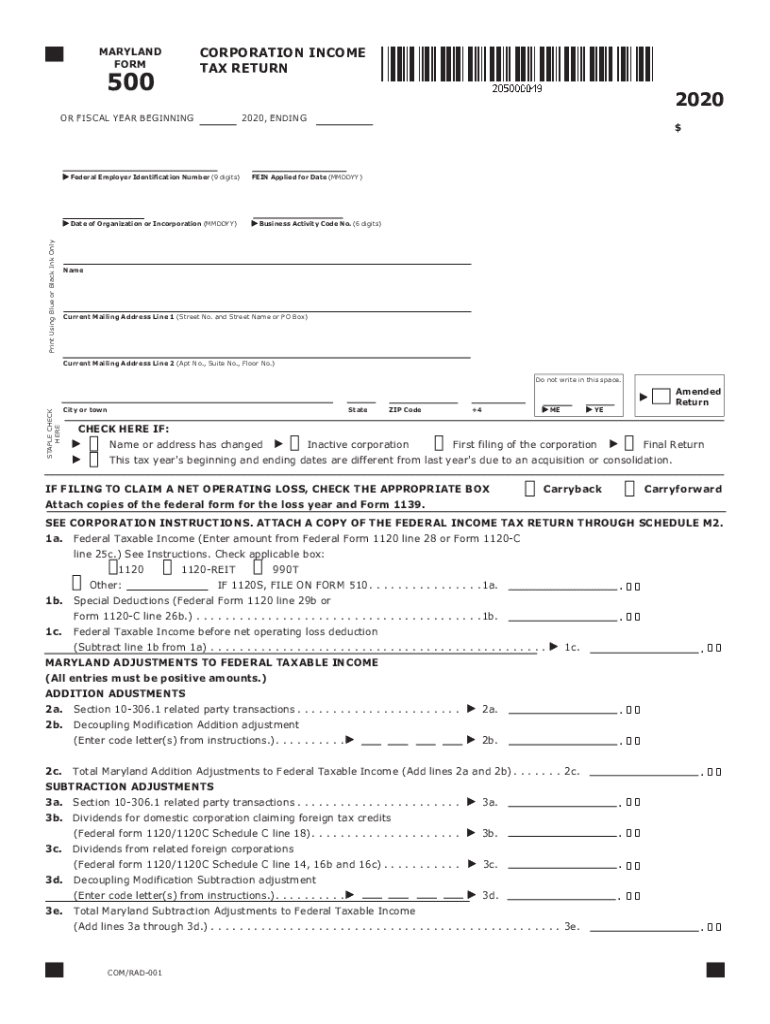

TY 500 Tax Year 500 Individual Taxpayer Form 2020

What is the Maryland 500 Income Form?

The Maryland 500 income form is a state tax document used by individuals to report their income and calculate their tax liability for the year. This form is essential for residents of Maryland who need to file their state income taxes, detailing various sources of income, deductions, and credits. The Maryland 500 is specifically designed for individual taxpayers, ensuring compliance with state tax regulations.

Steps to Complete the Maryland 500 Income Form

Completing the Maryland 500 income form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as standard or itemized deductions.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal Use of the Maryland 500 Income Form

The Maryland 500 income form is legally binding when completed accurately and submitted on time. To ensure its validity, it must be signed by the taxpayer, affirming that the information provided is true and correct. Compliance with state laws regarding eSignatures and document submission is crucial to avoid potential legal issues.

Filing Deadlines / Important Dates

It is important to be aware of the key deadlines associated with the Maryland 500 income form:

- The filing deadline for the Maryland 500 is typically April 15 of each year.

- If you require an extension, you must file for one by the original deadline.

- Any taxes owed should also be paid by the filing deadline to avoid penalties and interest.

Required Documents

To accurately complete the Maryland 500 income form, gather the following documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or dividends.

- Documentation for deductions, including mortgage interest statements and property tax receipts.

Form Submission Methods

The Maryland 500 income form can be submitted through various methods:

- Online submission via the Maryland Comptroller's website.

- Mailing a paper form to the appropriate address provided by the state.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete ty 2020 500 tax year 2020 500 individual taxpayer form

Complete TY 500 Tax Year 500 Individual Taxpayer Form effortlessly on any gadget

Online file management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents quickly without interruptions. Manage TY 500 Tax Year 500 Individual Taxpayer Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign TY 500 Tax Year 500 Individual Taxpayer Form without hassle

- Obtain TY 500 Tax Year 500 Individual Taxpayer Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Modify and eSign TY 500 Tax Year 500 Individual Taxpayer Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 500 tax year 2020 500 individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 500 tax year 2020 500 individual taxpayer form

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the pricing structure for Maryland 500 with airSlate SignNow?

The Maryland 500 plan offers an affordable pricing structure tailored to fit the needs of small to medium-sized businesses. With competitive rates, airSlate SignNow ensures that you can manage your document signing needs without stretching your budget. This plan enables unlimited eSigning capabilities, making it an ideal choice for Maryland businesses.

-

What features are included in the Maryland 500 plan?

The Maryland 500 plan includes a suite of powerful features designed for effortless document management. Key features include unlimited e-signatures, templates for frequently used documents, and a user-friendly interface that enhances productivity. Additionally, users can track document status and receive notifications, ensuring a smooth signing experience.

-

How does airSlate SignNow benefit businesses in Maryland?

AirSlate SignNow provides signNow benefits for businesses in Maryland by streamlining the document signing process. By utilizing the Maryland 500 plan, businesses can save time and reduce costs associated with traditional paper-based methods. Enhanced efficiency and faster turnaround times help businesses stay competitive in the digital age.

-

Can I integrate airSlate SignNow with other software systems?

Yes, the Maryland 500 plan allows seamless integration with various third-party applications and platforms. Popular systems like Google Workspace, Salesforce, and Microsoft Dynamics can easily connect with airSlate SignNow. This flexibility ensures that Maryland businesses can centralize their workflows and improve overall productivity.

-

Is airSlate SignNow compliant with Maryland laws?

Absolutely, airSlate SignNow operates in full compliance with Maryland e-signature laws and regulations. This compliance ensures that all electronically signed documents carry the same legal weight as their paper counterparts. Businesses can trust the Maryland 500 solution to help them meet local legal requirements efficiently.

-

What support options are available for Maryland 500 subscribers?

Subscribers of the Maryland 500 plan enjoy a variety of support options, including 24/7 customer service and access to an extensive online resource center. Whether you have questions about features, integrations, or account management, airSlate SignNow's support team is ready to assist you. This commitment to customer service ensures smooth operation for Maryland businesses.

-

How easy is it to get started with airSlate SignNow in Maryland?

Getting started with airSlate SignNow in Maryland is quick and straightforward. Simply sign up for the Maryland 500 plan on our website, and you'll have immediate access to all the necessary tools and features. The intuitive onboarding process and user-friendly interface make it easy for businesses to begin sending and signing documents within minutes.

Get more for TY 500 Tax Year 500 Individual Taxpayer Form

- Ohp 6610 community partner assistance consent form

- Fattura proforma pdf

- Murray and roberts application form

- Capital blue cross enrollment form

- A wagon of shoes summary form

- Certificate of acclimation pdf form

- Printable ptax 300 h form

- Portal ct govform207f1217pdfform 207f ct gov connecticuts official state website

Find out other TY 500 Tax Year 500 Individual Taxpayer Form

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later