Form HW 4 Rev Employee's Withholding Allowance and Status Certificate Forms 2016

What is the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

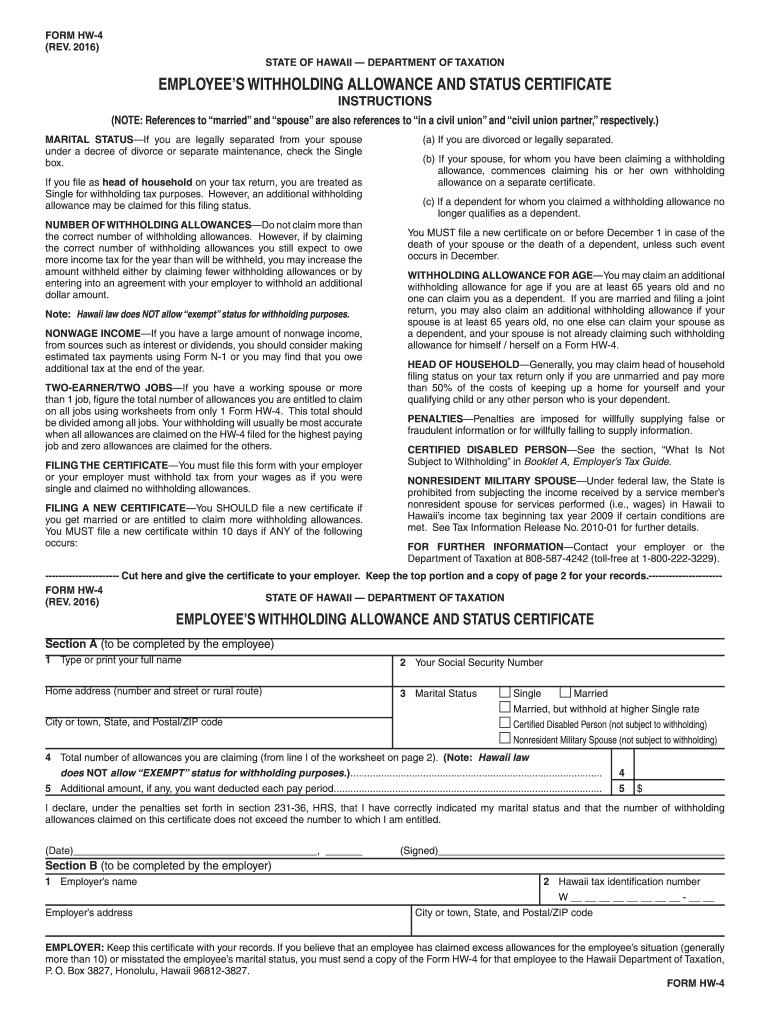

The Form HW 4 Rev Employee's Withholding Allowance And Status Certificate is a crucial document used by employees in the United States to determine their federal income tax withholding. This form allows employees to indicate their filing status and the number of allowances they are claiming, which directly affects the amount of tax withheld from their paychecks. By accurately completing this form, employees can ensure that they are not over- or under-withheld, helping them manage their tax liabilities effectively.

Steps to complete the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

Completing the Form HW 4 Rev involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Select your filing status, which can be single, married filing jointly, married filing separately, or head of household.

- Determine the number of allowances you wish to claim based on your personal situation, such as dependents and other deductions.

- Consider any additional amount you want withheld from each paycheck if you anticipate owing more taxes.

- Sign and date the form to certify that the information provided is accurate.

How to obtain the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

Employees can obtain the Form HW 4 Rev through various means. The form is typically available from the human resources department of an employer, as they often provide necessary tax forms to their employees. Additionally, the form can be downloaded from the official IRS website or other government resources. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal use of the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

The Form HW 4 Rev is legally recognized by the IRS and must be completed accurately to ensure compliance with federal tax laws. Employees are required to submit this form to their employer, who will use the information to calculate the appropriate amount of tax to withhold from their wages. Falsifying information on this form can lead to penalties, including fines and increased tax liabilities.

Key elements of the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

Several key elements are essential to the Form HW 4 Rev:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must select their filing status, which affects their tax rate.

- Allowances: The number of allowances claimed influences the amount of tax withheld.

- Additional Withholding: Employees can specify any extra amount they wish to be withheld from their paychecks.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form HW 4 Rev can be done through various methods, depending on the employer's processes:

- Online: Many employers allow employees to submit the form electronically through their payroll systems.

- Mail: Employees may also print the completed form and mail it directly to their employer's payroll department.

- In-Person: Submitting the form in person is another option, particularly if immediate confirmation is needed.

Quick guide on how to complete form hw 4 rev 2016 employees withholding allowance and status certificate forms 2016

Your assistance manual on how to prepare your Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

If you’re wondering how to finalize and submit your Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms, here are a few straightforward instructions to make tax filing more manageable.

To begin, you only need to create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely intuitive and effective document solution that enables you to modify, generate, and complete your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms in just a few minutes:

- Set up your account and start processing PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting in written form can lead to return errors and postpone refunds. It is important to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct form hw 4 rev 2016 employees withholding allowance and status certificate forms 2016

Create this form in 5 minutes!

How to create an eSignature for the form hw 4 rev 2016 employees withholding allowance and status certificate forms 2016

How to generate an eSignature for the Form Hw 4 Rev 2016 Employees Withholding Allowance And Status Certificate Forms 2016 online

How to make an electronic signature for your Form Hw 4 Rev 2016 Employees Withholding Allowance And Status Certificate Forms 2016 in Google Chrome

How to create an electronic signature for signing the Form Hw 4 Rev 2016 Employees Withholding Allowance And Status Certificate Forms 2016 in Gmail

How to make an eSignature for the Form Hw 4 Rev 2016 Employees Withholding Allowance And Status Certificate Forms 2016 right from your mobile device

How to make an electronic signature for the Form Hw 4 Rev 2016 Employees Withholding Allowance And Status Certificate Forms 2016 on iOS devices

How to create an eSignature for the Form Hw 4 Rev 2016 Employees Withholding Allowance And Status Certificate Forms 2016 on Android OS

People also ask

-

What is the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms?

The Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms is an essential document used by employees to declare their withholding allowances for tax purposes. Completing this form accurately ensures that the correct amount of tax is withheld from your paycheck, ultimately affecting your tax return outcome.

-

How can airSlate SignNow help me with the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms?

AirSlate SignNow allows you to seamlessly complete, sign, and send the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms digitally. This simplifies the process, enabling you to manage your paperwork efficiently and ensuring that your forms are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including individual users and large organizations. By choosing our platform, you can gain access to advanced features for managing Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms without breaking the bank.

-

What features does airSlate SignNow offer for managing Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms?

AirSlate SignNow provides numerous features that enhance your experience with Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms. These include eSignature capabilities, automated workflows, customizable templates, and secure storage, all designed to streamline your document management process.

-

Are there integration options available for using airSlate SignNow with Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms?

Yes, airSlate SignNow can be integrated with a variety of third-party applications to optimize the workflow surrounding Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms. This includes integration with popular platforms such as Google Drive, Salesforce, and Dropbox, which enhances document accessibility and collaboration.

-

What are the benefits of using airSlate SignNow for Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms?

Using airSlate SignNow for Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms offers several benefits, including increased efficiency, reduced turnaround time, and enhanced security. Additionally, the platform ensures compliance with legal standards, enabling businesses to manage their tax documentation with peace of mind.

-

Can I track the status of my Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms within airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking for all your documents, including Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms. You can monitor whether your form has been viewed, signed, or completed, providing you with full visibility and control over your document management process.

Get more for Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

Find out other Form HW 4 Rev Employee's Withholding Allowance And Status Certificate Forms

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe