Form Y 204 Yonkers Nonresident Partner Allocation Tax Year 2022

What is the Form Y-204 Yonkers Nonresident Partner Allocation Tax Year

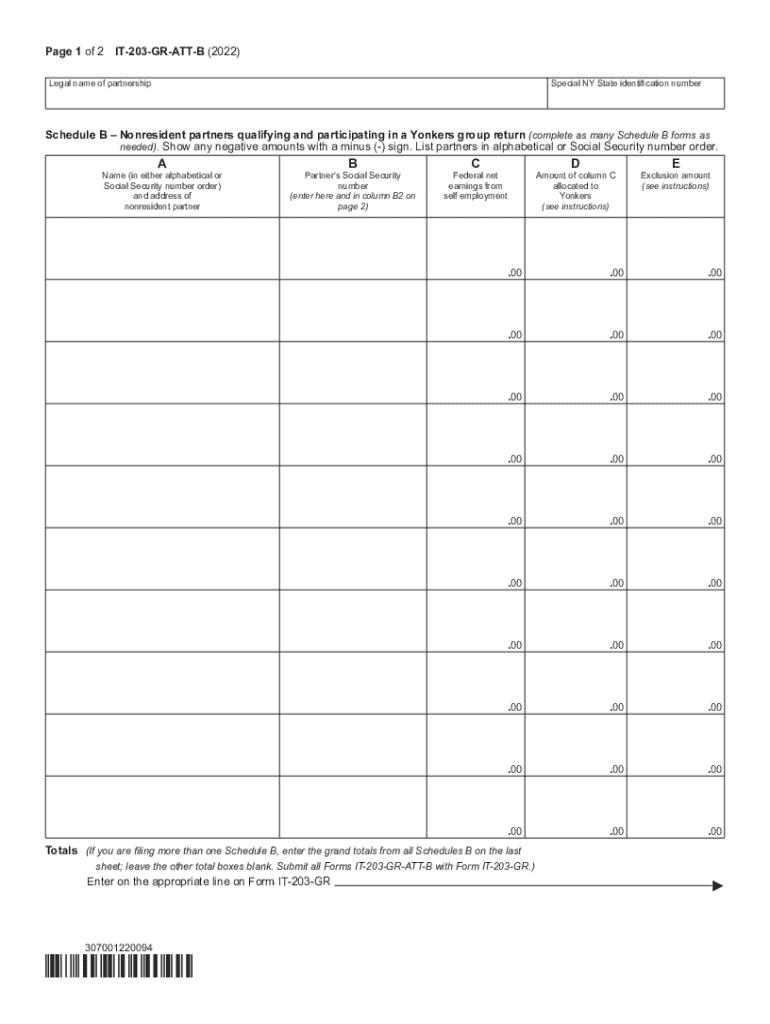

The Form Y-204 Yonkers Nonresident Partner Allocation Tax Year is a tax document required for nonresident partners of partnerships operating in Yonkers, New York. This form is used to report the allocation of income, deductions, and credits to nonresident partners for the tax year. It helps ensure that nonresident partners accurately report their share of income earned in Yonkers, facilitating compliance with local tax regulations.

How to use the Form Y-204 Yonkers Nonresident Partner Allocation Tax Year

To effectively use the Form Y-204, nonresident partners must first gather all relevant financial information related to their partnership. This includes income statements, expense reports, and any applicable deductions. Once the necessary data is compiled, partners can fill out the form, detailing their allocated share of the partnership's income and deductions. It is crucial to ensure that all information is accurate and complete to avoid issues with tax authorities.

Steps to complete the Form Y-204 Yonkers Nonresident Partner Allocation Tax Year

Completing the Form Y-204 involves several steps:

- Gather necessary documentation, including partnership agreements and financial statements.

- Identify your share of the partnership income and any applicable deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified filing methods.

Key elements of the Form Y-204 Yonkers Nonresident Partner Allocation Tax Year

The Form Y-204 includes several key elements that are essential for accurate reporting:

- Identification of the partnership and nonresident partner.

- Details of income allocated to the nonresident partner.

- Information on deductions and credits applicable to the partner.

- Signature section for verification and compliance.

Filing Deadlines / Important Dates

It is important for nonresident partners to be aware of filing deadlines for the Form Y-204. Typically, the form must be submitted by the due date for the partnership's tax return. Partners should also keep in mind any extensions that may apply, as well as any specific deadlines set by the Yonkers tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Form Y-204 can be submitted through various methods, providing flexibility for nonresident partners. Options include:

- Online submission through the appropriate tax authority portal.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Quick guide on how to complete form y 204 yonkers nonresident partner allocation tax year

Effortlessly prepare Form Y 204 Yonkers Nonresident Partner Allocation Tax Year on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly solution compared to conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without complications. Manage Form Y 204 Yonkers Nonresident Partner Allocation Tax Year on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form Y 204 Yonkers Nonresident Partner Allocation Tax Year without hassle

- Locate Form Y 204 Yonkers Nonresident Partner Allocation Tax Year and click on Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize important sections of the document or redact sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form Y 204 Yonkers Nonresident Partner Allocation Tax Year to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form y 204 yonkers nonresident partner allocation tax year

Create this form in 5 minutes!

How to create an eSignature for the form y 204 yonkers nonresident partner allocation tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

Form Y 204 Yonkers Nonresident Partner Allocation Tax Year is a tax form required by the City of Yonkers for nonresident partners to report their share of income. It helps ensure that nonresident partners comply with local tax laws, providing a clear allocation of income earned in Yonkers. Understanding this form is crucial for proper tax compliance for nonresidents.

-

How can airSlate SignNow help with submitting Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

airSlate SignNow offers easy-to-use eSignature solutions that simplify the process of completing and submitting Form Y 204 Yonkers Nonresident Partner Allocation Tax Year. Our platform ensures that all signatures are legally binding and securely stored. This streamlines the tax submission process, saving you time and reducing errors.

-

What are the features of airSlate SignNow that benefit users handling Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

Key features include customizable templates, secure eSigning capabilities, and document tracking. These tools allow users to effortlessly manage their Form Y 204 Yonkers Nonresident Partner Allocation Tax Year submissions while ensuring compliance. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is there a cost associated with using airSlate SignNow for Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

Yes, airSlate SignNow operates on a subscription model that is cost-effective and tailored to meet different business needs. Pricing plans vary based on the number of users and features required, ensuring you only pay for what you need. This makes it a smart solution for businesses assisting with Form Y 204 Yonkers Nonresident Partner Allocation Tax Year tasks.

-

Are there integrations available that can assist with Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

Absolutely! airSlate SignNow integrates with numerous business applications, enhancing your workflow for filling out Form Y 204 Yonkers Nonresident Partner Allocation Tax Year. From CRM software to accounting applications, our integrations ensure seamless data flow, simplifying the tax preparation process.

-

What benefits can I expect using airSlate SignNow for Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

Using airSlate SignNow for Form Y 204 Yonkers Nonresident Partner Allocation Tax Year allows for faster processing, reduced paperwork, and enhanced tracking of your documents. It also provides a more professional appearance while ensuring compliance with tax regulations. The ability to store documents securely digitally enhances your workflow and organization.

-

Is airSlate SignNow user-friendly for completing Form Y 204 Yonkers Nonresident Partner Allocation Tax Year?

Yes, airSlate SignNow is designed with user experience in mind. Its intuitive interface allows users, even those with minimal tech skills, to navigate easily while completing the Form Y 204 Yonkers Nonresident Partner Allocation Tax Year. This accessibility helps ensure that businesses can focus on compliance without getting bogged down by technology.

Get more for Form Y 204 Yonkers Nonresident Partner Allocation Tax Year

- South dakota living trust form

- Living trust for individual who is single divorced or widow or widower with children south dakota form

- Living trust for husband and wife with one child south dakota form

- Living trust for husband and wife with minor and or adult children south dakota form

- Amendment to living trust south dakota form

- Living trust property record south dakota form

- Financial account transfer to living trust south dakota form

- Sd assignment 497326361 form

Find out other Form Y 204 Yonkers Nonresident Partner Allocation Tax Year

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document