Apkpure Com Ilovepdf PDF Editor Scanner ComiLovePDF 1 2 2 Build Variants in Android APK Download 2021

Understanding Rhode Island Tax Forms

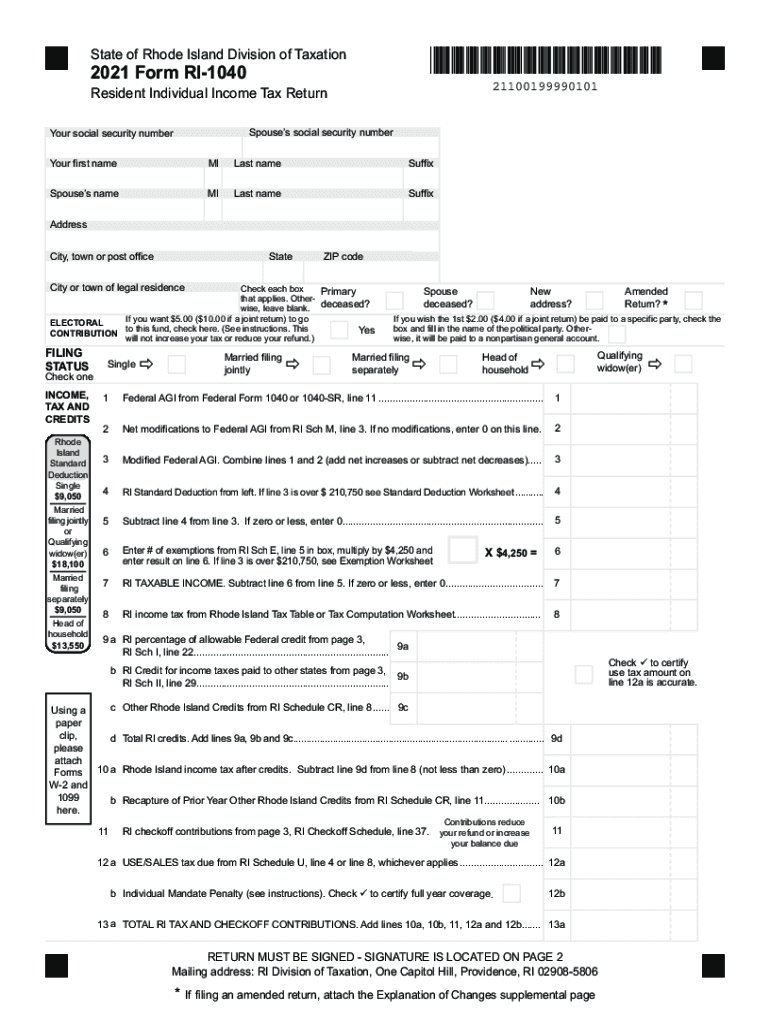

Rhode Island tax forms are essential documents for residents and businesses to report income and calculate tax liabilities. The primary form for individual taxpayers is the RI-1040, which is used to report personal income tax. This form includes various sections that require detailed information about income, deductions, and credits. Understanding the structure and requirements of the RI-1040 is crucial for accurate filing and compliance with state tax laws.

Key Deadlines for Filing Rhode Island Tax Forms

Timely submission of Rhode Island tax forms is vital to avoid penalties. The standard deadline for filing individual income tax returns, including the RI-1040, is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific extensions or changes announced by the Rhode Island Division of Taxation that may affect filing dates.

Required Documents for Completing RI Tax Forms

To accurately complete Rhode Island tax forms, individuals need to gather several key documents. This includes W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any deductions or credits claimed. Additionally, taxpayers should have their Social Security numbers and bank information ready for direct deposit of refunds.

Submission Methods for Rhode Island Tax Forms

Rhode Island tax forms can be submitted through various methods. Taxpayers have the option to file electronically using approved e-filing software, which can streamline the process and reduce errors. Alternatively, forms can be printed and mailed to the Rhode Island Division of Taxation. In-person submissions are also accepted at designated tax offices, providing another avenue for taxpayers who prefer face-to-face assistance.

Penalties for Non-Compliance with Rhode Island Tax Laws

Failure to file Rhode Island tax forms on time can result in significant penalties. The state imposes fines based on the amount of tax owed and the duration of the delay. Additionally, interest accrues on any unpaid taxes, increasing the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Digital vs. Paper Versions of Rhode Island Tax Forms

While paper versions of Rhode Island tax forms are still available, digital filing is increasingly encouraged. Electronic forms offer several advantages, including faster processing times, immediate confirmation of receipt, and reduced risk of errors. Additionally, using digital tools can simplify the completion process, making it easier for taxpayers to manage their submissions efficiently.

Common Variants of Rhode Island Tax Forms

In addition to the standard RI-1040, there are several variants of Rhode Island tax forms that cater to specific situations. For instance, the RI-1040H is designed for homeowners claiming a property tax relief credit. Understanding which form to use based on individual circumstances is essential for compliance and maximizing potential benefits.

Quick guide on how to complete apkpurecom ilovepdf pdf editor scanner comilovepdf 122 build variants in android apk download

Prepare Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download easily on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without any delays. Handle Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to alter and eSign Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download with ease

- Obtain Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you choose. Modify and eSign Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct apkpurecom ilovepdf pdf editor scanner comilovepdf 122 build variants in android apk download

Create this form in 5 minutes!

How to create an eSignature for the apkpurecom ilovepdf pdf editor scanner comilovepdf 122 build variants in android apk download

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What are Rhode Island tax forms, and why are they important?

Rhode Island tax forms are official documents required for filing state taxes in Rhode Island. These forms are crucial for individuals and businesses to report income, calculate taxes owed, and claim any eligible tax credits. Using the correct Rhode Island tax forms ensures compliance with state regulations and avoids potential penalties.

-

How can airSlate SignNow help with Rhode Island tax forms?

airSlate SignNow provides a seamless platform for managing and eSigning Rhode Island tax forms electronically. Our solution allows users to quickly fill out, sign, and send these forms, streamlining the tax filing process. With features like templates and cloud storage, users can handle their Rhode Island tax forms efficiently.

-

Are there any costs associated with using airSlate SignNow for Rhode Island tax forms?

Using airSlate SignNow for Rhode Island tax forms comes with flexible pricing options tailored to different business needs. We offer various subscription plans, ensuring that users can access features beneficial for efficiently managing tax forms without breaking the bank. You can choose a plan that fits your budget while enjoying our user-friendly tools.

-

Can I integrate airSlate SignNow with other tax preparation software for Rhode Island tax forms?

Yes, airSlate SignNow offers integrations with popular tax preparation software, allowing you to handle Rhode Island tax forms seamlessly. This integration enhances your productivity by allowing you to send and eSign documents directly without switching platforms. You can easily connect your existing tools to streamline your workflow.

-

What features does airSlate SignNow offer for handling Rhode Island tax forms?

Our platform offers features like customizable templates, secure cloud storage, and easy document tracking for Rhode Island tax forms. Additionally, you can collaborate with multiple signers and utilize advanced authentication methods to ensure the integrity of your tax documents. These features make managing Rhode Island tax forms easier and more efficient.

-

Is it easy to eSign Rhode Island tax forms using airSlate SignNow?

Absolutely! eSigning Rhode Island tax forms with airSlate SignNow is incredibly user-friendly. You can easily sign documents from any device, ensuring that you can complete your tax forms on-the-go. Our intuitive interface guides you through the process, making it quick and hassle-free.

-

How does airSlate SignNow ensure the security of my Rhode Island tax forms?

At airSlate SignNow, we prioritize your security. Our platform employs advanced encryption and secure access controls to protect your Rhode Island tax forms from unauthorized access. You can trust that your sensitive tax information is kept safe throughout the signing and storage process.

Get more for Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download

- Amended motion in limine mississippi form

- Response to plaintiffs motion in limine mississippi form

- Response to motion to quash plaintiffs mississippi form

- Dismissal prejudice 497314679 form

- Response interrogatories template form

- Separate answer and defenses mississippi form

- Answer and defenses mississippi 497314682 form

- Declaration of covenant sammamish sammamish form

Find out other Apkpure com Ilovepdf pdf editor scanner ComiLovePDF 1 2 2 Build Variants In Android APK Download

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later