Form HW 4 Rev Employee's Withholding Allowance and Status Certificate 2022-2026

What is the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate

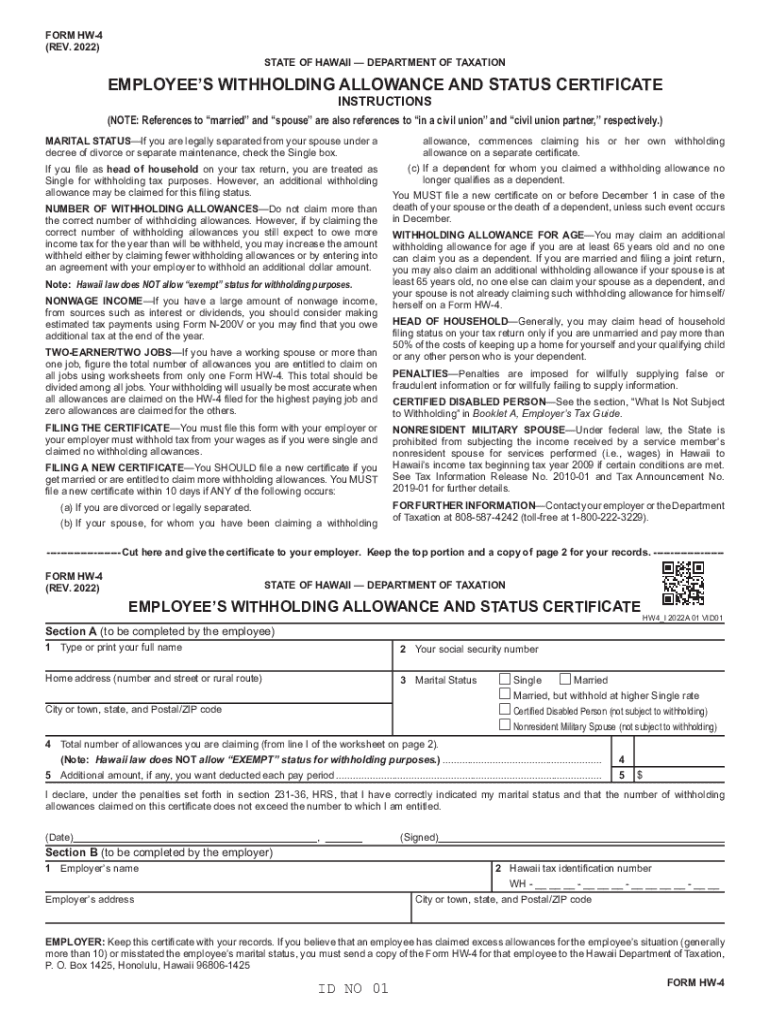

The Form HW 4 Rev, also known as the Employee's Withholding Allowance and Status Certificate, is a crucial document used in Hawaii for tax withholding purposes. This form allows employees to inform their employers about their withholding allowances and filing status. By accurately completing this form, employees can ensure that the correct amount of state income tax is withheld from their paychecks, which helps to avoid underpayment or overpayment of taxes throughout the year.

Steps to complete the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate

Completing the Form HW 4 Rev involves several key steps:

- Personal Information: Start by providing your name, address, and Social Security number.

- Filing Status: Indicate your filing status, which may include options such as single, married, or head of household.

- Withholding Allowances: Calculate the number of allowances you are entitled to claim based on your personal situation, including dependents and other factors.

- Signature: Sign and date the form to certify that the information provided is accurate.

Legal use of the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate

The Form HW 4 Rev is legally binding when completed and submitted to your employer. It is essential to provide truthful and accurate information, as any discrepancies may result in penalties or legal consequences. Employers are required to maintain this form in their records, ensuring compliance with state tax laws. Misuse or falsification of the form can lead to serious repercussions, including fines or audits by the state tax authority.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form HW 4 Rev. Generally, employees should submit this form to their employer when they start a new job or when there are changes in their personal or financial circumstances that affect their withholding allowances. Keeping the form updated ensures that the correct amount of tax is withheld, helping to avoid any surprises during tax season.

Form Submission Methods (Online / Mail / In-Person)

The Form HW 4 Rev can typically be submitted in several ways:

- Online: Some employers may offer electronic submission options through payroll systems.

- Mail: Employees can print the completed form and send it via postal mail to their employer's human resources or payroll department.

- In-Person: Delivering the form directly to the employer's office is also an option, ensuring immediate processing.

Key elements of the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate

Understanding the key elements of the Form HW 4 Rev is essential for accurate completion. The form includes sections for personal details, filing status, and the number of withholding allowances. Each section is designed to gather specific information that affects state tax withholding, making it crucial for employees to read the instructions carefully and provide accurate data.

Quick guide on how to complete form hw 4 rev 2022 employees withholding allowance and status certificate

Complete Form HW 4 Rev Employee's Withholding Allowance And Status Certificate seamlessly on any device

Digital document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form HW 4 Rev Employee's Withholding Allowance And Status Certificate on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and electronically sign Form HW 4 Rev Employee's Withholding Allowance And Status Certificate effortlessly

- Find Form HW 4 Rev Employee's Withholding Allowance And Status Certificate and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method to share your form—via email, SMS, or invite link—or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Adjust and electronically sign Form HW 4 Rev Employee's Withholding Allowance And Status Certificate to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form hw 4 rev 2022 employees withholding allowance and status certificate

Create this form in 5 minutes!

How to create an eSignature for the form hw 4 rev 2022 employees withholding allowance and status certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4 withholding allowance form and why is it important?

The 4 withholding allowance form is a tax document that helps determine the amount of federal income tax to withhold from your paycheck. It's important because it ensures that you withhold the correct amount, avoiding overpayment or underpayment to the IRS. Accurate withholding can also help you manage your finances effectively throughout the year.

-

How can airSlate SignNow help with the 4 withholding allowance form?

airSlate SignNow simplifies the process of completing and submitting the 4 withholding allowance form. With our platform, you can easily fill out the form electronically, ensuring that it is accurate and submitted in a timely manner. Our user-friendly interface also allows for quick revisions and updates as needed.

-

Are there any costs associated with using airSlate SignNow for the 4 withholding allowance form?

AirSlate SignNow offers a cost-effective solution for handling the 4 withholding allowance form and other documents. We have various pricing plans that cater to different business needs, providing flexibility and value without compromising on features. Detailed pricing information can be found on our website.

-

Is the 4 withholding allowance form secure when using airSlate SignNow?

Yes, your security is our priority at airSlate SignNow. We utilize industry-leading encryption methods to protect all documents, including the 4 withholding allowance form, ensuring your sensitive information remains safe and confidential. Our platform is compliant with strict security standards.

-

Can I integrate airSlate SignNow with other software to manage the 4 withholding allowance form?

Absolutely! airSlate SignNow offers integrations with various third-party applications, allowing you to streamline your workflow when managing the 4 withholding allowance form. Whether you use payroll software or other digital tools, our platform can connect seamlessly to enhance your efficiency.

-

What features does airSlate SignNow offer for handling the 4 withholding allowance form?

AirSlate SignNow provides a range of features designed to make managing the 4 withholding allowance form easy. These include electronic signatures, customizable templates, form tracking, and automatic reminders to keep your documents organized and accessible. This efficiency is key for both individuals and businesses.

-

How can I ensure timely submission of the 4 withholding allowance form with airSlate SignNow?

With airSlate SignNow, you can set up reminders and notifications that ensure you never miss the submission deadline for the 4 withholding allowance form. Our platform allows you to schedule your signing and submission processes efficiently, keeping you organized and on track throughout tax season.

Get more for Form HW 4 Rev Employee's Withholding Allowance And Status Certificate

- South carolina commercial form

- General partnership package south carolina form

- Contract for deed package south carolina form

- Statutory equivalent of living will or declaration for a desire of a natural death statutory south carolina form

- South carolina attorney form

- Revocation of statutory equivalent of living will or declaration south carolina form

- Gift act form

- South carolina process 497325894 form

Find out other Form HW 4 Rev Employee's Withholding Allowance And Status Certificate

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure