PDF Instructions for Form CT 5 4 Tax NY Gov

What is the PDF Instructions For Form CT-5 4 Tax NY gov

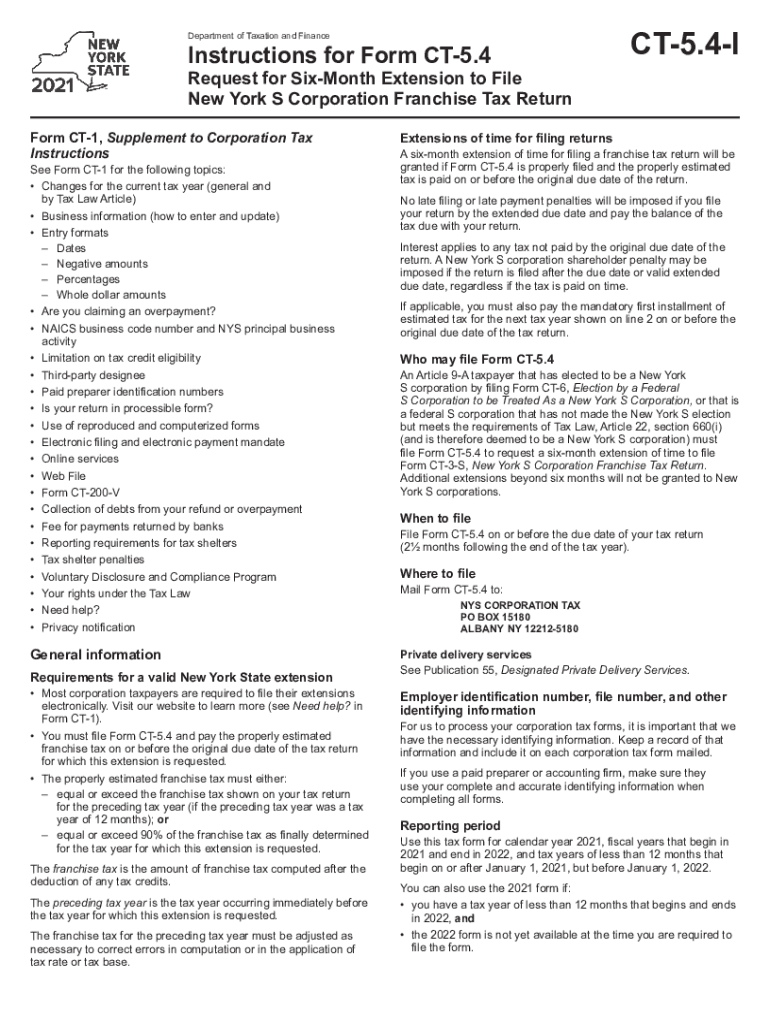

The PDF Instructions for Form CT-5 4 are essential guidelines provided by the New York State Department of Taxation and Finance. This document assists taxpayers in understanding the requirements and procedures for completing the CT-5 4 form, which is used for certain tax-related filings in New York. The instructions cover various aspects, including eligibility criteria, necessary documentation, and specific tax calculations that must be performed. Understanding these instructions is crucial for ensuring compliance with state tax laws.

Steps to complete the PDF Instructions For Form CT-5 4 Tax NY gov

Completing the PDF Instructions for Form CT-5 4 involves several key steps. First, carefully read through the entire instruction document to familiarize yourself with the requirements. Next, gather all necessary documents, such as financial statements and identification numbers. Fill out the form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. Finally, follow the specified submission methods outlined in the instructions to ensure your form is filed correctly and on time.

Legal use of the PDF Instructions For Form CT-5 4 Tax NY gov

The legal use of the PDF Instructions for Form CT-5 4 is governed by New York State tax regulations. These instructions provide the framework for taxpayers to comply with state laws when filing their taxes. Adhering to the guidelines ensures that submissions are valid and can withstand scrutiny from tax authorities. It is important to note that any discrepancies or failures to follow the instructions may result in penalties or delays in processing. Utilizing these instructions correctly is essential for maintaining compliance and avoiding legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the CT-5 4 form are critical for taxpayers to observe. Typically, the deadline aligns with the end of the tax year or specific due dates set forth by the New York State Department of Taxation and Finance. Late submissions may incur penalties or interest on unpaid taxes. It is advisable to check the latest updates from the state tax authority to ensure compliance with any changes in deadlines or important dates that may affect filing.

Required Documents

When completing the PDF Instructions for Form CT-5 4, several required documents must be gathered. These may include financial records, tax identification numbers, prior tax returns, and any supporting documentation that substantiates the information provided on the form. Ensuring that all required documents are available and organized will facilitate a smoother filing process and help avoid delays or complications during review by tax authorities.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting the CT-5 4 form as outlined in the PDF Instructions. Submissions can typically be made online through the New York State Department of Taxation and Finance website, which offers a secure platform for electronic filing. Alternatively, forms can be mailed to the designated address provided in the instructions or submitted in person at local tax offices. Each method has its own advantages, and taxpayers should choose the one that best suits their needs while ensuring timely submission.

Who Issues the Form

The CT-5 4 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides the necessary forms and instructions to help individuals and businesses fulfill their tax obligations. Understanding the role of the issuing authority can provide insight into the importance of adhering to the guidelines set forth in the PDF Instructions.

Quick guide on how to complete pdf instructions for form ct 54 taxnygov

Complete PDF Instructions For Form CT 5 4 Tax NY gov effortlessly on any device

Web-based document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can easily locate the correct form and securely archive it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage PDF Instructions For Form CT 5 4 Tax NY gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign PDF Instructions For Form CT 5 4 Tax NY gov effortlessly

- Locate PDF Instructions For Form CT 5 4 Tax NY gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact confidential information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign PDF Instructions For Form CT 5 4 Tax NY gov and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf instructions for form ct 54 taxnygov

Create this form in 5 minutes!

People also ask

-

What are the PDF Instructions For Form CT 5 4 Tax NY gov?

The PDF Instructions For Form CT 5 4 Tax NY gov provide detailed guidance on how to complete and file this specific tax form. These instructions clarify requirements and deadlines to ensure that businesses comply with state tax regulations efficiently. It is essential for anyone filing to understand these instructions to avoid penalties.

-

How can airSlate SignNow help with the PDF Instructions For Form CT 5 4 Tax NY gov?

airSlate SignNow simplifies the process of completing documents like the PDF Instructions For Form CT 5 4 Tax NY gov by enabling users to eSign and collaborate on documents seamlessly. Our platform allows you to upload the form, fill it out electronically, and send it for signatures, all in one easy step. This helps streamline your tax preparation process.

-

Is airSlate SignNow cost-effective for handling forms like the PDF Instructions For Form CT 5 4 Tax NY gov?

Yes, airSlate SignNow offers a range of pricing plans designed to suit businesses of all sizes, making it a cost-effective solution for handling forms like the PDF Instructions For Form CT 5 4 Tax NY gov. With flexible options, you can choose a plan that fits your budget while benefiting from our robust features. Investing in our solution can save time and improve accuracy.

-

What features does airSlate SignNow offer for document management related to the PDF Instructions For Form CT 5 4 Tax NY gov?

airSlate SignNow includes several features that enhance document management, such as templates, automated workflows, and secure storage. With these tools, you can efficiently create, edit, and manage your documents while ensuring that the information complies with the PDF Instructions For Form CT 5 4 Tax NY gov. Our platform ensures document integrity throughout the entire process.

-

Can I integrate airSlate SignNow with other software for processing the PDF Instructions For Form CT 5 4 Tax NY gov?

Absolutely! airSlate SignNow allows for seamless integration with various business applications, enhancing your workflow when processing documents like the PDF Instructions For Form CT 5 4 Tax NY gov. By integrating with your favorite tools, you can streamline your operations and make coordinating document management more efficient.

-

What are the benefits of using airSlate SignNow for the PDF Instructions For Form CT 5 4 Tax NY gov?

Using airSlate SignNow for the PDF Instructions For Form CT 5 4 Tax NY gov brings numerous benefits, including increased efficiency in document handling and reduced paperwork errors. Our platform ensures secure eSigning and document tracking, which allows for a more organized approach to tax filing. This ultimately saves businesses time and resources.

-

Is there customer support available for using airSlate SignNow with the PDF Instructions For Form CT 5 4 Tax NY gov?

Yes, airSlate SignNow offers comprehensive customer support for all users, including those needing assistance with the PDF Instructions For Form CT 5 4 Tax NY gov. Our knowledgeable support team is available to help you navigate any challenges you encounter while using our platform. You can signNow out via email, chat, or phone for timely assistance.

Get more for PDF Instructions For Form CT 5 4 Tax NY gov

- Worker request for claim classification review oregon form

- Worker claim form

- Oregon worker program form

- Oregon worker program 497323809 form

- Oregon program employment form

- Preferred worker program quarterly claim cost reimbursement request oregon form

- Preferred worker program quarterly claim cost reimbursement request worksheet oregon form

- Oregon workers compensation 497323813 form

Find out other PDF Instructions For Form CT 5 4 Tax NY gov

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement