Form it 204 CP New York Corporate Partners Schedule K 1 Tax Year 2022

What is the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

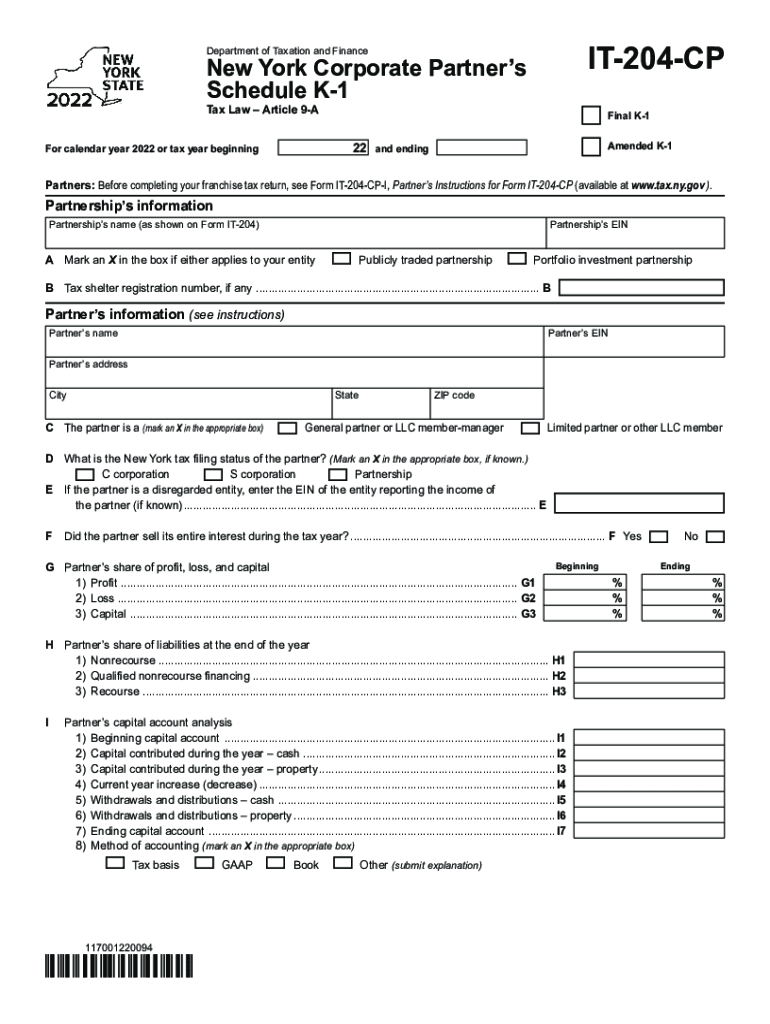

The Form IT 204 CP is a crucial document used by corporate partners in New York to report their share of income, deductions, and credits from partnerships. This form is specifically designed for the tax year and serves as a Schedule K-1. It details each partner's share of the partnership's income, which is essential for accurate tax reporting and compliance with state tax laws. Understanding this form is vital for corporate partners to ensure they fulfill their tax obligations correctly.

Steps to complete the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

Completing the Form IT 204 CP involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the partnership, including income statements and expense reports. Next, accurately report your share of the partnership’s income, deductions, and credits on the form. It is essential to provide correct information to avoid penalties or issues with the New York State Department of Taxation and Finance. After filling out the form, review it thoroughly for any errors before submission.

Key elements of the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

The Form IT 204 CP includes several key elements that are essential for proper tax reporting. These elements consist of the partner's name, address, and taxpayer identification number, alongside the partnership's details. Additionally, the form outlines the partner's share of income, losses, and other tax-related items. Understanding these components is vital for corporate partners to accurately report their tax obligations and ensure compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 204 CP are crucial for corporate partners to adhere to in order to avoid penalties. Typically, the form must be filed by the 15th day of the third month following the close of the tax year. For most partnerships, this means the deadline is March 15. It is important to stay informed about specific dates each tax year, as they may vary based on individual circumstances or changes in tax law.

Legal use of the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

The legal use of the Form IT 204 CP is governed by New York State tax laws. This form must be filed accurately to ensure that partners are in compliance with state regulations. Failure to file or inaccuracies in the form can lead to legal repercussions, including penalties and interest on unpaid taxes. Understanding the legal framework surrounding this form is essential for corporate partners to protect themselves against potential legal issues.

Examples of using the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

Examples of using the Form IT 204 CP can help clarify its application in real-world scenarios. For instance, if a partnership generates $100,000 in income and has two partners, each partner would report their share of income on their respective IT 204 CP forms. This ensures that each partner accurately reflects their share of the partnership's financial activity on their individual tax returns. Such examples illustrate the importance of the form in maintaining transparency and compliance in partnership tax reporting.

Quick guide on how to complete form it 204 cp new york corporate partners schedule k 1 tax year 2022

Complete Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Handle Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to alter and eSign Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year without hassle

- Obtain Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign function, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs within just a few clicks from any device of your choosing. Alter and eSign Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 204 cp new york corporate partners schedule k 1 tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 204 cp new york corporate partners schedule k 1 tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NY taxation CP and how does it relate to airSlate SignNow?

NY taxation CP refers to the New York taxation compliance process. With airSlate SignNow, businesses can seamlessly manage their documentation needs related to NY taxation CP by eSigning essential forms and agreements, ensuring compliance with state regulations efficiently.

-

How does airSlate SignNow help with the documentation required for NY taxation CP?

airSlate SignNow streamlines the documentation process for NY taxation CP by allowing users to create, send, and eSign necessary tax documents electronically. This speeds up compliance and reduces the potential for errors, making it easier for businesses to meet their tax obligations.

-

What are the pricing options available for airSlate SignNow that cater to NY taxation CP?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs, including those focusing on NY taxation CP. Whether you're a small business or a large enterprise, you can choose a plan that provides you with the essential features for compliance at a competitive price.

-

Can airSlate SignNow integrate with accounting software for NY taxation CP?

Yes, airSlate SignNow integrates with several popular accounting software systems, facilitating better management of NY taxation CP tasks. This integration allows users to sync data, ensuring that all documents related to taxation are automatically updated and easily accessible.

-

What features does airSlate SignNow offer to facilitate NY taxation CP?

airSlate SignNow provides features such as templates, automated workflows, and secure cloud storage specifically tailored for NY taxation CP. These tools help users save time and maintain the integrity of their documents, ensuring that they can streamline the tax compliance process.

-

Is airSlate SignNow suitable for small businesses dealing with NY taxation CP?

Absolutely! airSlate SignNow is designed with small businesses in mind, offering a user-friendly interface and cost-effective solutions for managing NY taxation CP. This makes it easy for smaller organizations to handle their tax documentation without overwhelming complexity.

-

How secure is airSlate SignNow when managing documents related to NY taxation CP?

Security is a top priority for airSlate SignNow. When handling documents related to NY taxation CP, the platform employs advanced encryption and security measures to ensure that sensitive information is protected. Users can confidently eSign and store their documents without fear of bsignNowes.

Get more for Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year

- Sd landlord form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497326173 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring south dakota form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings south dakota form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises south dakota form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles south dakota form

- Letter from tenant to landlord about landlords failure to make repairs south dakota form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497326179 form

Find out other Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online