CA Form 3519 Payment for Automatic Extension for Individuals 2022

What is the CA Form 3519 Payment For Automatic Extension For Individuals

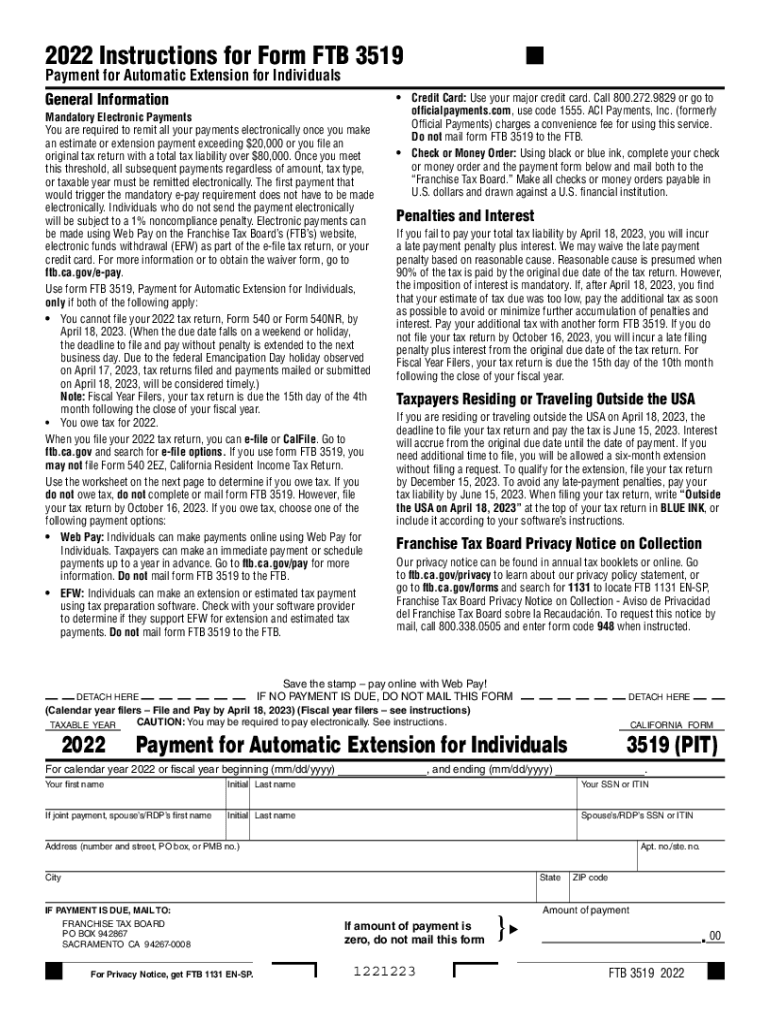

The CA Form 3519, also known as the Payment for Automatic Extension for Individuals, is a state-specific document used by California residents to request an extension for filing their state income tax returns. This form allows taxpayers to extend their filing deadline by six months, providing additional time to prepare their tax returns without incurring penalties for late filing. It is essential to note that while the form grants an extension for filing, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Steps to complete the CA Form 3519 Payment For Automatic Extension For Individuals

Completing the CA Form 3519 involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and any deductions you plan to claim. Next, fill out the form by providing your personal information, such as your name, address, and Social Security number. Indicate the amount of tax you are paying with the extension request. Finally, review the completed form for any errors, sign it, and submit it by the deadline to avoid penalties.

Filing Deadlines / Important Dates

The filing deadline for the CA Form 3519 coincides with the due date for individual income tax returns, typically April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to submit the form and payment by this date to ensure your extension is valid. The extended filing period allows you to submit your tax return by October 15, giving you ample time to prepare your documents accurately.

Legal use of the CA Form 3519 Payment For Automatic Extension For Individuals

The CA Form 3519 is legally recognized as a valid request for an extension of time to file your state tax return. To ensure its legal standing, it must be completed accurately and submitted on time along with any required payment. The form is compliant with California tax laws, and using it appropriately helps protect you from penalties associated with late filing. Always retain a copy of the submitted form and payment confirmation for your records.

Required Documents

When completing the CA Form 3519, you will need to have specific documents on hand. These include your previous year’s tax return, income statements such as W-2s or 1099s, and any documentation for deductions or credits you plan to claim. Having these documents readily available will facilitate the accurate completion of the form and ensure that you report the correct tax amount owed.

Who Issues the Form

The CA Form 3519 is issued by the California Franchise Tax Board (FTB), which is the state agency responsible for administering California's income tax laws. The FTB provides the form and guidelines for its use on their official website, ensuring taxpayers have access to the necessary resources for filing their state taxes accurately and on time.

Penalties for Non-Compliance

Failing to submit the CA Form 3519 by the due date can result in penalties and interest on any unpaid taxes. If you do not file your tax return by the extended deadline, additional penalties may apply. It is essential to adhere to the filing requirements and deadlines to avoid these financial repercussions and maintain compliance with California tax regulations.

Quick guide on how to complete ca form 3519 payment for automatic extension for individuals

Complete CA Form 3519 Payment For Automatic Extension For Individuals effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage CA Form 3519 Payment For Automatic Extension For Individuals on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign CA Form 3519 Payment For Automatic Extension For Individuals with ease

- Locate CA Form 3519 Payment For Automatic Extension For Individuals and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign CA Form 3519 Payment For Automatic Extension For Individuals and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca form 3519 payment for automatic extension for individuals

Create this form in 5 minutes!

People also ask

-

What is a 2022 California tax extension and how can it benefit me?

A 2022 California tax extension allows taxpayers to postpone their tax filing deadline, providing additional time to gather necessary documentation. This can help reduce stress and ensure that you're submitting accurate information on your taxes. By utilizing this extension, you can avoid late penalties and fees while maintaining compliance with state regulations.

-

How can airSlate SignNow help with the 2022 California tax extension process?

airSlate SignNow streamlines your document management process, making it easy to complete and eSign your 2022 California tax extension forms. With our user-friendly platform, you can quickly create, send, and track your tax-related documents, ensuring that your extension request is submitted accurately and on time.

-

Are there any costs associated with filing a 2022 California tax extension using airSlate SignNow?

Using airSlate SignNow for your 2022 California tax extension comes with affordable pricing plans that cater to various business needs. Our cost-effective solution helps you manage your documents without breaking the bank, and you can take advantage of a free trial to see if our features align with your requirements.

-

What features does airSlate SignNow offer for managing my 2022 California tax extension documents?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage for your 2022 California tax extension documents. These tools enhance your workflow efficiency and ensure that you never miss an important deadline while maintaining a secure and organized document repository.

-

Can I integrate airSlate SignNow with my accounting software for 2022 California tax extensions?

Yes, airSlate SignNow seamlessly integrates with various accounting and finance software, making it easier to manage your 2022 California tax extension documents. These integrations allow for the automatic transfer of data, reducing manual entry and ensuring your records are accurate and up to date.

-

Is it safe to use airSlate SignNow for my 2022 California tax extension forms?

Absolutely! airSlate SignNow prioritizes document security and employs advanced encryption technologies to protect your sensitive information during the 2022 California tax extension process. You can trust our platform to handle your documents securely, allowing you to focus on successfully filing your extension.

-

How long does it take to file a 2022 California tax extension using airSlate SignNow?

Filing a 2022 California tax extension using airSlate SignNow is a quick and efficient process. Typically, users can complete and eSign their forms within minutes, allowing them to submit their extension requests without delay and reduce the stress associated with looming deadlines.

Get more for CA Form 3519 Payment For Automatic Extension For Individuals

- Certificate of publication and of no opposition louisiana form

- Certificate of attorney concerning action for money due on petition for open account louisiana form

- Order to return child form

- La supreme court form

- Set child support form

- Louisiana child support 497308688 form

- Motion and order for reduction of child support louisiana form

- Claim affidavit form

Find out other CA Form 3519 Payment For Automatic Extension For Individuals

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF