Form HW 4 Rev Employee's Withholding Allowance and Status Certificate Forms 2021

What is the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate?

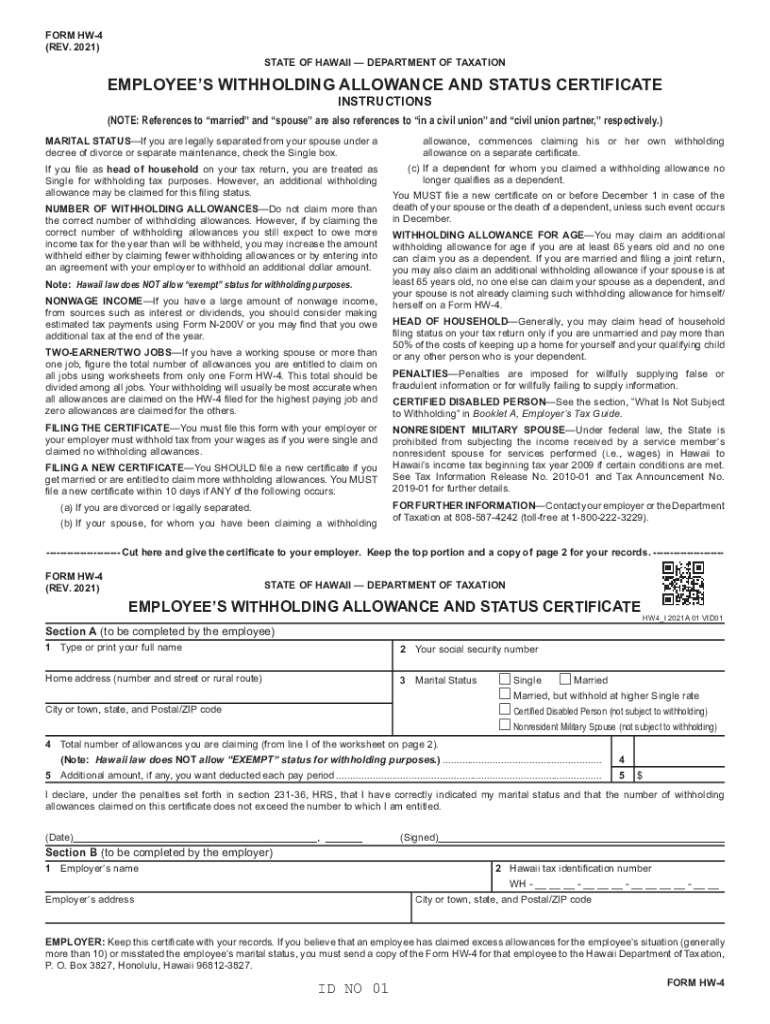

The Form HW 4 Rev, also known as the Employee's Withholding Allowance and Status Certificate, is a crucial document used by employees in the state of Hawaii to determine their state income tax withholding. This form allows employees to claim allowances based on their personal circumstances, such as marital status and number of dependents. By accurately completing this form, employees can ensure that the correct amount of state income tax is withheld from their paychecks, which can help avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the Form HW 4 Rev

Completing the Form HW 4 Rev involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status by checking the appropriate box (single, married, etc.).

- Allowances: Calculate and enter the number of allowances you are claiming based on your situation.

- Additional Withholding: If you wish to have additional amounts withheld, specify that amount in the designated section.

- Signature: Sign and date the form to certify that the information provided is accurate.

Legal Use of the Form HW 4 Rev

The Form HW 4 Rev is legally binding once completed and submitted to your employer. It is essential to provide accurate information, as any discrepancies may lead to incorrect tax withholding. The form complies with state tax laws and regulations, ensuring that both employees and employers fulfill their tax obligations. Employers are required to keep this form on file for their records and to ensure compliance with state withholding requirements.

State-Specific Rules for the Form HW 4 Rev

In Hawaii, specific rules govern the use of the Form HW 4 Rev. Employees must adhere to the state's guidelines regarding the number of allowances they can claim. Additionally, any changes in personal circumstances, such as marriage or the birth of a child, should prompt a review and possible update of the form. It is important for employees to stay informed about any changes in state tax laws that may affect their withholding status.

Filing Deadlines / Important Dates

Employees should submit the Form HW 4 Rev to their employer as soon as they start a new job or experience a change in their tax situation. There are no specific filing deadlines for this form, but timely submission is essential to ensure that the correct amount of tax is withheld from your paycheck. Keeping the form updated throughout the year can help avoid tax-related issues during tax season.

Examples of Using the Form HW 4 Rev

Consider a scenario where an employee recently got married and wants to adjust their tax withholding. By completing the Form HW 4 Rev and claiming additional allowances based on their new filing status, they can ensure that the correct amount of state tax is withheld. Another example is a parent who has had a child; they may claim an additional allowance for the dependent, which can reduce their overall tax withholding. These adjustments can lead to a more accurate reflection of their tax liability.

Quick guide on how to complete form hw 4 rev 2021 employees withholding allowance and status certificate forms 2021

Complete Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents promptly without delays. Manage Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms with ease

- Find Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about missing or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form hw 4 rev 2021 employees withholding allowance and status certificate forms 2021

Create this form in 5 minutes!

How to create an eSignature for the form hw 4 rev 2021 employees withholding allowance and status certificate forms 2021

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is hw 4 in relation to airSlate SignNow?

The term 'hw 4' refers to the fourth generation of airSlate SignNow's electronic signature solution, designed to provide enhanced features and usability. This version streamlines the document signing process, making it easier for users to manage their workflows efficiently.

-

How much does airSlate SignNow cost for hw 4?

The pricing for hw 4 varies depending on the plan you choose, starting with a basic subscription that is budget-friendly. By offering scalable pricing options, airSlate SignNow ensures that businesses of all sizes can access powerful eSignature features without breaking the bank.

-

What key features are included in hw 4?

hw 4 includes advanced features like template creation, bulk sending, and customizable branding options. These features enhance user experience and increase productivity by allowing teams to manage documents smarter and faster.

-

What are the benefits of using hw 4 for document signing?

Using hw 4 for document signing brings numerous benefits, including signNow time savings and increased security for sensitive information. It simplifies the entire signing process, allowing businesses to accelerate transactions while maintaining compliance.

-

Is hw 4 suitable for small businesses?

Absolutely! hw 4 is ideal for small businesses looking to enhance their document management with cost-effective eSigning solutions. Its ease of use and affordability make it a perfect fit for organizations with limited resources.

-

Can hw 4 integrate with other software solutions?

Yes, hw 4 integrates seamlessly with various software solutions, including CRM and project management tools. This interoperability provides users with a streamlined workflow and enhances overall operational efficiency.

-

How does airSlate SignNow ensure the security of hw 4 eSignatures?

airSlate SignNow employs robust security measures for hw 4, including encryption and secure storage methods. These practices ensure that your documents and signatures are protected at all times, giving users peace of mind.

Get more for Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

- Limited power of attorney where you specify powers with sample powers included maryland form

- Limited power of attorney for stock transactions and corporate powers maryland form

- Special durable power of attorney for bank account matters maryland form

- Maryland small business startup package maryland form

- Maryland property management package maryland form

- Maryland annual form

- Maryland bylaws corporation form

- Md professional corporation form

Find out other Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement