Oregon State Tax Form 40 2018

What is the Oregon State Tax Form 40

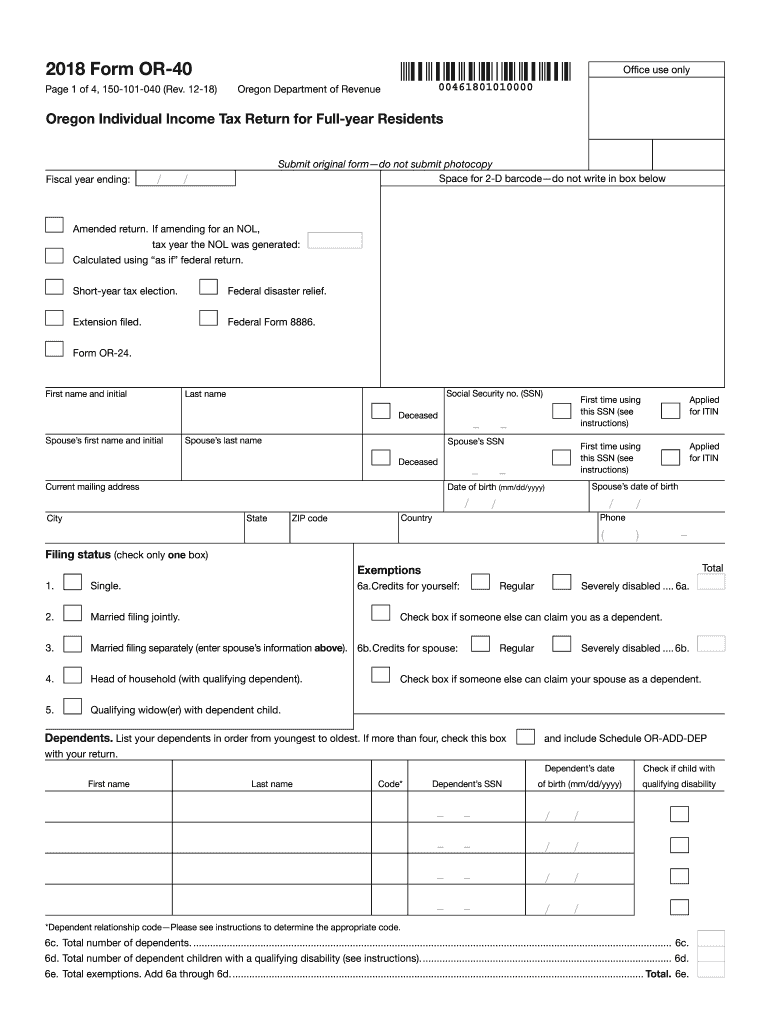

The Oregon State Tax Form 40 is a tax return form specifically designed for residents of Oregon who need to report their income and calculate their state tax obligations. This form is essential for individuals filing their state income taxes, allowing them to detail their earnings, deductions, and credits. The 2018 Form 40 is tailored to the tax year 2018, and it is important for taxpayers to use the correct version to ensure compliance with state regulations.

How to use the Oregon State Tax Form 40

Using the Oregon State Tax Form 40 involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Once the required information is collected, individuals can fill out the form, detailing their income, deductions, and credits. After completing the form, taxpayers must review it for accuracy before submitting it to the Oregon Department of Revenue either online or by mail.

Steps to complete the Oregon State Tax Form 40

Completing the Oregon State Tax Form 40 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant tax documents, including income statements and previous year’s tax returns.

- Begin filling out the form by entering personal information such as name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Claim applicable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or mail it to the appropriate address.

Key elements of the Oregon State Tax Form 40

The Oregon State Tax Form 40 includes several key elements that taxpayers must understand to complete it correctly. These elements consist of:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed sections for various income types, including wages and self-employment income.

- Deductions: Areas to claim state-specific deductions, such as those for dependents and retirement contributions.

- Tax Calculation: A section that calculates the total tax liability based on reported income and deductions.

- Signature Line: A place for the taxpayer to sign and date the form, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Oregon State Tax Form 40. For the tax year 2018, the standard deadline for filing is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be mindful of any extensions that may apply and ensure they file within the required timeframe to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Oregon State Tax Form 40. They can choose to file online through the Oregon Department of Revenue's website, which is often the quickest method. Alternatively, individuals may opt to print the completed form and mail it to the appropriate address. In-person submissions are also possible at designated state tax offices. Each method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete 2018 form or 40 oregon individual income tax return for full year residents 150 101 040

Your assistance manual on how to prepare your Oregon State Tax Form 40

If you seek to understand how to complete and submit your Oregon State Tax Form 40, below are a few straightforward guidelines to simplify the tax submission process.

To begin, you just need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely intuitive and efficient document management tool that allows you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, returning to adjust entries as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Oregon State Tax Form 40 in no time:

- Establish your account and start working on PDFs in just minutes.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Obtain form to open your Oregon State Tax Form 40 in our editor.

- Input the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Signature Tool to insert your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can increase the likelihood of return errors and delay refunds. Certainly, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form or 40 oregon individual income tax return for full year residents 150 101 040

Create this form in 5 minutes!

How to create an eSignature for the 2018 form or 40 oregon individual income tax return for full year residents 150 101 040

How to create an eSignature for your 2018 Form Or 40 Oregon Individual Income Tax Return For Full Year Residents 150 101 040 in the online mode

How to generate an electronic signature for the 2018 Form Or 40 Oregon Individual Income Tax Return For Full Year Residents 150 101 040 in Google Chrome

How to generate an electronic signature for signing the 2018 Form Or 40 Oregon Individual Income Tax Return For Full Year Residents 150 101 040 in Gmail

How to generate an eSignature for the 2018 Form Or 40 Oregon Individual Income Tax Return For Full Year Residents 150 101 040 straight from your smartphone

How to generate an eSignature for the 2018 Form Or 40 Oregon Individual Income Tax Return For Full Year Residents 150 101 040 on iOS devices

How to generate an eSignature for the 2018 Form Or 40 Oregon Individual Income Tax Return For Full Year Residents 150 101 040 on Android OS

People also ask

-

What are the 2018 form or 40 instructions required for filing taxes?

The 2018 form or 40 instructions provide detailed guidance on how to accurately complete the tax return for that year. They cover updates in tax laws, deductions, credits, and requirements for different types of filers. It’s crucial to carefully read these instructions to ensure compliance and maximize your tax benefits.

-

How can airSlate SignNow help with the 2018 form or 40 instructions process?

airSlate SignNow streamlines the process of completing and signing your 2018 form or 40. With our platform, you can easily upload documents, fill in necessary fields, and get them signed electronically. This eliminates delays and ensures all parties have access to the latest version of the forms and instructions.

-

Is airSlate SignNow cost-effective for handling the 2018 form or 40 instructions?

Yes, airSlate SignNow provides a cost-effective solution for managing your documents and eSignatures. Our pricing plans are designed to fit various budgets, ensuring that you have access to essential features without breaking the bank while handling your 2018 form or 40 instructions.

-

What features does airSlate SignNow offer for 2018 form or 40 instructions?

airSlate SignNow includes a range of features tailored for the 2018 form or 40 instructions, including customizable templates, automated workflows, and secure storage. These features simplify document management while ensuring security and compliance with tax regulations. You can fully focus on getting your forms completed correctly.

-

Can I integrate airSlate SignNow with my accounting software for the 2018 form or 40 instructions?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing your workflow while managing the 2018 form or 40 instructions. This integration allows for better data flow, connectivity, and allows you to maintain accurate records throughout the tax filing process.

-

What support does airSlate SignNow provide for users dealing with the 2018 form or 40 instructions?

airSlate SignNow offers comprehensive support, including tutorials and customer service, to assist you with any questions related to the 2018 form or 40 instructions. Our knowledgeable team is available to guide you through the process, ensuring you make the best use of our tools. We provide assistance whenever you need it.

-

Is electronic signing valid for the 2018 form or 40 instructions?

Yes, electronic signing is valid and legally recognized for the 2018 form or 40 instructions. airSlate SignNow utilizes advanced encryption methods to ensure the authenticity and integrity of signatures. This means you can confidently eSign your tax documents without worry.

Get more for Oregon State Tax Form 40

- Lakewood possibilities fund financial assistance application form

- State of californiaform ad 10133 57

- Fr hd homestead deduction form

- City of greenville hospitality tax form

- Oral conscious sedation informed consent form

- L 1 rewrite equations in y mx b form

- State of delaware dnrec repair saa authorization form

- Town of millville36404 club house roadmillville form

Find out other Oregon State Tax Form 40

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online