Business Income Tax Forms and Instructions 2023-2026

Understanding the Maryland Form 500

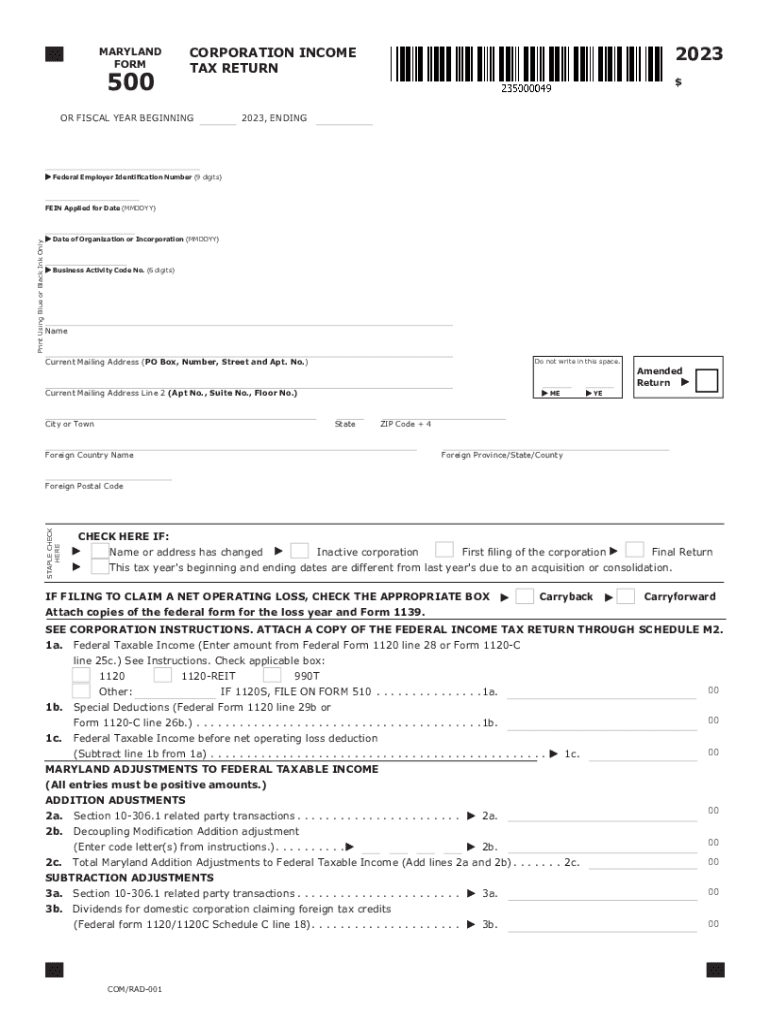

The Maryland Form 500 is the official document used by corporations to file their income tax returns in the state of Maryland. This form is essential for any business entity classified as a corporation, including C corporations and S corporations. The form captures various financial details, including income, deductions, and credits, which are necessary for calculating the corporation's tax liability. For the 2023 tax year, businesses must ensure they accurately report their income to comply with state tax laws.

Steps to Complete the Maryland Form 500

Completing the Maryland Form 500 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and records of deductions.

- Fill out the form by entering your corporation's income, deductions, and credits in the appropriate sections.

- Calculate the total tax owed based on the information provided.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form by the designated deadline, either electronically or by mail.

Required Documents for Filing

When preparing to file the Maryland Form 500, certain documents are necessary to ensure accurate reporting. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income earned during the tax year.

- Documentation for any deductions or credits claimed, such as receipts and invoices.

- Previous tax returns, if applicable, to reference past filings and ensure consistency.

Filing Deadlines for Maryland Form 500

The filing deadline for the Maryland Form 500 typically aligns with the federal tax return deadline. For most corporations, this means the form is due on the fifteenth day of the fourth month following the end of the tax year. For corporations with a tax year ending December 31, the deadline is April 15. It is important to be aware of these dates to avoid penalties and interest on late filings.

Legal Use of the Maryland Form 500

The Maryland Form 500 must be used in compliance with state tax laws. It is legally binding and serves as an official record of a corporation's income and tax obligations. Accurate completion and timely submission are crucial to avoid legal repercussions, including fines or audits. Corporations should ensure that they are aware of any changes in tax law that may affect their filing requirements.

Obtaining the Maryland Form 500

The Maryland Form 500 can be obtained from the Maryland Comptroller's website or through various tax preparation software that includes state tax forms. The form is available in a PDF format, making it easy to download and print for completion. Businesses should ensure they are using the correct version of the form for the tax year they are filing.

Quick guide on how to complete business income tax forms and instructions

Prepare Business Income Tax Forms And Instructions effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, adjust, and electronically sign your documents swiftly without any delays. Handle Business Income Tax Forms And Instructions on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to update and electronically sign Business Income Tax Forms And Instructions with ease

- Locate Business Income Tax Forms And Instructions and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors requiring new printed copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Business Income Tax Forms And Instructions and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business income tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the business income tax forms and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Maryland Form 500?

The 2023 Maryland Form 500 is the official tax return form for corporate income tax that businesses in Maryland must file. It is essential for companies to accurately complete this form to ensure compliance with state tax laws and avoid penalties. Utilizing tools like airSlate SignNow can streamline the process of eSigning and submitting the 2023 Maryland Form 500.

-

How can airSlate SignNow help with the 2023 Maryland Form 500?

airSlate SignNow provides an intuitive platform for businesses to easily send and eSign the 2023 Maryland Form 500. With its user-friendly interface, you can quickly complete your form and obtain necessary signatures, ensuring timely submission and compliance. This greatly reduces the hassle associated with traditional paperwork.

-

What are the pricing options for airSlate SignNow when filing the 2023 Maryland Form 500?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes looking to manage documents efficiently, including the filing of the 2023 Maryland Form 500. Plans are designed to be cost-effective while providing excellent features for document management and eSigning. Visit our pricing page for detailed options tailored to your needs.

-

Can I integrate airSlate SignNow with other software to manage the 2023 Maryland Form 500?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software, enhancing your workflow when handling the 2023 Maryland Form 500. These integrations allow for better data management and minimize the risk of errors during the filing process. Consult our integration documentation for a list of supported applications.

-

What features does airSlate SignNow offer for signing the 2023 Maryland Form 500?

airSlate SignNow provides a comprehensive suite of features for signing the 2023 Maryland Form 500, including customizable templates, secure cloud storage, and advanced tracking capabilities. These features ensure that your documents remain organized and that you can monitor their signing status in real-time. This makes the filing process more efficient.

-

Is airSlate SignNow secure for handling sensitive information related to the 2023 Maryland Form 500?

Absolutely! airSlate SignNow employs industry-leading security protocols to protect sensitive information during the completion of the 2023 Maryland Form 500. Our platform uses encryption and secure servers to ensure that your data remains confidential and safe throughout the entire process of eSigning and filing.

-

What benefits does airSlate SignNow offer for businesses filing the 2023 Maryland Form 500?

Using airSlate SignNow offers numerous benefits for businesses filing the 2023 Maryland Form 500, including increased efficiency, reduced paperwork, and quicker turnaround times for approvals. You can easily manage all documentation digitally, which saves time and simplifies tracking. This results in a more streamlined filing experience.

Get more for Business Income Tax Forms And Instructions

Find out other Business Income Tax Forms And Instructions

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement