Ri 1040 Form 2016

What is the Ri 1040 Form

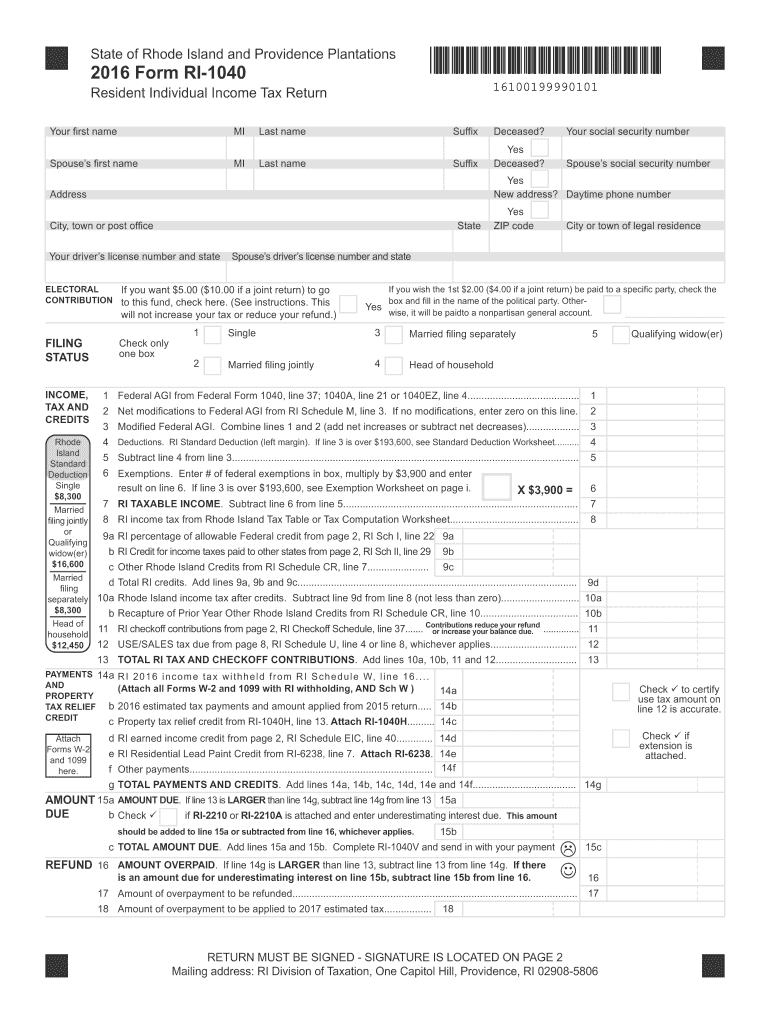

The Ri 1040 Form is a tax document used by residents of Rhode Island to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and must comply with Rhode Island tax laws. The Ri 1040 Form is specifically designed to capture various income sources, deductions, and credits that may apply to taxpayers in Rhode Island.

How to use the Ri 1040 Form

Using the Ri 1040 Form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, complete the form by entering your personal information, income details, and any applicable deductions or credits. After filling out the form, review it for accuracy, sign it, and submit it to the Rhode Island Division of Taxation either electronically or by mail.

Steps to complete the Ri 1040 Form

Completing the Ri 1040 Form can be done effectively by following these steps:

- Gather all relevant tax documents, including income statements.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any deductions or credits for which you qualify.

- Calculate your total tax liability based on the information provided.

- Review the form for any errors before signing.

- Submit the completed form by the specified deadline.

Legal use of the Ri 1040 Form

The Ri 1040 Form is legally binding once it is signed and submitted to the Rhode Island Division of Taxation. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. The form must be filed annually, and compliance with state tax regulations is crucial to avoid legal issues.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Ri 1040 Form. Typically, the deadline for submitting the form is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates from the Rhode Island Division of Taxation regarding specific due dates and any potential extensions.

Required Documents

To complete the Ri 1040 Form, certain documents are required. These include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits claimed.

- Previous year's tax return, if applicable.

Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete ri 1040 2015 2016 form

Complete Ri 1040 Form effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your papers swiftly without delays. Handle Ri 1040 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Ri 1040 Form without any hassle

- Locate Ri 1040 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Put an end to the worry of lost or misplaced files, tedious form searches, or inaccuracies that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ri 1040 Form and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ri 1040 2015 2016 form

Create this form in 5 minutes!

How to create an eSignature for the ri 1040 2015 2016 form

How to make an electronic signature for your Ri 1040 2015 2016 Form in the online mode

How to make an eSignature for the Ri 1040 2015 2016 Form in Google Chrome

How to generate an eSignature for putting it on the Ri 1040 2015 2016 Form in Gmail

How to generate an electronic signature for the Ri 1040 2015 2016 Form from your smartphone

How to make an eSignature for the Ri 1040 2015 2016 Form on iOS devices

How to make an electronic signature for the Ri 1040 2015 2016 Form on Android devices

People also ask

-

What is the Ri 1040 Form and who needs it?

The Ri 1040 Form is the individual income tax return form specifically designed for residents of Rhode Island. It is required for individuals who earn income in the state and need to report their earnings to the Rhode Island Division of Taxation. Completing the Ri 1040 Form accurately ensures compliance with state tax laws.

-

How can airSlate SignNow help with the Ri 1040 Form?

airSlate SignNow offers a seamless solution for electronically signing and sending your Ri 1040 Form. Our platform simplifies the document signing process, allowing you to complete your tax forms quickly and efficiently without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for the Ri 1040 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different user needs, including those who need to eSign the Ri 1040 Form. Our competitive pricing structure ensures you have access to essential features without breaking the bank, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing the Ri 1040 Form?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time tracking of document status, which are perfect for managing your Ri 1040 Form. These tools streamline the process, making it easier to ensure that your tax forms are handled correctly and efficiently.

-

Can I integrate airSlate SignNow with other software for the Ri 1040 Form?

Absolutely! airSlate SignNow integrates with a variety of popular applications, allowing you to connect your workflow for the Ri 1040 Form with tools you already use. Whether it’s CRM systems or accounting software, our integrations enhance productivity and keep your documents organized.

-

What are the benefits of eSigning the Ri 1040 Form with airSlate SignNow?

eSigning the Ri 1040 Form with airSlate SignNow enhances efficiency, reduces turnaround time, and increases document security. You'll benefit from an easy-to-use interface that ensures your tax forms are signed promptly, reducing the risk of delays in filing your taxes.

-

How secure is my information when using airSlate SignNow for the Ri 1040 Form?

Security is a top priority at airSlate SignNow. When you use our platform for the Ri 1040 Form, your information is protected with advanced encryption methods and secure cloud storage, ensuring that your sensitive data remains confidential and safe from unauthorized access.

Get more for Ri 1040 Form

- California legal last will and testament form for married person with minor children

- How to write a purchase offer real estate form

- Ohio general warranty deed from husband and wife to llc form

- Louisiana name change instructions and forms package for a minor

- Kansas quitclaim deed from husband to himself and wife form

- New york legal last will and testament form for single person with adult and minor children

- Arkansas warranty deed for fiduciary form

- Kansas bill of sale for automobile or vehicle including odometer statement and promissory note form

Find out other Ri 1040 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors