Form FTB 3519 Payment for Automatic Extension for Individuals , Form FTB 3519, Payment for Automatic Extension for Individuals 2021

Understanding the Form FTB 3519 for Tax Extensions

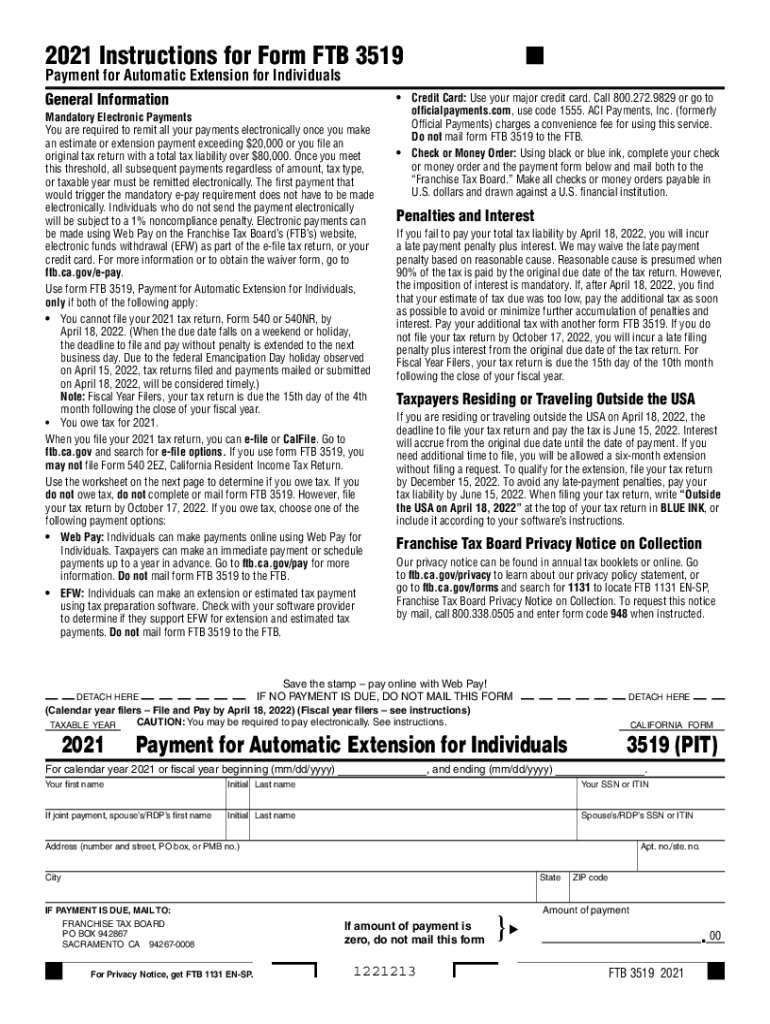

The Form FTB 3519, also known as the California Tax Extension Form, is essential for individuals seeking an automatic extension to file their California state tax returns. This form allows taxpayers to request an extension of time to file their income tax returns without incurring late filing penalties. It is important to note that while the form grants an extension for filing, it does not extend the deadline for any tax payments owed. Taxpayers must ensure that they submit any payments due by the original filing deadline to avoid interest and penalties.

How to Complete the Form FTB 3519

Completing the Form FTB 3519 involves several straightforward steps. First, gather your financial information, including your estimated tax liability for the year. This will help you determine the amount you need to pay with the form. Next, accurately fill out the form, providing your personal information, such as your name, address, and Social Security number. Ensure that you calculate any payment due correctly. After completing the form, you can submit it either electronically or by mail, depending on your preference and the options available to you.

Filing Deadlines for the Form FTB 3519

The deadline for submitting the Form FTB 3519 coincides with the original due date of your California state tax return, typically April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to adhere to this timeline to avoid penalties. If you miss the deadline, you may face late fees and interest on any unpaid taxes.

Required Documents for Filing the Form FTB 3519

When filing the Form FTB 3519, you may need to prepare specific documents to support your request for an extension. These documents typically include your previous year's tax return, any relevant income statements, and documentation of your estimated tax payments for the current year. Having these documents ready will facilitate a smoother filing process and ensure that your payment estimates are accurate.

Submission Methods for the Form FTB 3519

The Form FTB 3519 can be submitted through various methods, providing flexibility for taxpayers. You can file the form electronically using approved e-filing software, which often streamlines the process and provides immediate confirmation of submission. Alternatively, you can print the completed form and mail it to the appropriate address specified by the California Franchise Tax Board. Ensure that you choose a method that best suits your needs and allows for timely submission.

Key Elements of the Form FTB 3519

Several key elements are essential to understand when dealing with the Form FTB 3519. The form requires your personal information, including your name, address, and Social Security number. Additionally, you must provide your estimated tax liability for the year and any payment due. Understanding these components will help you complete the form accurately and comply with California tax regulations.

Legal Considerations for the Form FTB 3519

The Form FTB 3519 is legally binding when completed and submitted according to California tax laws. By filing this form, you are formally requesting an extension of time to file your tax return, which is recognized by the state. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. Utilizing a reliable e-signature solution can further enhance the legal validity of your submission.

Quick guide on how to complete 2021 form ftb 3519 payment for automatic extension for individuals 2021 form ftb 3519 payment for automatic extension for

Complete Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to obtain the correct format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals effortlessly

- Obtain Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form ftb 3519 payment for automatic extension for individuals 2021 form ftb 3519 payment for automatic extension for

Create this form in 5 minutes!

How to create an eSignature for the 2021 form ftb 3519 payment for automatic extension for individuals 2021 form ftb 3519 payment for automatic extension for

How to create an e-signature for your PDF document online

How to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an e-signature for a PDF file on Android OS

People also ask

-

What is form 3519?

Form 3519 is a document used for various administrative processes. With airSlate SignNow, you can easily eSign and send form 3519, streamlining your workflow and ensuring compliance with regulatory requirements.

-

How can airSlate SignNow help me with form 3519?

airSlate SignNow simplifies the process of managing form 3519 by providing a user-friendly platform for electronic signatures. You can quickly fill out, sign, and share form 3519, saving time and reducing paperwork.

-

Is there a free trial available for using form 3519 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features before committing to a plan. You can use the trial to manage and eSign form 3519, helping you understand the benefits firsthand.

-

What are the pricing options for using airSlate SignNow to manage form 3519?

airSlate SignNow provides flexible pricing plans that cater to various business needs. Depending on your requirements for managing form 3519, you can choose the plan that fits your budget and unlock essential features.

-

Can I integrate airSlate SignNow with other applications for form 3519?

Absolutely! airSlate SignNow offers integrations with popular applications, allowing you to easily import and export form 3519 data. This seamless integration enhances your productivity and minimizes any disruptions in your processes.

-

What are the security features for signing form 3519 electronically?

airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your form 3519 and other documents. You can trust that your electronic signatures are safe, ensuring compliance with legal standards.

-

How can I share form 3519 with others using airSlate SignNow?

Sharing form 3519 is easy with airSlate SignNow. Once you’ve signed the document, you can send it directly via email or share a secure link, ensuring that all parties involved can access and complete the form without hassle.

Get more for Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals

- 31 day notice to terminate month to month lease from tenant to landlord massachusetts form

- Massachusetts 90 day form

- Assignment of mortgage by individual mortgage holder massachusetts form

- Assignment mortgage corporate 497309720 form

- Agreement under 37 37a for workers compensation massachusetts form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property massachusetts form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497309724 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property massachusetts form

Find out other Form FTB 3519 Payment For Automatic Extension For Individuals , Form FTB 3519, Payment For Automatic Extension For Individuals

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract