Form FTB 3519 Automatic Extension Payment Instructions 2024-2026

What is the Form FTB 3519 Automatic Extension Payment?

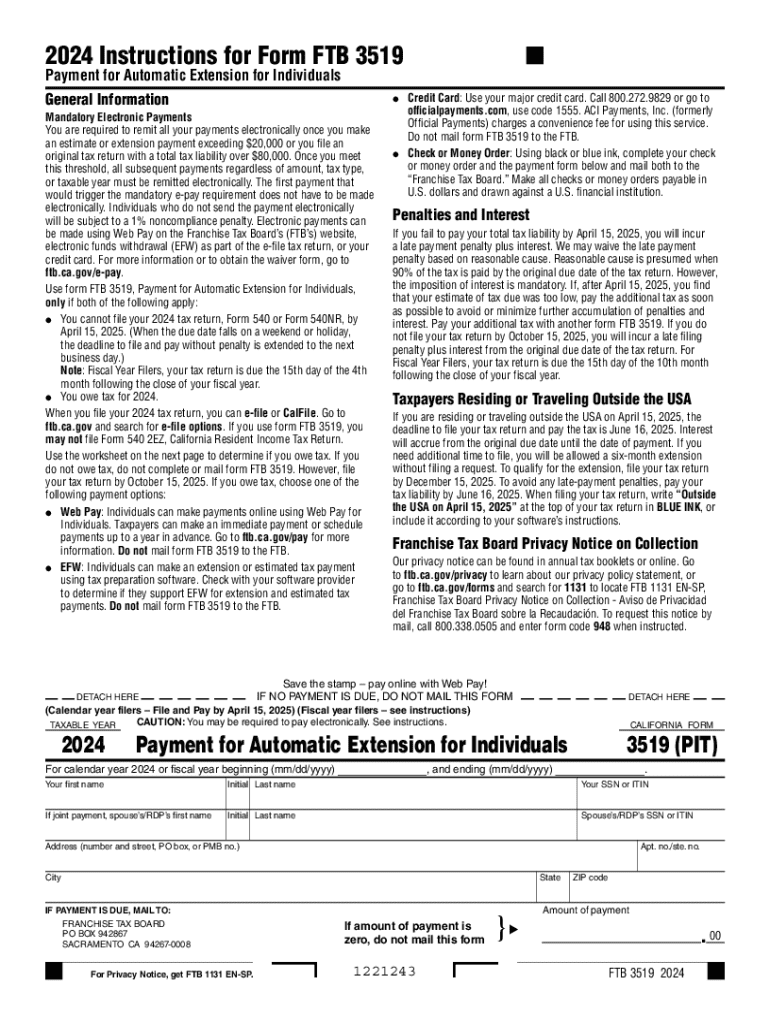

The FTB 3519 is a form used by taxpayers in California to request an automatic extension for filing their state income tax returns. This form is specifically designed for individuals and businesses seeking to extend their filing deadline while ensuring that any taxes owed are paid on time. By submitting FTB 3519, taxpayers can avoid penalties associated with late payments, allowing them additional time to prepare their returns without incurring unnecessary fees.

Steps to Complete the Form FTB 3519

Completing the FTB 3519 involves several straightforward steps:

- Gather necessary information, including your Social Security number or Employer Identification Number, and estimated tax liability.

- Fill out the form with your personal details, including your name, address, and the tax year for which you are requesting an extension.

- Calculate the total amount due based on your estimated tax liability.

- Submit the form along with your payment by the specified deadline to avoid penalties.

Ensure that all information is accurate to prevent delays in processing your extension request.

Filing Deadlines for the FTB 3519

The deadline for submitting the FTB 3519 typically aligns with the due date for your California state income tax return. For most taxpayers, this date is April 15 of the tax year. If April 15 falls on a weekend or holiday, the deadline may be adjusted. It is essential to submit your FTB 3519 by this date to qualify for an automatic extension and avoid late payment penalties.

Form Submission Methods for FTB 3519

Taxpayers can submit the FTB 3519 through various methods:

- Online: Use the California Franchise Tax Board's website to submit the form electronically and make your payment.

- Mail: Print the completed form and send it to the address specified on the form, along with your payment.

- In-Person: Visit a California Franchise Tax Board office to submit the form and payment directly.

Choosing the online method is often the most efficient, as it allows for immediate confirmation of submission.

Key Elements of the Form FTB 3519

Understanding the key elements of the FTB 3519 is crucial for successful completion:

- Taxpayer Information: This section requires your name, address, and identification number.

- Estimated Tax Liability: Provide an accurate estimate of the taxes you owe for the year.

- Payment Information: Indicate the amount you are paying with the extension request.

Each of these components is essential for ensuring that your extension is processed correctly and that you remain compliant with California tax regulations.

Legal Use of the Form FTB 3519

The FTB 3519 is legally recognized as a valid request for an extension of time to file your state income tax return. By submitting this form, you are formally notifying the California Franchise Tax Board of your intention to extend your filing deadline. It is important to note that while the form allows for an extension of time to file, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Create this form in 5 minutes or less

Find and fill out the correct form ftb 3519 automatic extension payment instructions

Create this form in 5 minutes!

How to create an eSignature for the form ftb 3519 automatic extension payment instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 3519 form and how can airSlate SignNow help?

The ftb 3519 form is a California tax form used for various tax-related purposes. airSlate SignNow simplifies the process of filling out and eSigning the ftb 3519, ensuring that your documents are completed accurately and efficiently. With our platform, you can easily manage your tax documents from anywhere.

-

How much does it cost to use airSlate SignNow for ftb 3519?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have access to all the features necessary for managing the ftb 3519 form. Our cost-effective solution helps you save time and money.

-

What features does airSlate SignNow provide for managing the ftb 3519?

airSlate SignNow provides a range of features for managing the ftb 3519, including customizable templates, secure eSigning, and document tracking. These features streamline the process, making it easier for you to complete and submit your tax forms. Additionally, our user-friendly interface ensures a smooth experience.

-

Can I integrate airSlate SignNow with other applications for ftb 3519 management?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow for managing the ftb 3519. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. This integration capability allows for a more efficient process.

-

What are the benefits of using airSlate SignNow for the ftb 3519?

Using airSlate SignNow for the ftb 3519 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly, ensuring that you meet deadlines without hassle. Additionally, you can access your documents anytime, anywhere.

-

Is airSlate SignNow secure for handling sensitive ftb 3519 information?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive ftb 3519 information. You can trust that your documents are safe and secure while using our platform. We adhere to industry standards to ensure data protection.

-

How can I get started with airSlate SignNow for the ftb 3519?

Getting started with airSlate SignNow for the ftb 3519 is easy. Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating and eSigning your documents. Our intuitive platform guides you through the process, making it accessible for everyone.

Get more for Form FTB 3519 Automatic Extension Payment Instructions

- Application for criminal rehabilitation imm 1444 2009 form

- Imm 5457 form

- Application for a travel document permanent resident abroad form

- Canada adult simplified renewal passport application form

- Alberta courts notice of mandatory seminar form

- How to complete an answer and plan of care for court 2003 form

- Form 25c adoption order ontario court forms ontariocourtforms on

- Right to information department of child safety youth and

Find out other Form FTB 3519 Automatic Extension Payment Instructions

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure