CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00 2022

Understanding the Maryland Corporation Income Tax Return

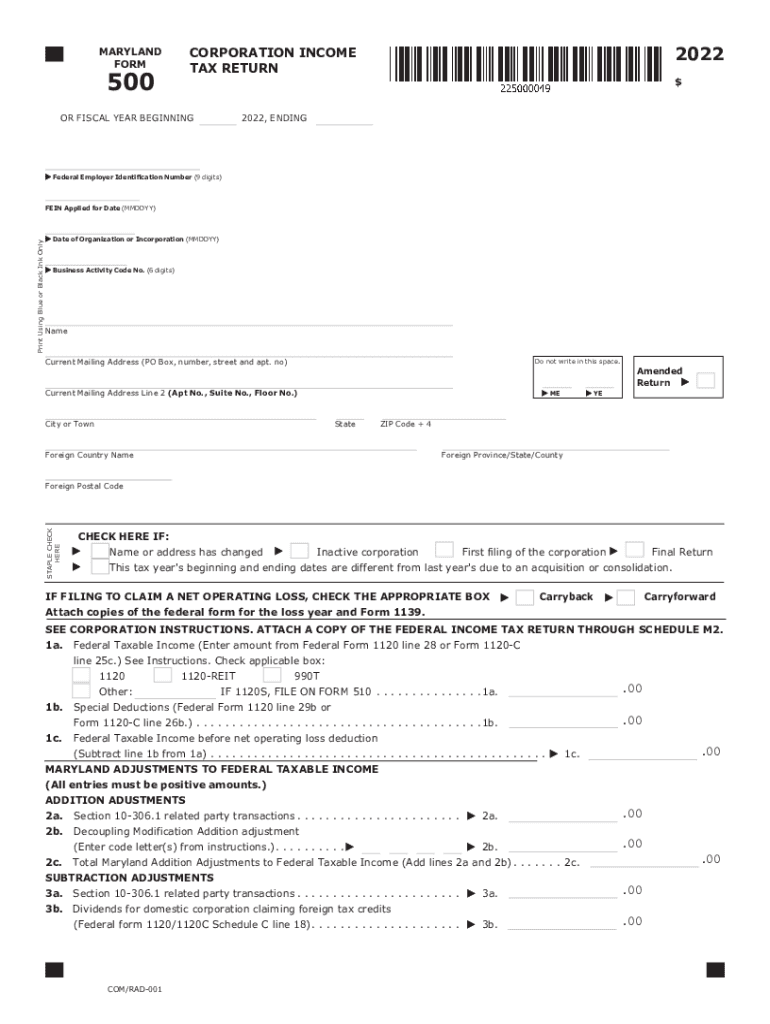

The Maryland 500 form, officially known as the Maryland Corporation Income Tax Return, is a crucial document for corporations operating within the state. This form is used to report income, deductions, and credits, ultimately determining the corporation's tax liability. It is essential for compliance with Maryland tax laws and helps ensure that corporations fulfill their financial obligations to the state.

Steps to Complete the Maryland Corporation Income Tax Return

Completing the Maryland 500 form involves several steps to ensure accuracy and compliance. Here is a general outline:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, such as business expenses, to calculate the taxable income.

- Apply any tax credits for which the corporation may be eligible.

- Calculate the total tax due and ensure all figures are accurate.

- Sign and date the form, ensuring that it is submitted by the deadline.

Filing Deadlines for the Maryland 500 Form

Corporations must adhere to specific filing deadlines for the Maryland 500 form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by April 15. It is essential to file on time to avoid penalties and interest on unpaid taxes.

Required Documents for Filing

When preparing to file the Maryland 500 form, corporations should have several documents ready to ensure a smooth filing process. Key documents include:

- Financial statements, including income statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of all business expenses and deductions.

- Previous year’s tax return, if applicable.

Penalties for Non-Compliance

Failure to file the Maryland 500 form on time or inaccurately reporting information can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, calculated from the due date until payment is made.

- Potential legal action for persistent non-compliance.

Digital vs. Paper Version of the Maryland 500 Form

Corporations have the option to file the Maryland 500 form either digitally or via paper. The digital version is often preferred for its convenience and efficiency. Electronic filing can expedite processing times and reduce the risk of errors. However, some corporations may still choose to submit a paper form, especially if they lack the necessary technology or prefer traditional methods.

Quick guide on how to complete corporation income tax return 00 00 00 00 00 00 00 00

Easily Prepare CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00 Effortlessly

- Obtain CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from your preferred device. Edit and electronically sign CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation income tax return 00 00 00 00 00 00 00 00

Create this form in 5 minutes!

How to create an eSignature for the corporation income tax return 00 00 00 00 00 00 00 00

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland 500 form?

The Maryland 500 form is a state tax return form used to report personal income tax for residents of Maryland. It is essential for fulfilling your state tax obligations and helps ensure that your tax filings are accurate and complete. Utilizing airSlate SignNow can simplify the process of signing and submitting your Maryland 500 form digitally.

-

How can airSlate SignNow help with the Maryland 500 form?

airSlate SignNow streamlines the process of completing and eSigning the Maryland 500 form. Our platform allows you to fill out the form electronically, ensuring all necessary information is captured efficiently. Additionally, you can save time and reduce errors by sending the form directly for signatures.

-

Is there a cost associated with using airSlate SignNow for Maryland 500 form?

Yes, there is a cost for using airSlate SignNow, but it offers a cost-effective solution for eSigning documents, including the Maryland 500 form. Our pricing plans are designed to accommodate various business needs, ensuring that you get the best value for your investment. Consider starting with a free trial to explore the features available.

-

What features does airSlate SignNow offer for the Maryland 500 form?

airSlate SignNow offers features like template creation, in-document commenting, and secure eSigning specifically designed for forms like the Maryland 500 form. These features enhance collaboration and ensure that your document management process is seamless and efficient. You also benefit from tracking capabilities to monitor the status of your form.

-

Can I integrate airSlate SignNow with other software for my Maryland 500 form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easier to manage your Maryland 500 form workflow. Popular integrations include CRM systems, cloud storage solutions, and productivity tools, all designed to enhance your document management experience and streamline your processes.

-

What are the benefits of using airSlate SignNow for the Maryland 500 form?

Using airSlate SignNow for the Maryland 500 form offers numerous benefits, including increased efficiency and reduced paperwork. With our secure eSigning capabilities, you can complete your tax filings faster and with less hassle. Additionally, the platform helps maintain compliance and offers a clear audit trail for your records.

-

Is airSlate SignNow secure for submitting the Maryland 500 form?

Yes, airSlate SignNow prioritizes security and compliance for all documents, including the Maryland 500 form. Our platform uses advanced encryption and secure access protocols to protect your sensitive information. You can confidently submit your form, knowing that your data is safe and secure.

Get more for CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00

- Security contractor package rhode island form

- Insulation contractor package rhode island form

- Paving contractor package rhode island form

- Site work contractor package rhode island form

- Siding contractor package rhode island form

- Refrigeration contractor package rhode island form

- Drainage contractor package rhode island form

- Tax free exchange package rhode island form

Find out other CORPORATION INCOME TAX RETURN 00 00 00 00 00 00 00 00

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast