Form RI 1040 Rhode Island Division of Taxation 2019

What is the Form RI 1040 Rhode Island Division Of Taxation

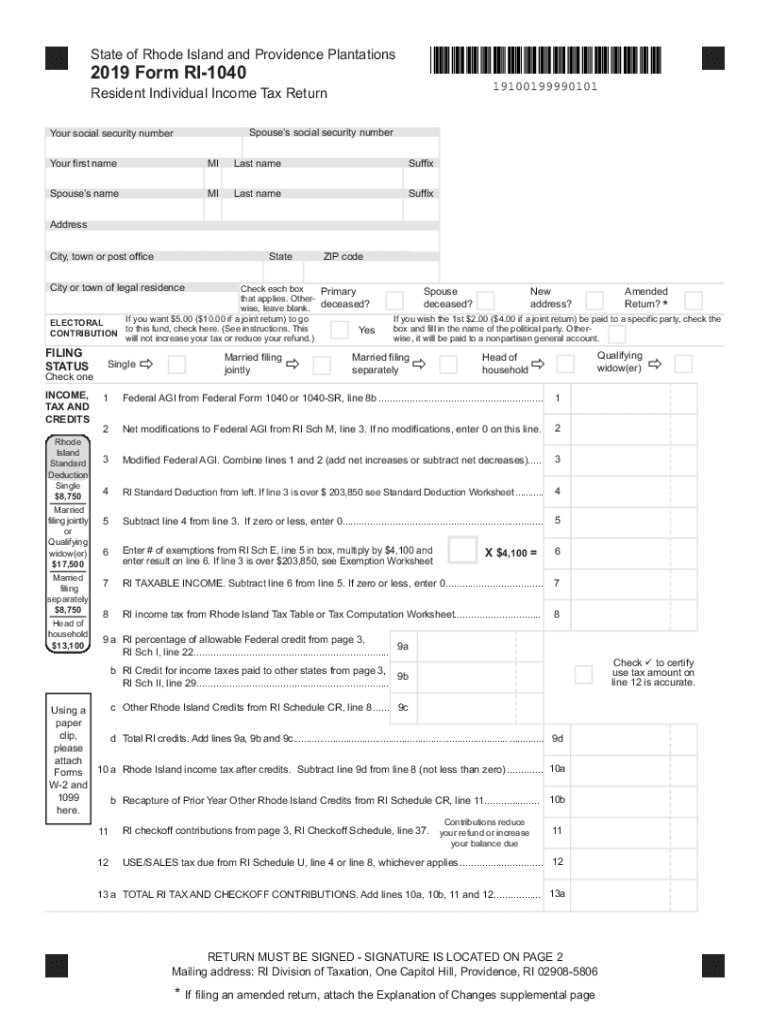

The Form RI 1040 is the primary income tax return form used by residents of Rhode Island to report their annual income to the Rhode Island Division of Taxation. This form is essential for individuals who earn income within the state and need to fulfill their tax obligations. It includes various sections where taxpayers can detail their income, deductions, and credits, ultimately determining their tax liability or refund.

Steps to complete the Form RI 1040 Rhode Island Division Of Taxation

Completing the Form RI 1040 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and records of any other income.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy to avoid discrepancies.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

How to obtain the Form RI 1040 Rhode Island Division Of Taxation

The Form RI 1040 can be obtained through various methods. Taxpayers can download the form directly from the Rhode Island Division of Taxation's official website. Alternatively, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form RI 1040. Typically, the deadline for submitting your income tax return is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any deadlines for estimated tax payments if applicable.

Required Documents

To complete the Form RI 1040 accurately, several documents are necessary:

- W-2 forms from employers to report wages and tax withholdings.

- 1099 forms for any additional income, such as freelance work or interest.

- Documentation of deductions, such as mortgage interest statements or medical expenses.

- Any previous year tax returns for reference.

Legal use of the Form RI 1040 Rhode Island Division Of Taxation

The Form RI 1040 is legally recognized as the official document for reporting personal income tax in Rhode Island. To ensure its legal validity, taxpayers must complete the form accurately and submit it by the established deadlines. Additionally, using a compliant eSignature solution can enhance the legitimacy of the submission, as electronic signatures are recognized under U.S. law when proper protocols are followed.

Quick guide on how to complete 2019 form ri 1040 rhode island division of taxation

Accomplish Form RI 1040 Rhode Island Division Of Taxation with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents quickly without holdups. Manage Form RI 1040 Rhode Island Division Of Taxation on any device using airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The simplest way to adjust and eSign Form RI 1040 Rhode Island Division Of Taxation effortlessly

- Obtain Form RI 1040 Rhode Island Division Of Taxation and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Confirm the details and click on the Done button to save your changes.

- Choose how to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form RI 1040 Rhode Island Division Of Taxation and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form ri 1040 rhode island division of taxation

Create this form in 5 minutes!

How to create an eSignature for the 2019 form ri 1040 rhode island division of taxation

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 2014 Rhode Island state tax form?

The 2014 Rhode Island state tax form is a document used by residents to report their income and calculate their state taxes for that year. It is essential for individuals and businesses to accurately fill out this form to ensure compliance with state tax laws and avoid potential penalties.

-

How can I obtain the 2014 Rhode Island state tax form?

You can easily obtain the 2014 Rhode Island state tax form from the Rhode Island Division of Taxation's website or through various tax software programs. Many websites also offer downloadable versions of the form for convenience.

-

Is the 2014 Rhode Island state tax form available for e-filing?

Yes, the 2014 Rhode Island state tax form can be e-filed through various tax preparation software that supports state tax submissions. E-filing is often faster and more secure, making it a preferred choice for many taxpayers.

-

What features does airSlate SignNow offer for signing the 2014 Rhode Island state tax form?

AirSlate SignNow provides an easy-to-use platform for electronically signing the 2014 Rhode Island state tax form. With its advanced features, users can upload documents, add signature fields, and send forms for signatures securely and efficiently.

-

Are there any costs associated with using airSlate SignNow for the 2014 Rhode Island state tax form?

AirSlate SignNow offers a cost-effective solution with various pricing plans to suit different business needs. Users can take advantage of a free trial to explore features and determine the best plan for eSigning the 2014 Rhode Island state tax form.

-

Can airSlate SignNow integrate with other tools for the 2014 Rhode Island state tax form?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This ensures that you can manage and eSign the 2014 Rhode Island state tax form alongside your existing workflows easily.

-

What are the benefits of using airSlate SignNow for my 2014 Rhode Island state tax form?

Using airSlate SignNow for your 2014 Rhode Island state tax form streamlines the eSigning process, saves time, and enhances document security. It allows you to quickly send, sign, and store your tax forms within a single platform.

Get more for Form RI 1040 Rhode Island Division Of Taxation

- Subcontractors agreement utah form

- Option to purchase addendum to residential lease lease or rent to own utah form

- Utah prenuptial premarital agreement uniform premarital agreement act with financial statements utah

- Utah prenuptial premarital agreement without financial statements utah form

- Amendment to prenuptial or premarital agreement utah form

- Financial statements only in connection with prenuptial premarital agreement utah form

- Revocation of premarital or prenuptial agreement utah form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children utah form

Find out other Form RI 1040 Rhode Island Division Of Taxation

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form