Personal Income Tax FormsRI Division of Taxation RI Gov 2022-2026

What is the RI 1040 Personal Income Tax Form?

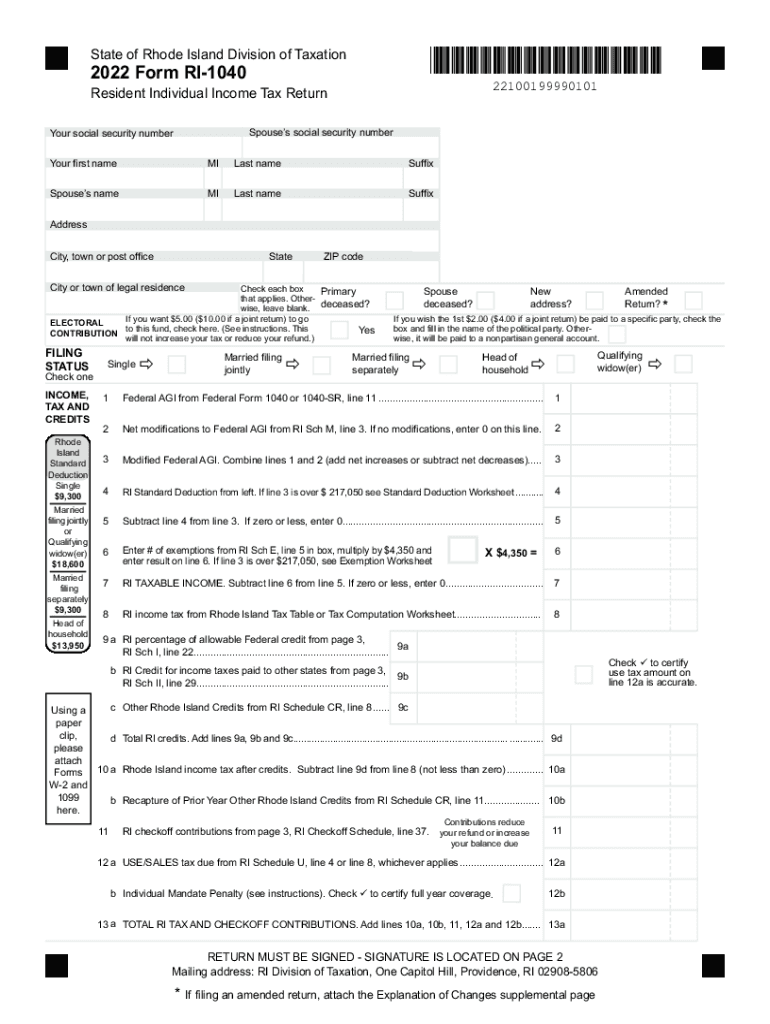

The RI 1040 is the primary personal income tax form used by residents of Rhode Island to report their annual income to the state. This form is essential for individuals seeking to fulfill their tax obligations and determine their tax liability. It includes sections for reporting various sources of income, deductions, and credits applicable to Rhode Island taxpayers. Understanding the structure and requirements of the RI 1040 is crucial for accurate and compliant tax filing.

Steps to Complete the RI 1040 Form

Completing the RI 1040 involves several key steps to ensure accuracy and compliance with state tax laws:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of other income.

- Fill out personal information: Provide your name, address, Social Security number, and filing status at the top of the form.

- Report income: Enter all sources of income in the designated sections, ensuring you include wages, interest, dividends, and any other taxable income.

- Claim deductions and credits: Review available deductions and credits that apply to your situation, such as personal exemptions or education credits, and enter them accordingly.

- Calculate tax liability: Use the tax tables provided by the Rhode Island Division of Taxation to determine your tax due based on your taxable income.

- Sign and date the form: Ensure you sign and date the form before submission to validate your tax return.

Legal Use of the RI 1040 Form

The RI 1040 form is legally binding once completed and submitted according to state regulations. It is essential to provide accurate information, as any discrepancies can lead to penalties or audits. The form must be signed by the taxpayer, and electronic submissions should comply with the ESIGN Act to ensure legal validity. Using a reliable eSignature solution can enhance the legal standing of your submitted form, providing a secure and compliant method for digital signatures.

Filing Deadlines for the RI 1040

Taxpayers must be aware of the important deadlines associated with filing the RI 1040. Typically, the deadline for filing personal income tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid last-minute issues and ensure timely processing of your return.

Required Documents for the RI 1040

To successfully complete the RI 1040, you will need to gather several key documents:

- W-2 forms: These forms report your wages and tax withheld from your employer.

- 1099 forms: If you received income from freelance work, investments, or other sources, these forms will detail that income.

- Proof of deductions: Keep receipts and documentation for any deductions you plan to claim, such as medical expenses or charitable contributions.

- Previous year’s tax return: Having your last year's return can help ensure consistency and accuracy in your current filing.

Form Submission Methods for the RI 1040

Taxpayers can submit the RI 1040 form through various methods, ensuring flexibility and convenience:

- Online: Many taxpayers choose to file electronically through authorized e-filing services, which can expedite processing times.

- Mail: Completed forms can be printed and mailed to the Rhode Island Division of Taxation at the address specified in the instructions.

- In-person: Some individuals may prefer to submit their forms in person at designated tax offices, especially if they have questions or need assistance.

Quick guide on how to complete personal income tax formsri division of taxation rigov

Handle Personal Income Tax FormsRI Division Of Taxation RI gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to design, modify, and electronically sign your documents quickly without delays. Manage Personal Income Tax FormsRI Division Of Taxation RI gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Steps to adjust and eSign Personal Income Tax FormsRI Division Of Taxation RI gov easily

- Obtain Personal Income Tax FormsRI Division Of Taxation RI gov and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Mark important sections of the documents or obscure confidential details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your delivery method for the form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Personal Income Tax FormsRI Division Of Taxation RI gov and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal income tax formsri division of taxation rigov

Create this form in 5 minutes!

How to create an eSignature for the personal income tax formsri division of taxation rigov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the RI 1040 2016 form?

The RI 1040 2016 form is a crucial tax document for individuals filing their state income tax in Rhode Island. It allows residents to report their income and calculate their tax liabilities. Understanding the RI 1040 2016 form ensures you meet your tax obligations accurately and avoid penalties.

-

How can airSlate SignNow help with the RI 1040 2016 form?

airSlate SignNow simplifies the process of filling out and signing the RI 1040 2016 form by allowing users to fill in the document electronically. With features like eSignature and document tracking, you can ensure that your form is completed and submitted on time. This streamlines tax compliance, enhancing efficiency and reducing the stress of tax season.

-

Is airSlate SignNow cost-effective for handling the RI 1040 2016?

Yes, airSlate SignNow offers a cost-effective solution for managing the RI 1040 2016 form. With various pricing plans, businesses can choose a plan that fits their needs and budget without sacrificing essential features. This affordability ensures that everyone can access reliable eSignature services while handling their tax documents.

-

Can I integrate airSlate SignNow with my existing accounting software for RI 1040 2016?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage the RI 1040 2016 form within your existing workflows. This integration allows for a smooth transfer of data, reducing errors and saving time in preparing your tax documents and filings.

-

What features does airSlate SignNow provide for the RI 1040 2016 form?

airSlate SignNow includes a range of features for the RI 1040 2016 form, such as customizable templates, electronic signatures, and robust document storage. These features enable users to fill out and sign their tax forms easily while ensuring they remain secure and easily accessible. This all-in-one solution optimizes the entire document signing experience.

-

Does airSlate SignNow offer customer support for RI 1040 2016 users?

Yes, airSlate SignNow provides excellent customer support for users managing the RI 1040 2016 form. Whether you need assistance with technical issues or guidance on using the platform effectively, their dedicated support team is available to help. This ensures a smooth and trouble-free experience when using the service.

-

What are the benefits of using airSlate SignNow for the RI 1040 2016?

Using airSlate SignNow for the RI 1040 2016 form provides numerous benefits, including reduced turnaround time and improved accuracy in filling out tax documents. The ease of use and electronic signing capabilities streamline the process, making it less daunting. With added security features, users can be confident their sensitive information remains protected.

Get more for Personal Income Tax FormsRI Division Of Taxation RI gov

- Sellers information for appraiser provided to buyer rhode island

- Subcontractors agreement rhode island form

- Option to purchase addendum to residential lease lease or rent to own rhode island form

- Rhode island prenuptial premarital agreement uniform premarital agreement act with financial statements rhode island

- Rhode island agreement form

- Amendment to prenuptial or premarital agreement rhode island form

- Financial statements only in connection with prenuptial premarital agreement rhode island form

- Restraining order after hearing order of protecti form

Find out other Personal Income Tax FormsRI Division Of Taxation RI gov

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy