Cms Oregon GovobtpDocumentsOregon Individual Income Tax Return for Part Year Residents 2022

Steps to complete the Oregon Form 40

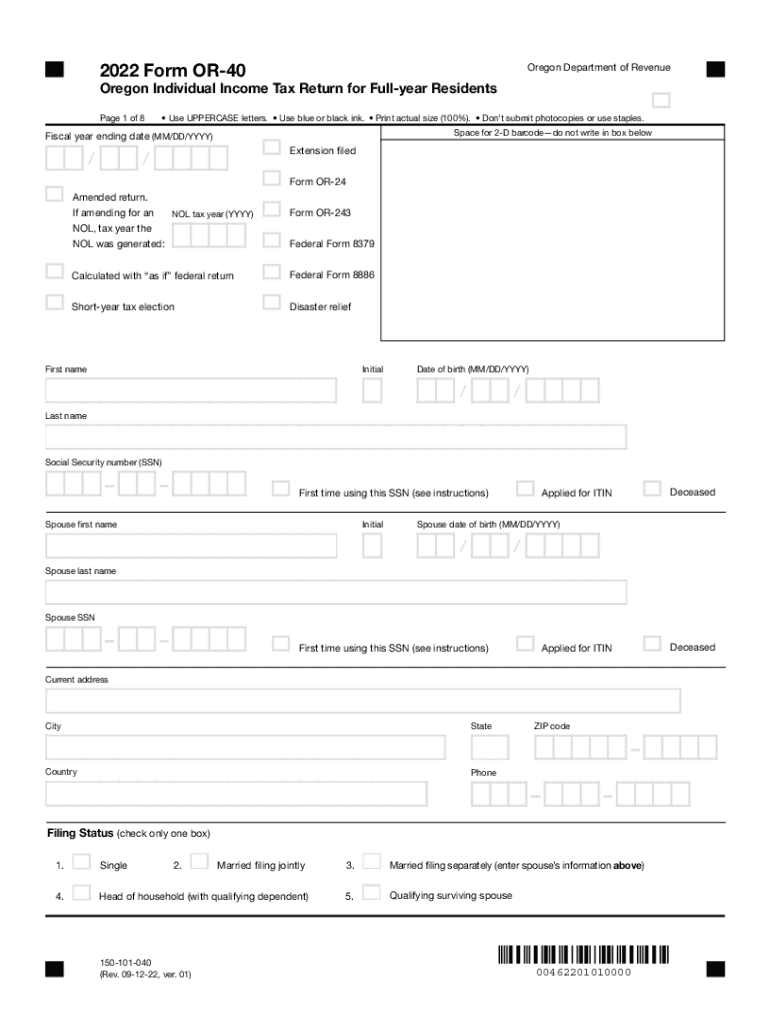

Completing the Oregon Form 40 requires careful attention to detail. Start by gathering all necessary documentation, including your federal tax return, W-2s, and any other income statements. Ensure you have your Social Security number and any relevant deductions or credits you plan to claim.

Begin filling out the form by entering your personal information at the top, including your name, address, and filing status. Follow the instructions provided for each section, ensuring you report all income accurately. Deduct any eligible expenses and credits as outlined in the instructions.

Double-check your calculations and ensure all required fields are completed. Once finished, sign and date the form. If you are filing jointly, ensure your spouse also signs the form.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for avoiding penalties. For most taxpayers, the deadline to file the Oregon Form 40 is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

If you need more time, you can request an extension, which typically allows an additional six months to file. However, it is important to note that this extension does not extend the time to pay any taxes owed. Payments should still be made by the original deadline to avoid interest and penalties.

Required Documents

To complete the Oregon Form 40 accurately, you will need several key documents. These include:

- Your federal tax return (Form 1040)

- W-2 forms from all employers

- 1099 forms for any additional income

- Records of any deductions or credits you intend to claim

- Proof of residency if applicable

Having these documents ready will streamline the process and help ensure that your tax return is complete and accurate.

Form Submission Methods

You can submit the Oregon Form 40 through various methods. The most common options include:

- Online filing through the Oregon Department of Revenue's e-file system

- Mailing a paper copy of the form to the appropriate address

- In-person submission at designated tax offices

Each method has its own processing times, so consider your circumstances when choosing how to file.

Eligibility Criteria

Eligibility to file the Oregon Form 40 generally requires that you are a resident of Oregon for the entire tax year. You must report all income earned during that time, regardless of where it was earned. Additionally, certain income thresholds may apply, which can affect your requirement to file.

Specific criteria may also apply based on your filing status, age, and whether you are claiming dependents. Review the instructions carefully to determine if you meet all eligibility requirements.

Penalties for Non-Compliance

Failing to file the Oregon Form 40 on time can result in penalties. If you do not file by the deadline, you may incur a late filing penalty, which is typically a percentage of the unpaid tax amount. Additionally, if you owe taxes and do not pay by the due date, interest will accrue on the unpaid balance.

It is important to file even if you cannot pay the full amount owed, as this can help mitigate penalties and interest.

Quick guide on how to complete cmsoregongovobtpdocumentsoregon individual income tax return for part year residents

Complete Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents seamlessly

- Locate Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Highlight relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents and ensure strong communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cmsoregongovobtpdocumentsoregon individual income tax return for part year residents

Create this form in 5 minutes!

How to create an eSignature for the cmsoregongovobtpdocumentsoregon individual income tax return for part year residents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Oregon Form 40 instructions?

The Oregon Form 40 instructions provide detailed guidelines on how to complete your Oregon tax return. This document is essential for ensuring accurate filing and compliance with state tax laws. Understanding these instructions helps taxpayers avoid common mistakes that could lead to delays or penalties.

-

How can airSlate SignNow help with Oregon Form 40 instructions?

airSlate SignNow can simplify the process of signing and submitting your Oregon Form 40 instructions. Our platform allows users to easily upload and eSign documents, making tax filing more efficient. With our digital solution, you can focus on completing your tax forms rather than managing paperwork.

-

What features does airSlate SignNow offer for managing Oregon Form 40 instructions?

airSlate SignNow offers a range of features including secure eSigning, document templates, and real-time collaboration for managing Oregon Form 40 instructions. These tools streamline the document workflow, making it easier to share and sign important tax forms. Additionally, our solution is user-friendly, catering to all levels of tech-savviness.

-

Is airSlate SignNow cost-effective for handling Oregon Form 40 instructions?

Yes, airSlate SignNow is a cost-effective solution for handling Oregon Form 40 instructions. With affordable subscription plans, it provides excellent value by reducing the need for paper, printing, and mailing costs. By digitizing your tax documents, you also save time, making it a smart financial choice.

-

Can airSlate SignNow integrate with other software for Oregon Form 40 instructions?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of software applications, enhancing the experience of filing Oregon Form 40 instructions. This connectivity allows users to easily import data from their accounting software, simplifying the overall process. With these integrations, users can streamline their workflows and increase efficiency.

-

What are the benefits of using airSlate SignNow for Oregon Form 40 instructions?

Using airSlate SignNow for Oregon Form 40 instructions offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible. Furthermore, the ability to track document status helps users stay organized during tax season.

-

How does airSlate SignNow ensure the security of Oregon Form 40 instructions?

airSlate SignNow prioritizes the security of Oregon Form 40 instructions by implementing robust encryption and secure storage measures. We comply with industry standards to protect sensitive data during the signing process and beyond. Users can feel confident that their information is safe and secure when using our platform.

Get more for Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents

- Quitclaim deed from individual to llc rhode island form

- Warranty deed from individual to llc rhode island form

- Ri lien 497325081 form

- Quitclaim deed from husband and wife to corporation rhode island form

- Warranty deed from husband and wife to corporation rhode island form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form rhode island

- Notice mechanic lien form

- Assignment of mechanics lien individual rhode island form

Find out other Cms oregon govobtpDocumentsOregon Individual Income Tax Return For Part year Residents

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF