Form Hw 4 Employee S Withholding Allowance and Status Certificate 2018

What is the Form HW-4 Employee's Withholding Allowance and Status Certificate

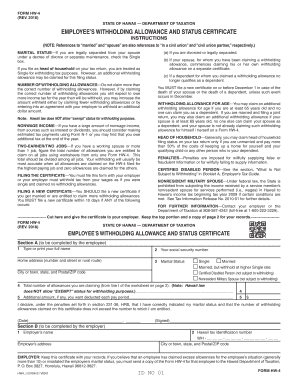

The HW-4 Employee's Withholding Allowance and Status Certificate is a crucial document used by employees in Hawaii to determine the amount of state income tax that should be withheld from their paychecks. This form allows employees to indicate their filing status and the number of allowances they are claiming, which directly affects their withholding amount. By accurately completing this form, employees can ensure that they are not over- or under-withheld, helping them manage their tax liabilities effectively.

How to Use the Form HW-4 Employee's Withholding Allowance and Status Certificate

Using the HW-4 form is straightforward. Employees need to fill out personal information, including their name, address, and Social Security number. They must also select their filing status, which could be single, married, or head of household. Additionally, employees can claim allowances based on their personal situation, such as dependents or other deductions. Once completed, the form should be submitted to the employer, who will use the information provided to adjust the withholding amount accordingly.

Steps to Complete the Form HW-4 Employee's Withholding Allowance and Status Certificate

Completing the HW-4 form involves several key steps:

- Obtain the HW-4 form from your employer or download it from the Hawaii Department of Taxation website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Select your filing status by marking the appropriate box.

- Claim the number of allowances you are entitled to based on your personal circumstances.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal Use of the Form HW-4 Employee's Withholding Allowance and Status Certificate

The HW-4 form is legally recognized in Hawaii and must be used by employees to ensure compliance with state tax regulations. Employers are required to keep this form on file for each employee, as it serves as the basis for calculating state income tax withholding. It is essential that employees provide accurate information to avoid penalties or issues with their tax filings.

Key Elements of the Form HW-4 Employee's Withholding Allowance and Status Certificate

Several key elements are included in the HW-4 form that employees should be aware of:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: Employees can claim allowances based on dependents and deductions.

- Signature: A signature is required to validate the information provided.

Filing Deadlines / Important Dates

Employees should be aware of important deadlines related to the HW-4 form. Generally, it should be submitted to the employer at the start of employment or whenever there is a change in personal circumstances that affects withholding. It is advisable to review and update the form annually or when significant life events occur, such as marriage or the birth of a child, to ensure that withholding amounts remain accurate.

Quick guide on how to complete form hw 4 rev 2018 employees withholding allowance and status certificate forms 2018

Your assistance manual on how to prepare your Form Hw 4 Employee S Withholding Allowance And Status Certificate

If you’re curious about how to generate and submit your Form Hw 4 Employee S Withholding Allowance And Status Certificate, here are some brief instructions on how to simplify tax submission considerably.

To begin, you merely need to create your airSlate SignNow account to revolutionize how you handle documentation online. airSlate SignNow is an exceptionally intuitive and powerful document management solution that empowers you to modify, generate, and complete your income tax files effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify details as necessary. Enhance your tax oversight with sophisticated PDF editing, eSigning, and seamless sharing.

Adhere to the steps outlined below to complete your Form Hw 4 Employee S Withholding Allowance And Status Certificate in minutes:

- Establish your account and start working on PDFs right away.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Select Get form to open your Form Hw 4 Employee S Withholding Allowance And Status Certificate in our editor.

- Complete the required fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual for filing your taxes electronically with airSlate SignNow. Remember that submitting via paper can lead to filing errors and delayed refunds. Additionally, prior to e-filing your taxes, consult the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form hw 4 rev 2018 employees withholding allowance and status certificate forms 2018

FAQs

-

Actually I want to fill out my JEE Advanced application form and I belong to OBC-NCL, but my NCL certificate is applicable only until 31st of March 2018. What should I do now?

u can quickly get new one by showing old one and request them to do as soon as possible

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

Create this form in 5 minutes!

How to create an eSignature for the form hw 4 rev 2018 employees withholding allowance and status certificate forms 2018

How to create an electronic signature for the Form Hw 4 Rev 2018 Employees Withholding Allowance And Status Certificate Forms 2018 online

How to create an eSignature for your Form Hw 4 Rev 2018 Employees Withholding Allowance And Status Certificate Forms 2018 in Google Chrome

How to make an eSignature for signing the Form Hw 4 Rev 2018 Employees Withholding Allowance And Status Certificate Forms 2018 in Gmail

How to generate an eSignature for the Form Hw 4 Rev 2018 Employees Withholding Allowance And Status Certificate Forms 2018 from your mobile device

How to make an eSignature for the Form Hw 4 Rev 2018 Employees Withholding Allowance And Status Certificate Forms 2018 on iOS

How to make an eSignature for the Form Hw 4 Rev 2018 Employees Withholding Allowance And Status Certificate Forms 2018 on Android

People also ask

-

What is airSlate SignNow and how does it relate to hi hw?

airSlate SignNow is a powerful eSignature solution that enables businesses to send, sign, and manage documents effortlessly. With hi hw, users can enjoy a seamless experience in document automation and signature collection, ensuring that transactions are both quick and reliable.

-

How much does airSlate SignNow cost for users interested in hi hw?

Pricing for airSlate SignNow varies based on the plan you choose, starting from a basic tier to more advanced options. For customers exploring hi hw, it's best to review the pricing details on our website to find a plan that suits your business needs and budget effectively.

-

What features does airSlate SignNow offer that are relevant to hi hw?

airSlate SignNow provides a wide array of features, including customizable templates, in-person signing, and remote signing capabilities. These features, particularly when looking at hi hw, make document management and signing processes easier for businesses of all sizes.

-

Can airSlate SignNow integrate with other applications for hi hw users?

Yes, airSlate SignNow offers robust integrations with numerous popular applications, enhancing your workflow with hi hw. Whether you need to connect with CRM systems or cloud storage solutions, airSlate SignNow can integrate smoothly to streamline your document processes.

-

What are the benefits of using airSlate SignNow for hi hw?

Using airSlate SignNow for hi hw offers numerous benefits including increased efficiency, cost savings, and improved compliance. Businesses can easily track document statuses and ensure that all signing processes are completed in a timely manner.

-

How secure is airSlate SignNow for hi hw transactions?

airSlate SignNow prioritizes security for all transactions, including those related to hi hw. With advanced encryption and compliance with industry standards, users can trust that their documents and data are safeguarded throughout the signing process.

-

Is it easy to get started with airSlate SignNow for hi hw?

Absolutely! Getting started with airSlate SignNow for hi hw is user-friendly, allowing businesses to set up their account and begin sending documents in minutes. The intuitive interface ensures that users can navigate the platform effortlessly.

Get more for Form Hw 4 Employee S Withholding Allowance And Status Certificate

- Pregnancy history form providence washington

- Ar licensed wholesaler quarterly report form

- Grannas brothers form

- Cdtfa ca department of tax and fee administration california form

- Tobacco and vapor server awareness form

- Change hartwick college form

- How to make your own cards against humanity family edition form

- Live performance band contract template

Find out other Form Hw 4 Employee S Withholding Allowance And Status Certificate

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement