Page 1 of 4, 150 101 040 Rev 2017

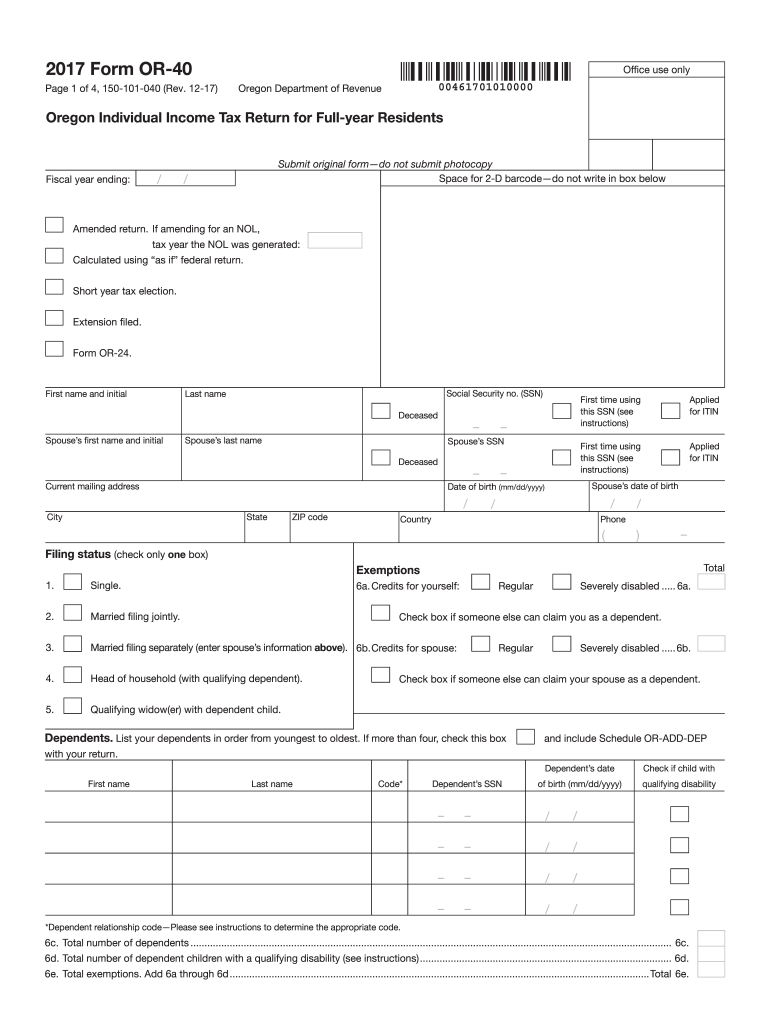

What is the Oregon 40 Income Tax Form?

The Oregon 40 income tax form, officially known as the Oregon Individual Income Tax Return, is a crucial document for individuals filing their state taxes. This form is used by residents of Oregon to report their income, calculate their tax liability, and determine any refund due. The form includes sections for various types of income, deductions, and credits that may apply to the taxpayer's situation. Understanding this form is essential for accurate tax reporting and compliance with state tax laws.

Steps to Complete the Oregon 40 Income Tax Form

Completing the Oregon 40 income tax form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any applicable deductions, such as those for mortgage interest or medical expenses.

- Calculate your tax liability using the provided tax tables or formulas.

- Determine if you are eligible for any tax credits that may reduce your overall tax burden.

- Review your completed form for accuracy before signing and submitting.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Oregon 40 income tax form to avoid penalties. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may need to file, as well as deadlines for estimated tax payments throughout the year.

Form Submission Methods

The Oregon 40 income tax form can be submitted through various methods to accommodate different preferences:

- Online Filing: Many taxpayers choose to file electronically using tax preparation software that supports the Oregon 40 form.

- Mail: Taxpayers can print the completed form and mail it to the appropriate state tax authority address.

- In-Person: Some individuals may opt to deliver their forms in person at local tax offices during business hours.

Legal Use of the Oregon 40 Income Tax Form

The Oregon 40 income tax form is legally required for residents who meet certain income thresholds. Filing this form accurately ensures compliance with state tax laws and helps avoid potential penalties. It is essential to understand the legal implications of submitting false information, as this can lead to fines or other legal consequences. Taxpayers are encouraged to seek assistance if they are unsure about any aspect of the form or their tax situation.

Key Elements of the Oregon 40 Income Tax Form

Several key elements make up the Oregon 40 income tax form, including:

- Personal Information: Required details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Sections to report various income sources, including wages, self-employment income, and investment income.

- Deductions and Credits: Areas to claim deductions and tax credits that can reduce taxable income or tax liability.

- Signature Section: A place for the taxpayer to sign and date the form, certifying that the information provided is accurate.

Quick guide on how to complete page 1 of 4 150 101 040 rev

Your assistance manual for preparing your Page 1 Of 4, 150 101 040 Rev

If you’re wondering how to create and submit your Page 1 Of 4, 150 101 040 Rev, here are a few brief tips on how to simplify tax filing.

To begin, all you need to do is set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to edit, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify responses as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and simple sharing.

Follow these steps to finalize your Page 1 Of 4, 150 101 040 Rev in just a few minutes:

- Create your account and start editing PDFs in no time.

- Browse our library to obtain any IRS tax form; explore various versions and schedules.

- Tap Get form to access your Page 1 Of 4, 150 101 040 Rev in our editor.

- Complete the necessary fillable sections with your details (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print a copy, forward it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting paper forms can increase errors and delay refunds. Furthermore, before e-filing your taxes, check the IRS website for filing requirements in your state.

Create this form in 5 minutes or less

Find and fill out the correct page 1 of 4 150 101 040 rev

FAQs

-

How can we track our visitors conversion/drop off when the visitor actually fills out fields on a form page outside of our site domain (Visitor finds listing in SERPS, hits our site, jumps to client site to complete form)?

The short answer: You can't unless the client site allows you to do so. A typical way to accomplish measuring external conversions is to use a postback pixels. You can easily google how they work - in short you would require your client to send a http request to your tracking software on the form submit. A good way to do this in practice is to provide an embedable form to your clients that already includes this feature and sends along a clientID with the request, so that you can easily see which client generates how many filled out forms.

-

I am a working software professional in the Bay Area and looking to switch jobs. I can't openly write in my LinkedIn profile about the same. How do I approach recruiters/companies? Is there an easier way than filling out 4 - 5 page forms in the career website of the company?

I'd say that you should just seek out the jobs that interest you and apply for them. Many don't have such onerous application forms. Some even allow you to apply through LinkedIn. And if you target a small set of companies that really interest you, then it's worth the extra effort to customize each application. Many recruiters and hiring managers, myself included, give more weight to candidates who seem specifically interested in an opportunity, as compared to those who seem to be taking a shotgun approach to the job seeking process.

-

I’ve been out of work for a month. I need to file a disability claim signed by 1 doctor. I have seen 4 doctors and spent 2 days in the hospital. How do I consolidate all records, so 1 of my doctors can review and sign my disability claim form?

You should have a primary care doctor who is your main point of contact for all of your health care. You can request that the other doctors that you have seen send their records to your primary care doctor. His office should help you with your disability claim.You are entitled to get copies of your own medical records from your doctors and the hospital. All you have to do is call and ask. They will have you sign a release and will then give you their records. There might be a charge for this. Once you have all of your own medical records, you can take them wherever you wish.I keep copies of all of my own medical records. If I go to a new doctor, I pull out the pertinent reports and take them with me. I am the only one who has copies of all of my medical reports.

-

A committee of five members is to be formed out of 5 IT officers, 4 clerks and 2 peons, In how many different ways can it be done if the committee should consists of 3 IT officers, 1 clerk & 1 peon?

5p3 ×4p1 × 2p1

-

In my GA-H61M-S (rev. 1.0) motherboard out of 4 USB ports on back panel 2 aren't working after inserting pen drive, the lights are on but PC wont recognize pen drive, when same pen drive inserted in one of other 2 ports, it works. How to solve this?

At first Glance it doesn't seems a Hardware issue just try some troubleshooting at software level and see if it works.Insert Pendrive in both USB's and Go to Disk Management See if it's showing here or not.If it's there,check if the USB is listed of not in Device Manager>Disk DrivesIf both of above failed,Now only thing you can try is updating the USB BUS Controller Drivers from Device Manager,if it's possible for you to identify that specific USB which is not working then update it's driver otherwise Update the drivers of all.If it's still not Fixed then now it sounds like a Hardware Issue i.e. something wrong with the port.Hope This Helped!Thanks!:)

Create this form in 5 minutes!

How to create an eSignature for the page 1 of 4 150 101 040 rev

How to create an electronic signature for the Page 1 Of 4 150 101 040 Rev in the online mode

How to generate an eSignature for your Page 1 Of 4 150 101 040 Rev in Chrome

How to create an eSignature for signing the Page 1 Of 4 150 101 040 Rev in Gmail

How to make an electronic signature for the Page 1 Of 4 150 101 040 Rev right from your smart phone

How to make an electronic signature for the Page 1 Of 4 150 101 040 Rev on iOS devices

How to generate an electronic signature for the Page 1 Of 4 150 101 040 Rev on Android OS

People also ask

-

What is the Oregon 40 income tax form?

The Oregon 40 income tax form is a key document that residents must file to report their income and determine their tax liability. This form is used by individuals who reside in Oregon and is essential for accurately calculating state tax obligations.

-

How can airSlate SignNow help with the Oregon 40 income tax form?

airSlate SignNow enables users to effortlessly create, send, and eSign the Oregon 40 income tax form. By providing a secure and user-friendly platform, businesses can streamline their tax documentation process while ensuring compliance with state tax regulations.

-

Are there any costs associated with using airSlate SignNow for the Oregon 40 income tax form?

Yes, airSlate SignNow offers several pricing plans designed to accommodate different business needs. Each plan provides features that simplify the process of managing documents, including the Oregon 40 income tax form, ensuring that businesses stay within budget while meeting their tax filing requirements.

-

What features does airSlate SignNow offer for completing the Oregon 40 income tax form?

airSlate SignNow provides advanced features such as customizable templates, electronic signatures, and audit trails for the Oregon 40 income tax form. These tools help ensure that your tax form is filled out accurately, signed, and securely stored, making tax season less stressful.

-

Is airSlate SignNow compliant with Oregon tax laws for the Oregon 40 income tax form?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that the features support adherence to Oregon tax laws for the Oregon 40 income tax form. By using this platform, you can trust that your signed documents will meet legal and regulatory requirements.

-

Can airSlate SignNow integrate with other accounting software for the Oregon 40 income tax form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your financial documents, including the Oregon 40 income tax form. This integration helps streamline workflows and enhances overall efficiency for businesses.

-

What are the benefits of using airSlate SignNow for tax form management, particularly the Oregon 40 income tax form?

Using airSlate SignNow for tax form management offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. When managing the Oregon 40 income tax form, these advantages translate into a smoother filing process and peace of mind knowing your documents are protected.

Get more for Page 1 Of 4, 150 101 040 Rev

- South carolina commercial lease agreement wikiforms

- Chess club registration form

- Healthy heart questionnaire hhq gp 1 uc denver form

- Templeton fire department training announcement templetonfd form

- Private residential tenancy agreement template form

- Private rent agreement template form

- House cleaner contract template form

- House contract template form

Find out other Page 1 Of 4, 150 101 040 Rev

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter