Exempt Property SC Department of Revenue 2021

What is the SC Homestead Exemption?

The SC Homestead Exemption is a property tax exemption available to eligible residents of South Carolina. It is designed to provide financial relief for homeowners who meet specific criteria, such as being at least sixty-five years old, being permanently disabled, or being a legally blind individual. This exemption reduces the taxable value of a homeowner's property, ultimately lowering their property tax bill. The exemption applies to the first one hundred thousand dollars of the fair market value of the home, making it a significant benefit for qualifying homeowners.

Eligibility Criteria for the SC Homestead Exemption

To qualify for the SC Homestead Exemption, applicants must meet several eligibility requirements:

- Applicants must be at least sixty-five years old, permanently disabled, or legally blind.

- The property must be the applicant's primary residence.

- Applicants must have owned the property for at least one year prior to applying.

- Income limits may apply, depending on the applicant's circumstances.

It is important for applicants to review these criteria carefully to ensure they meet all requirements before submitting the application.

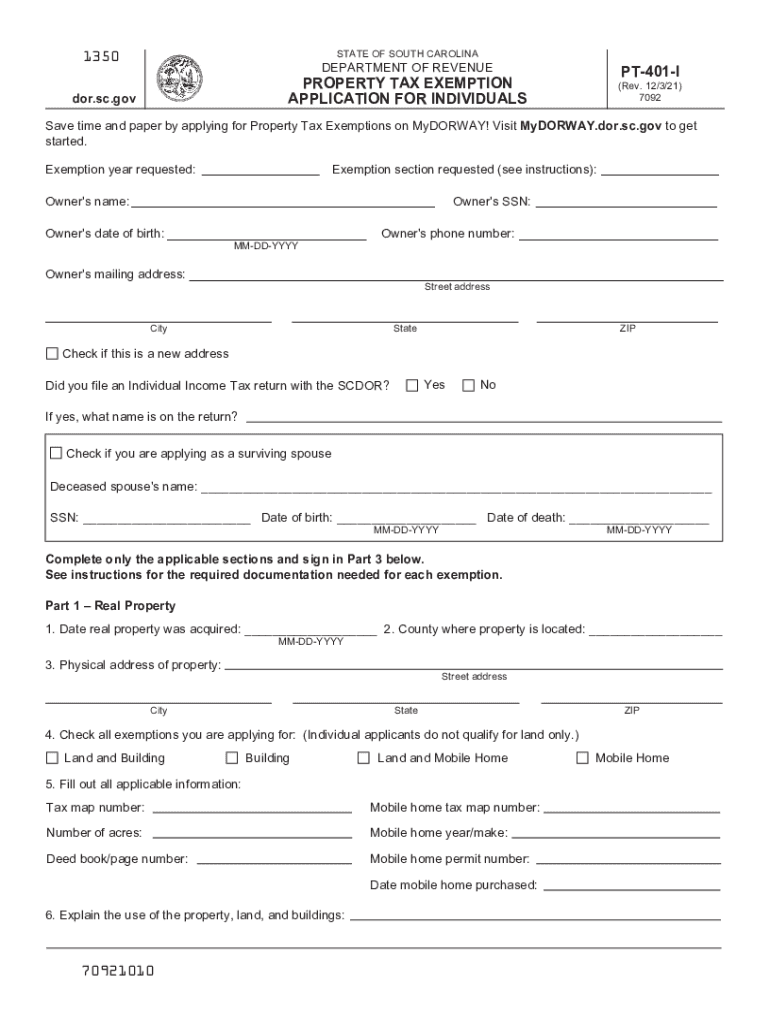

Steps to Complete the SC Homestead Exemption Form

Completing the SC Homestead Exemption form involves a few straightforward steps:

- Obtain the SC Homestead Exemption form, which can be accessed online or through local county offices.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Provide documentation that verifies your eligibility, such as proof of age or disability.

- Submit the completed form along with any required documentation to your local county assessor's office.

- Keep a copy of the submitted form for your records.

Following these steps can help ensure a smooth application process and timely approval of your exemption.

Required Documents for the SC Homestead Exemption

When applying for the SC Homestead Exemption, applicants must provide specific documents to support their application. These may include:

- A completed SC Homestead Exemption form.

- Proof of age, such as a birth certificate or driver's license for applicants aged sixty-five or older.

- Documentation of disability, if applicable, which may include a letter from a medical professional.

- Proof of residency, such as a utility bill or bank statement showing the applicant's name and address.

Gathering these documents in advance can facilitate a more efficient application process.

Form Submission Methods for the SC Homestead Exemption

Applicants can submit the SC Homestead Exemption form through various methods, making it convenient for residents. The available submission methods include:

- Online submission through the South Carolina Department of Revenue website.

- Mailing the completed form and supporting documents to the local county assessor's office.

- In-person submission at the local county assessor's office during business hours.

Choosing the most suitable submission method can help ensure that your application is processed promptly.

Legal Use of the SC Homestead Exemption

The SC Homestead Exemption is legally binding once the application is approved. It provides homeowners with a significant reduction in property taxes, which can lead to substantial savings. Homeowners must adhere to the eligibility requirements and notify the local assessor's office of any changes in circumstances that may affect their exemption status. Failure to comply with these regulations can result in penalties or the loss of the exemption.

Quick guide on how to complete exempt property sc department of revenue

Accomplish Exempt Property SC Department Of Revenue seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to construct, modify, and eSign your documents quickly without holdups. Handle Exempt Property SC Department Of Revenue on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

The easiest way to modify and eSign Exempt Property SC Department Of Revenue without hassle

- Locate Exempt Property SC Department Of Revenue and click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Exempt Property SC Department Of Revenue and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exempt property sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the exempt property sc department of revenue

The best way to generate an e-signature for your PDF file online

The best way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF document on Android devices

People also ask

-

What is the SC homestead exemption form?

The SC homestead exemption form is a legal document that allows eligible South Carolina residents to reduce their property taxes on their primary residence. By completing this form, homeowners can apply for exemptions that can signNowly decrease their tax liabilities, making homeownership more affordable.

-

Who is eligible to file the SC homestead exemption form?

Eligibility to file the SC homestead exemption form generally includes South Carolina residents who are 65 years or older, are permanently disabled, or qualify as a surviving spouse of a qualifying veteran. It is essential to check the specific requirements and ensure all qualifications are met before submitting the form.

-

How do I complete the SC homestead exemption form?

To complete the SC homestead exemption form, you can obtain it from your local county auditor's office or download it online. Make sure to fill in all required information accurately and attach any necessary supporting documents to ensure your application is processed without delays.

-

When is the deadline for submitting the SC homestead exemption form?

The deadline for submitting the SC homestead exemption form is typically July 15 each year. It's important to ensure your application is submitted on time to receive the tax benefits for the current tax year, so mark your calendar and avoid last-minute submissions.

-

How can airSlate SignNow help with the SC homestead exemption form?

AirSlate SignNow makes managing the SC homestead exemption form simple and efficient. With our eSigning solution, you can easily prepare, send, and sign your exemption forms online, ensuring a hassle-free experience while saving time and paper.

-

Are there any costs associated with filing the SC homestead exemption form?

Filing the SC homestead exemption form itself does not have a direct cost; however, there may be fees involved if you seek assistance from tax professionals. Utilizing airSlate SignNow to complete and submit your form can be a cost-effective solution compared to traditional methods.

-

What features does airSlate SignNow offer for managing the SC homestead exemption form?

AirSlate SignNow offers various features to streamline the process of managing the SC homestead exemption form, including customizable templates, electronic signatures, and secure document storage. These tools help ensure that your application is completed accurately and efficiently.

Get more for Exempt Property SC Department Of Revenue

- Aging parent package maryland form

- Sale of a business package maryland form

- Legal documents for the guardian of a minor package maryland form

- New state resident package maryland form

- Commercial property sales package maryland form

- General partnership package maryland form

- Maryland directive form

- Contract for deed package maryland form

Find out other Exempt Property SC Department Of Revenue

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form