Submitting Electronic Extension Payments for CA Form 2023

What is the Submitting Electronic Extension Payments For CA Form

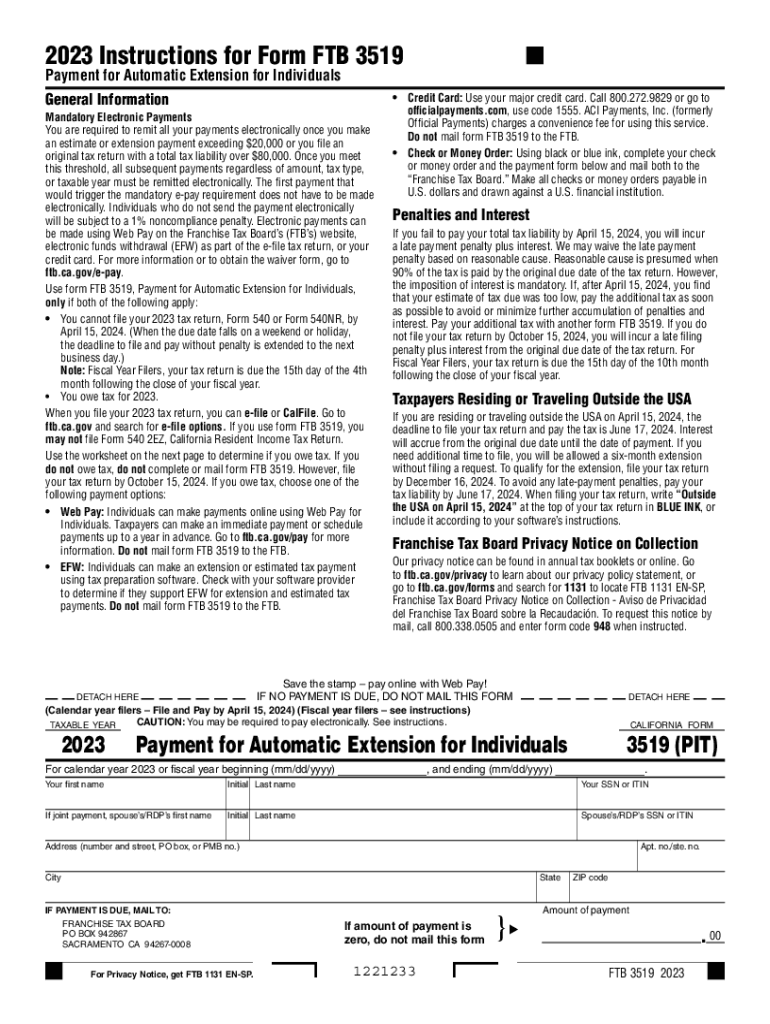

The Submitting Electronic Extension Payments For CA Form, specifically the 2015 ftb extension, allows California taxpayers to request an extension for filing their state tax returns. This form is crucial for individuals and businesses who need additional time to prepare their taxes without incurring late fees. By submitting this form, taxpayers can avoid penalties associated with late filing while ensuring they remain compliant with California tax regulations.

How to use the Submitting Electronic Extension Payments For CA Form

To use the 2015 ftb extension form effectively, taxpayers must first ensure they meet the eligibility criteria for an extension. The form can typically be filled out online or downloaded for manual completion. After filling out the necessary information, including personal details and estimated tax payments, taxpayers should submit the form electronically through the California Franchise Tax Board's website. It's important to keep a copy of the submitted form for personal records.

Steps to complete the Submitting Electronic Extension Payments For CA Form

Completing the 2015 ftb extension form involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Access the form online or download it from the California Franchise Tax Board's website.

- Fill out the form with accurate personal and financial information.

- Calculate any estimated tax payments due and include this information on the form.

- Submit the completed form electronically or via mail, ensuring it is sent before the filing deadline.

Filing Deadlines / Important Dates

For the 2015 ftb extension, the filing deadline for submitting the extension request typically aligns with the original tax return due date. Taxpayers should be aware that extensions generally provide an additional six months to file the tax return, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to check the California Franchise Tax Board's official website for specific dates related to the 2015 tax year.

Required Documents

When completing the 2015 ftb extension form, taxpayers should have the following documents on hand:

- Previous year’s tax return for reference.

- W-2 forms from employers and 1099 forms for any freelance work.

- Records of any estimated tax payments made throughout the year.

- Documentation of any deductions or credits that may apply.

Penalties for Non-Compliance

Failing to submit the 2015 ftb extension form on time can result in significant penalties. Taxpayers may incur late filing fees, which can accumulate quickly. Additionally, if any taxes owed are not paid by the original due date, interest will accrue on the unpaid balance. It is crucial to understand these penalties to avoid unnecessary financial strain.

Create this form in 5 minutes or less

Find and fill out the correct submitting electronic extension payments for ca form

Create this form in 5 minutes!

How to create an eSignature for the submitting electronic extension payments for ca form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 ftb extension and how does it work?

The 2015 ftb extension is a form that allows taxpayers to extend their filing deadline for California state taxes. By submitting this extension, you can avoid late penalties while ensuring you have ample time to prepare your tax documents. airSlate SignNow simplifies this process by enabling you to eSign and send your extension forms quickly and securely.

-

How can airSlate SignNow help with the 2015 ftb extension process?

airSlate SignNow provides an easy-to-use platform for completing and eSigning your 2015 ftb extension forms. With our solution, you can fill out the necessary information, sign electronically, and send it directly to the California Franchise Tax Board. This streamlines the process and ensures your extension is submitted on time.

-

What are the pricing options for using airSlate SignNow for the 2015 ftb extension?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Our plans are designed to be cost-effective, allowing you to manage your 2015 ftb extension and other document needs without breaking the bank. You can choose a plan that fits your budget and usage requirements.

-

Are there any features specifically beneficial for the 2015 ftb extension?

Yes, airSlate SignNow includes features that are particularly useful for managing the 2015 ftb extension. These features include customizable templates, secure eSigning, and real-time tracking of document status. This ensures that you can efficiently handle your tax extension while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for my 2015 ftb extension?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage your 2015 ftb extension alongside your other financial tasks. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for my 2015 ftb extension?

Using airSlate SignNow for your 2015 ftb extension provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to complete and send your extension forms quickly, reducing the stress associated with tax season. Additionally, electronic signatures are legally binding, ensuring your documents are valid.

-

Is airSlate SignNow secure for handling my 2015 ftb extension?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling your 2015 ftb extension. We utilize advanced encryption and secure data storage to protect your sensitive information. You can trust that your documents are safe while using our platform.

Get more for Submitting Electronic Extension Payments For CA Form

- Form 2587 rev 3 2022 application for special enrollment examination

- Department of the treasury instructions for form ct 1

- 2022 schedule o form 990 supplemental information to form 990 or 990 ez

- How to adjust already filed partnership returns under bba croweadministrative adjustment requests under the bba the tax form

- Instructions for form 944 2022internal revenue service irs tax forms

- Virginia department of taxation income tax return po box 1500 form

- Draft 2022 form 763 virginia nonresident income tax return 2022 virginia nonresident income tax return

- Wwwtaxformfinderorgindexvirginiavirginia form 760py part year resident individual income tax

Find out other Submitting Electronic Extension Payments For CA Form

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter