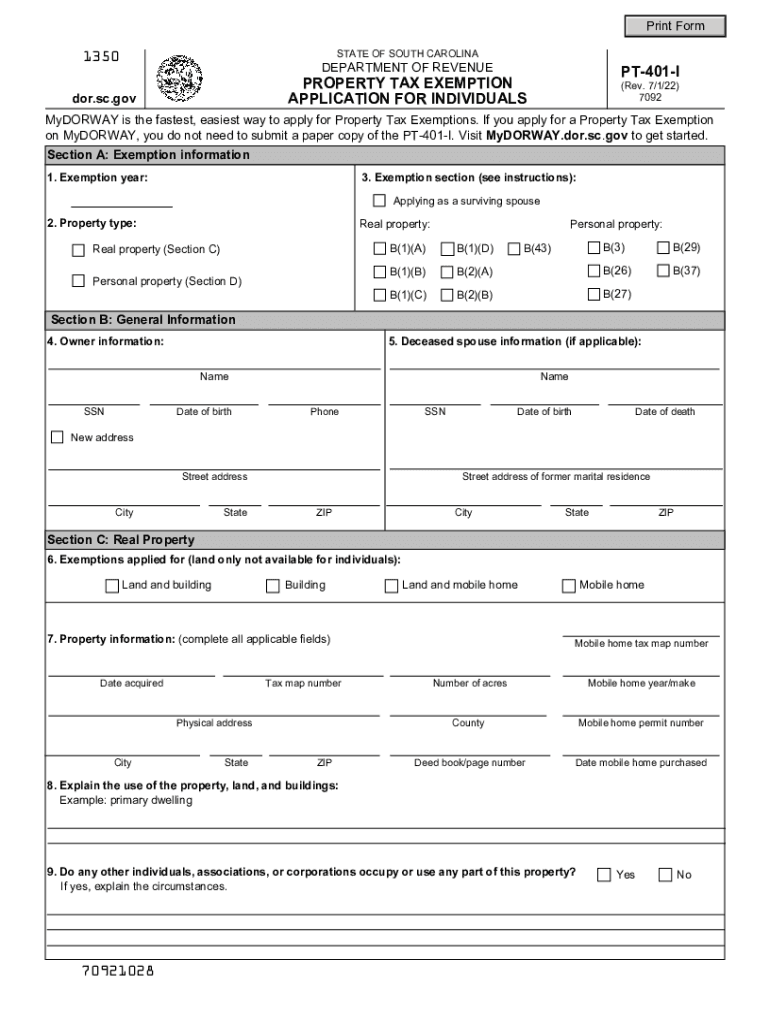

Printable South Carolina Sales Tax Exemption Certificates1350 STATE of SOUTH CAROLINA SC W 4 DEPARTMENT of REVENUEPrintable Sout 2022

Understanding the W-4 Form for 2024

The W-4 form for 2024 is essential for employees in the United States to determine the amount of federal income tax withheld from their paychecks. This form allows individuals to adjust their withholding allowances based on personal circumstances, such as marital status, dependents, and additional income. Understanding how to fill out the W-4 accurately can help ensure that you are not overpaying or underpaying your taxes throughout the year.

Steps to Complete the W-4 Form for 2024

Completing the W-4 form involves several key steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: Indicate if you have multiple jobs or if your spouse is also employed, as this can affect your withholding.

- Claim Dependents: If you have qualifying children or other dependents, you can claim them to reduce your withholding.

- Other Adjustments: Specify any additional income or deductions that may affect your tax situation.

- Signature: Sign and date the form to validate your information.

Eligibility Criteria for Adjusting Withholding

To adjust your withholding using the W-4 form, you must meet certain eligibility criteria. Generally, you should complete a new W-4 if you experience significant life changes, such as marriage, divorce, the birth of a child, or a change in employment status. Additionally, if you expect to owe taxes at the end of the year or receive a refund, adjusting your withholding can help manage your tax liability effectively.

IRS Guidelines for the W-4 Form

The Internal Revenue Service (IRS) provides specific guidelines for completing the W-4 form. It is important to follow these guidelines to ensure compliance with tax laws. The IRS recommends using the online withholding calculator to estimate your tax obligations accurately. This tool can help you determine the appropriate number of allowances to claim based on your unique financial situation.

Form Submission Methods

Once you have completed the W-4 form, you can submit it to your employer through various methods. Most commonly, you can hand it in personally or send it via email if your employer allows electronic submissions. It is essential to keep a copy for your records. If you need to make changes in the future, you can submit a new W-4 at any time during the year.

Digital vs. Paper Version of the W-4 Form

The W-4 form is available in both digital and paper formats. Using a digital version can streamline the process, allowing for easier edits and submissions. Many employers now accept electronic signatures, making it convenient to complete and submit the form online. However, if you prefer a paper version, you can print it from the IRS website and fill it out manually.

Quick guide on how to complete printable south carolina sales tax exemption certificates1350 state of south carolina sc w 4 department of revenueprintable

Complete Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout with ease

- Locate Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout and assure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable south carolina sales tax exemption certificates1350 state of south carolina sc w 4 department of revenueprintable

Create this form in 5 minutes!

People also ask

-

What is a W 4 form 2024 printable and why do I need it?

The W 4 form 2024 printable is a tax document used by employees to indicate their withholding allowances. Completing this form accurately ensures that the right amount of tax is withheld from your paycheck. It's crucial for both compliance and effective tax planning.

-

How can airSlate SignNow help me with the W 4 form 2024 printable?

airSlate SignNow allows you to easily complete and eSign your W 4 form 2024 printable electronically. With our platform, you can fill out your form, sign it, and send it to your employer, all in a secure and user-friendly environment.

-

Is there a cost associated with using airSlate SignNow to fill out my W 4 form 2024 printable?

While airSlate SignNow offers various pricing plans, you can access our basic features, including the ability to complete a W 4 form 2024 printable, at no cost. For additional features such as advanced integrations and templates, we offer affordable subscription options.

-

Can I store my completed W 4 form 2024 printable on airSlate SignNow?

Yes! airSlate SignNow provides secure storage for all your completed documents, including the W 4 form 2024 printable. This means you can easily access your forms whenever you need them, ensuring you always have your important documents at hand.

-

Are there any special features for the W 4 form 2024 printable on airSlate SignNow?

Yes, airSlate SignNow offers several beneficial features for the W 4 form 2024 printable, including real-time collaboration, eSigning, and automatic reminders. These features make it easier to manage your tax documents and ensure that submissions are timely and accurate.

-

How does airSlate SignNow ensure the security of my W 4 form 2024 printable?

Security is a top priority at airSlate SignNow. When you complete and store your W 4 form 2024 printable on our platform, your data is protected with advanced encryption protocols and secure storage solutions, giving you peace of mind.

-

Can I integrate airSlate SignNow with other software for managing my W 4 form 2024 printable?

Absolutely! airSlate SignNow offers integrations with various software applications that can help you manage your W 4 form 2024 printable more efficiently. This includes popular tools for accounting, HR, and payroll, making document management seamless.

Get more for Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout

- Letter landlord rent template 497323667 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession oregon form

- Letter from tenant to landlord about illegal entry by landlord oregon form

- Letter from landlord to tenant about time of intent to enter premises oregon form

- Letter tenant notice 497323671 form

- Letter from tenant to landlord about sexual harassment oregon form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children oregon form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure oregon form

Find out other Printable South Carolina Sales Tax Exemption Certificates1350 STATE OF SOUTH CAROLINA SC W 4 DEPARTMENT OF REVENUEPrintable Sout

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast