Maryland Form 500 1995

What is the Maryland Form 500

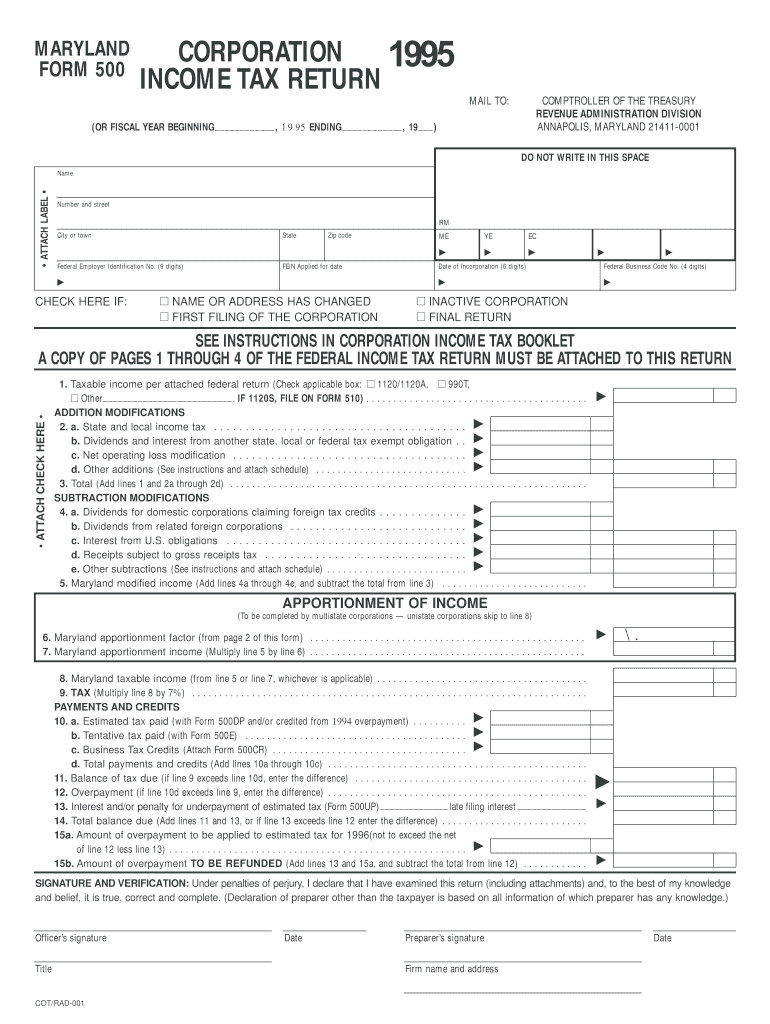

The Maryland Form 500 is a crucial document used for filing corporate income taxes in the state of Maryland. This form is specifically designed for corporations operating within the state, allowing them to report their income, deductions, and tax liabilities. It is essential for compliance with Maryland tax laws and helps ensure that corporations fulfill their financial obligations to the state. Understanding the purpose and requirements of the Maryland Form 500 is vital for any business entity looking to operate legally and efficiently in Maryland.

Steps to complete the Maryland Form 500

Completing the Maryland Form 500 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, accurately fill out the form by entering your corporation's income, deductions, and credits. Pay close attention to each section, as errors can lead to delays or penalties. Once the form is completed, review it thoroughly for accuracy, and then submit it by the designated deadline. Utilizing electronic signature solutions can streamline this process, making it easier to manage and submit the form securely.

Legal use of the Maryland Form 500

The Maryland Form 500 must be completed and submitted in accordance with state tax regulations to be considered legally valid. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions, including audits or penalties. The use of electronic signatures is accepted, provided they meet the standards set by the ESIGN Act and UETA, ensuring that the signed document holds the same legal weight as a traditional paper signature.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 500 are critical for compliance. Generally, corporations must file their tax returns by the 15th day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this typically falls on April 15. It is important to mark your calendar and ensure that the form is submitted on time to avoid late fees or penalties. Additionally, extensions may be available, but they must be requested in advance and do not exempt the corporation from paying any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Maryland Form 500 can be submitted through various methods, providing flexibility for corporations. The form can be filed online through the Maryland Comptroller's website, which offers a secure and efficient way to submit tax documents. Alternatively, corporations may choose to mail the completed form to the appropriate address provided by the state. In-person submissions are also accepted, although this method may be less convenient. Each submission method has its own guidelines and requirements, so it is advisable to review these before proceeding.

Required Documents

To successfully complete the Maryland Form 500, several documents are required. Corporations should gather financial statements, including profit and loss statements, balance sheets, and any supporting documentation for deductions and credits claimed. Additionally, prior year tax returns may be necessary for reference. Ensuring that all required documents are available and organized can facilitate a smoother filing process and help prevent errors that could lead to complications.

Key elements of the Maryland Form 500

The Maryland Form 500 includes several key elements that must be accurately completed. These elements typically consist of the corporation's name, address, federal employer identification number (EIN), and details regarding income and deductions. Additionally, it is important to include any applicable tax credits and to calculate the total tax liability correctly. Each section of the form is designed to capture specific financial information, making it essential to follow the instructions carefully to ensure compliance with state regulations.

Quick guide on how to complete maryland form 500

Complete Maryland Form 500 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle Maryland Form 500 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Maryland Form 500 with ease

- Obtain Maryland Form 500 and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Maryland Form 500 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form 500

Create this form in 5 minutes!

How to create an eSignature for the maryland form 500

How to generate an eSignature for the Maryland Form 500 online

How to generate an electronic signature for your Maryland Form 500 in Google Chrome

How to create an eSignature for signing the Maryland Form 500 in Gmail

How to create an electronic signature for the Maryland Form 500 from your mobile device

How to generate an electronic signature for the Maryland Form 500 on iOS devices

How to generate an eSignature for the Maryland Form 500 on Android

People also ask

-

What is the Maryland 500 package offered by airSlate SignNow?

The Maryland 500 package from airSlate SignNow is designed for businesses that require efficient document signing solutions. This package allows users to send and eSign up to 500 documents annually at a competitive rate, making it an ideal choice for companies in Maryland looking to streamline their workflows.

-

How much does the Maryland 500 package cost?

The pricing for the Maryland 500 package is tailored to fit the needs of small to medium-sized businesses. By choosing this package, you gain access to robust features at an affordable rate, ensuring that your document management needs are met without exceeding your budget.

-

What features are included in the Maryland 500 package?

The Maryland 500 package includes features such as unlimited templates, a user-friendly interface, mobile access, and advanced security measures. These features are aimed at simplifying the signing process and enhancing productivity for businesses operating in Maryland.

-

How can the Maryland 500 package benefit my business?

By using the Maryland 500 package, your business can signNowly reduce the time spent on document handling and ensure secure eSigning. This not only increases operational efficiency but also enhances customer satisfaction by providing a swift and seamless experience when managing important documents.

-

Does the Maryland 500 package allow for document integrations?

Yes, the Maryland 500 package from airSlate SignNow offers integrations with popular business tools and software. This capability allows businesses to incorporate eSigning and document management directly into their existing workflows, enhancing overall productivity and collaboration.

-

Is there a free trial available for the Maryland 500 package?

Yes, airSlate SignNow offers a free trial for the Maryland 500 package, allowing potential customers to explore its features without any commitments. This trial period enables businesses to assess the benefits of eSigning and determine how it fits into their specific needs.

-

Can the Maryland 500 package be used on mobile devices?

Absolutely! The Maryland 500 package is optimized for mobile devices, enabling users to send and eSign documents on the go. Whether you’re in the office or traveling, you can manage your document workflows efficiently from any smartphone or tablet.

Get more for Maryland Form 500

- Navmc 11297 usmc fitness report naval forms online

- Oas form 64

- Oas 64b form

- Oas 64d personnel data information and pilot carding fillable

- Truck carrier tool worksheets all pdf us environmental epa form

- Aircraft registration renewal application ac form 8050 1b

- Ia renewal activity training form faa faa

- Fda form 3667

Find out other Maryland Form 500

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document