutely! airSlate SignNow supports integration with a variety of business tools and software, allowing you to seamlessly connect with platforms necessary for managing Form IT 2102 6Certificate Of Income Tax Withheld. This feature enhances your workflow and helps manage documents more efficiently.

-

What features does airSlate SignNow offer for managing Form IT 2102 6Certificate Of Income Tax Withheld?

airSlate SignNow provides a range of features designed for efficiently managing Form IT 2102 6Certificate Of Income Tax Withheld, including customizable templates, easy document tracking, and automatic reminders for signatures. These functionalities enhance your ability to manage tax forms quickly and effectively.

-

How does eSigning work for Form IT 2102 6Certificate Of Income Tax Withheld on airSlate SignNow?

eSigning on airSlate SignNow is a straightforward process that allows you to electronically sign Form IT 2102 6Certificate Of Income Tax Withheld from anywhere. Signers receive notifications via email to review and sign the document securely. The platform ensures that all eSignatures are legally binding and compliant with eSignature laws.

Get more for Form IT 2102 6Certificate Of Income Tax Withheld

- Change of business information change of business information

- Pdf renewal application for electrician certification cagov form

- Pdf plumbing permit application city of madison wisconsin form

- Regulatory agency approval to operate child care business dcf f dwsw13259 child care certification form

- Application for additional sets of dealer plates in transit form

- Beer wine authority type 118 form

- Affairs dca licensing center form

- Barber student permit application instructions form

Find out other Form IT 2102 6Certificate Of Income Tax Withheld

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe