Oregon Tax Form 40 2019

What is the Oregon Tax Form 40

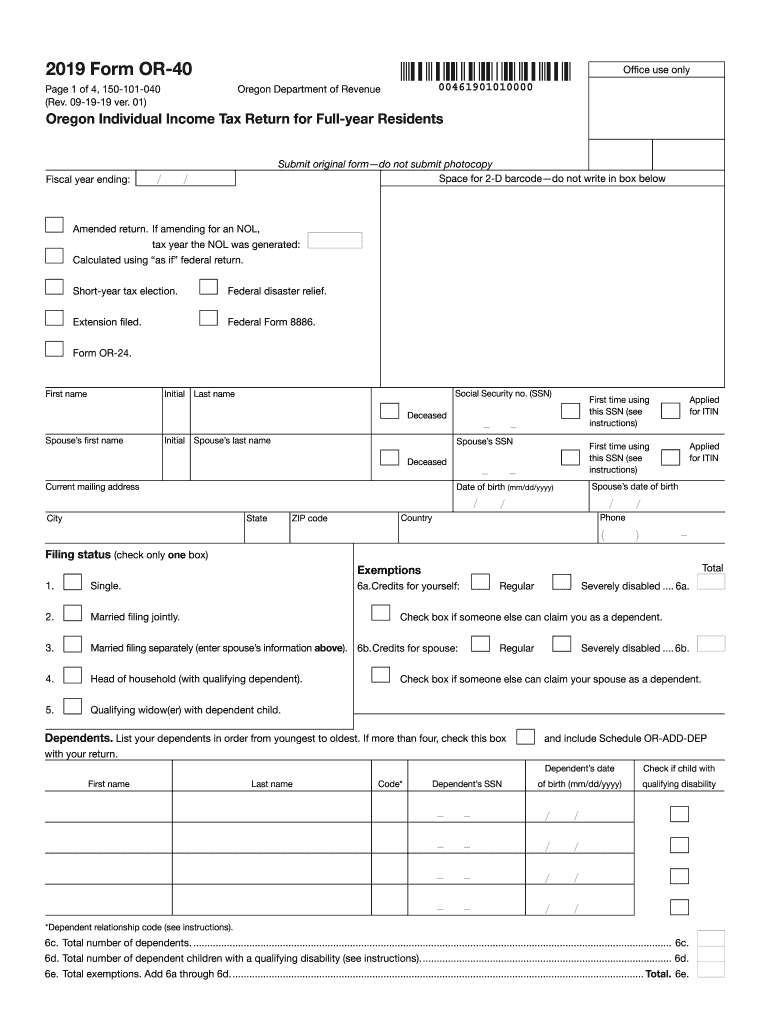

The Oregon Tax Form 40 is a state income tax return form used by residents of Oregon to report their income and calculate their tax liability. This form is specifically designed for individuals who have income that is subject to Oregon state tax. The form includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation. Understanding this form is crucial for ensuring compliance with state tax laws and for accurately calculating any taxes owed or refunds due.

How to use the Oregon Tax Form 40

Using the Oregon Tax Form 40 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions provided on the form to report your income and claim deductions. It is important to carefully review each section for accuracy. After completing the form, you can submit it either electronically or by mailing a paper copy to the appropriate tax authority. Ensure that you keep a copy of the completed form for your records.

Steps to complete the Oregon Tax Form 40

Completing the Oregon Tax Form 40 requires a systematic approach:

- Collect all relevant income documents, such as W-2s and 1099 forms.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and other earnings.

- Claim any deductions you are eligible for, such as standard or itemized deductions.

- Calculate your total tax liability using the provided tax tables or software.

- Review the completed form for accuracy before submission.

Legal use of the Oregon Tax Form 40

The Oregon Tax Form 40 must be used in accordance with state tax laws to ensure its legal validity. This includes accurately reporting income, claiming eligible deductions, and submitting the form by the required deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential to understand the legal implications of the information provided on the form and to maintain accurate records in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Tax Form 40 typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may be available, as well as deadlines for estimated tax payments throughout the year. Keeping track of these important dates helps avoid late fees and penalties.

Required Documents

To complete the Oregon Tax Form 40, certain documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions, such as mortgage interest or student loan interest.

- Documentation of any tax credits you plan to claim.

Having these documents organized and ready will streamline the process of filling out the form and help ensure accuracy.

Quick guide on how to complete 2019 form or 40 p oregon individual income tax return for

Prepare Oregon Tax Form 40 effortlessly on any device

Digital document management has gained increased popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Oregon Tax Form 40 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Oregon Tax Form 40 with ease

- Locate Oregon Tax Form 40 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Oregon Tax Form 40 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form or 40 p oregon individual income tax return for

Create this form in 5 minutes!

How to create an eSignature for the 2019 form or 40 p oregon individual income tax return for

How to make an electronic signature for your 2019 Form Or 40 P Oregon Individual Income Tax Return For online

How to create an eSignature for the 2019 Form Or 40 P Oregon Individual Income Tax Return For in Google Chrome

How to make an electronic signature for putting it on the 2019 Form Or 40 P Oregon Individual Income Tax Return For in Gmail

How to create an electronic signature for the 2019 Form Or 40 P Oregon Individual Income Tax Return For from your mobile device

How to generate an eSignature for the 2019 Form Or 40 P Oregon Individual Income Tax Return For on iOS devices

How to make an eSignature for the 2019 Form Or 40 P Oregon Individual Income Tax Return For on Android devices

People also ask

-

What is the 2018 form or 40 instructions?

The 2018 form or 40 instructions refer to the IRS guidelines for filing your individual income tax return. They provide you with detailed steps on how to properly complete Form 1040 for the 2018 tax year. Understanding these instructions is crucial for accurate tax reporting.

-

How can airSlate SignNow help with completing the 2018 form or 40 instructions?

AirSlate SignNow simplifies the process of eSigning and sending documents, including tax forms like the 2018 form or 40 instructions. With our platform, you can easily upload, fill out, and securely eSign your forms, ensuring compliance and facilitating faster submissions.

-

What features does airSlate SignNow offer for tax document management?

Our platform offers features designed specifically for tax document management, such as customizable templates, secure storage, and automated reminders. These tools can enhance your efficiency when dealing with essential documents, including the 2018 form or 40 instructions.

-

Is airSlate SignNow cost-effective for small businesses needing eSigning solutions?

Yes, airSlate SignNow is a cost-effective solution ideal for small businesses. We provide affordable pricing plans that cater to various needs, making it easy for you to manage your documents and comply with requirements like the 2018 form or 40 instructions without breaking the bank.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers integrations with popular software tools such as Google Drive, Salesforce, and Microsoft Office. This means you can seamlessly incorporate our eSigning solution into your existing workflow, aiding in the completion of tasks like filing the 2018 form or 40 instructions.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We utilize bank-level encryption, secure data storage, and compliance with international standards to protect your documents. This ensures that your sensitive information related to the 2018 form or 40 instructions is kept safe throughout the eSigning process.

-

Does airSlate SignNow provide support for tax professionals?

Yes, airSlate SignNow offers robust support tailored for tax professionals. Our platform allows users to manage client documents seamlessly, including their 2018 form or 40 instructions, facilitating a smoother tax preparation process.

Get more for Oregon Tax Form 40

- 2013 demonstration jump insurance application uspa form

- A3490 internetformular deutsche rentenversicherung deutsche rentenversicherung

- Choice of superannuation fund standard choice form cbus

- Cbus withdrawal form

- Sleep study form

- Boat agreement purchase template form

- Land title identity verification form 2014

- Fibromyalgia medical assessment form disability

Find out other Oregon Tax Form 40

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney