Statement of Financial Condition for Businesses REV 484 FormsPublications

What is the Statement of Financial Condition for Businesses REV 484?

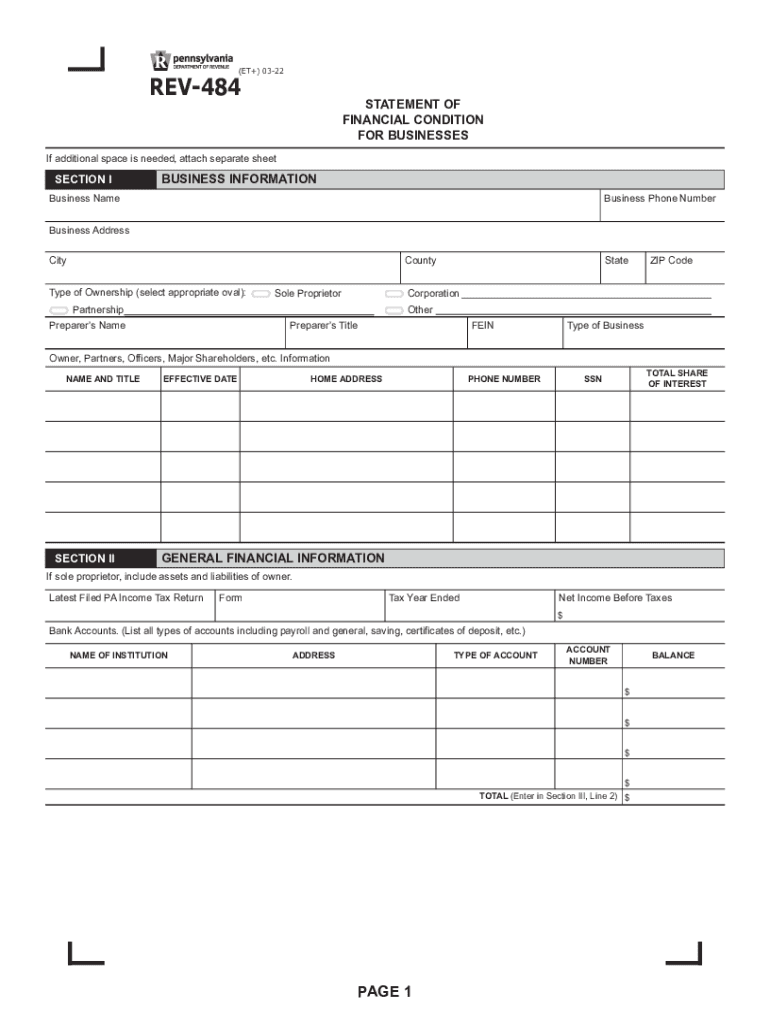

The Statement of Financial Condition for Businesses, commonly referred to as the REV 484 form, is a crucial document required by the Pennsylvania Department of Revenue. This form provides a comprehensive overview of a business's financial status, including assets, liabilities, and overall equity. It is essential for various business entities, including partnerships, corporations, and sole proprietorships, to accurately report their financial condition for tax purposes and compliance with state regulations.

Steps to Complete the Statement of Financial Condition for Businesses REV 484

Completing the REV 484 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including balance sheets and income statements. Next, accurately fill out each section of the form, detailing your business’s assets and liabilities. It is important to double-check all figures for accuracy to avoid discrepancies. Once completed, the form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Legal Use of the Statement of Financial Condition for Businesses REV 484

The REV 484 form holds significant legal weight in Pennsylvania. It is used to assess a business's financial health and compliance with state tax laws. Properly completing and submitting this form can protect businesses from potential legal issues related to tax compliance. Additionally, the information provided may be used in audits or financial assessments by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates for REV 484

It is crucial for businesses to be aware of the filing deadlines associated with the REV 484 form. Typically, the form must be submitted annually, coinciding with the business's tax filing schedule. Missing these deadlines can result in penalties or interest charges. Businesses should consult the Pennsylvania Department of Revenue's official guidelines to confirm specific dates and any changes in filing requirements.

Form Submission Methods for REV 484

The REV 484 form can be submitted through various methods, providing flexibility for businesses. Options include online submission via the Pennsylvania Department of Revenue's website, mailing a physical copy to the appropriate office, or delivering it in person. Each method has its own set of instructions and requirements, so it is important to choose the one that best fits your business's needs.

Key Elements of the Statement of Financial Condition for Businesses REV 484

Understanding the key elements of the REV 484 form is essential for accurate completion. The form typically includes sections for reporting current assets, fixed assets, current liabilities, and long-term liabilities. Additionally, businesses must provide information on equity and any contingent liabilities. Each section must be filled out with precise figures to ensure compliance and avoid potential issues with the Pennsylvania Department of Revenue.

Quick guide on how to complete statement of financial condition for businesses rev 484 formspublications

Prepare Statement Of Financial Condition For Businesses REV 484 FormsPublications effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, since you can access the appropriate form and securely store it online. airSlate SignNow provides all the essentials you require to create, alter, and eSign your documents quickly without setbacks. Manage Statement Of Financial Condition For Businesses REV 484 FormsPublications on any gadget using airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The simplest method to alter and eSign Statement Of Financial Condition For Businesses REV 484 FormsPublications with ease

- Find Statement Of Financial Condition For Businesses REV 484 FormsPublications and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your adjustments.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign Statement Of Financial Condition For Businesses REV 484 FormsPublications and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Pennsylvania REV fo Revenue?

The Pennsylvania REV fo Revenue refers to the forms and procedures established for various tax filings in Pennsylvania. Understanding this system is crucial for businesses operating in the state to ensure compliance with local tax regulations.

-

How can airSlate SignNow help with Pennsylvania REV fo Revenue documents?

AirSlate SignNow streamlines the process of sending and signing Pennsylvania REV fo Revenue documents. With its user-friendly interface, you can quickly prepare, execute, and securely store your tax forms, enhancing your efficiency during tax season.

-

Is airSlate SignNow compliant with Pennsylvania REV fo Revenue regulations?

Yes, airSlate SignNow is designed to comply with the legal requirements of Pennsylvania REV fo Revenue regulations. This ensures that all your eSigned documents are secure and valid for submission to the state.

-

What features does airSlate SignNow offer for managing Pennsylvania REV fo Revenue forms?

AirSlate SignNow offers features such as customizable templates, bulk sending, and real-time tracking to help you manage Pennsylvania REV fo Revenue forms. These tools enable you to automate your document workflow and reduce the time spent on manual processes.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides various pricing plans to accommodate different business needs. Each plan includes features that are optimized for handling documents like Pennsylvania REV fo Revenue, ensuring you find a cost-effective solution that fits your budget.

-

Can airSlate SignNow integrate with other applications for Pennsylvania REV fo Revenue management?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, which can enhance your overall workflow for Pennsylvania REV fo Revenue management. These integrations help consolidate your processes, making it easier to send and receive necessary documents.

-

What are the benefits of using airSlate SignNow for Pennsylvania REV fo Revenue?

By using airSlate SignNow for Pennsylvania REV fo Revenue, you benefit from increased efficiency, reduced paperwork, and enhanced security. The platform's easy-to-use features allow you to focus on your core business rather than getting bogged down in document management tasks.

Get more for Statement Of Financial Condition For Businesses REV 484 FormsPublications

Find out other Statement Of Financial Condition For Businesses REV 484 FormsPublications

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast