Form it 203 GR ATT B Schedule B Yonkers Group Return for Nonresident Partners Tax Year 2023

Understanding the Form IT 203 GR ATT B Schedule B for Nonresident Partners

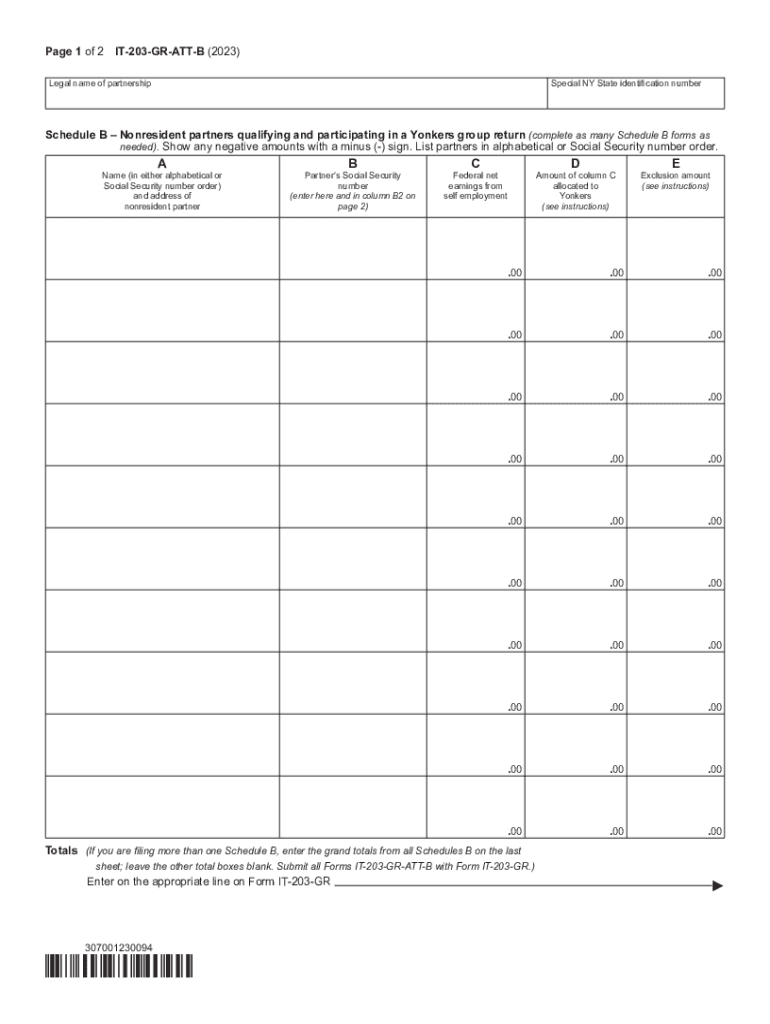

The Form IT 203 GR ATT B Schedule B is a specific tax form used for filing a Yonkers Group Return for nonresident partners. This form is essential for partnerships that have nonresident partners who earn income in Yonkers, New York. It allows these partnerships to report the income earned by their nonresident partners collectively, simplifying the filing process. The form ensures compliance with state tax laws and helps in calculating the appropriate tax liability for each partner based on their share of income.

Steps to Complete the Form IT 203 GR ATT B Schedule B

Completing the Form IT 203 GR ATT B requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the partnership and its nonresident partners.

- Complete the identification section, including the partnership's name, address, and Employer Identification Number (EIN).

- List all nonresident partners and their respective shares of income.

- Calculate the total income earned by the partnership and the individual shares for each nonresident partner.

- Fill in the tax calculation section, ensuring accurate figures are reported.

- Review the completed form for accuracy before submission.

Obtaining the Form IT 203 GR ATT B Schedule B

The Form IT 203 GR ATT B can be obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing users to print and fill it out manually. Alternatively, the form may also be accessible through tax preparation software that supports New York state tax forms, facilitating easier completion and submission.

Legal Use of the Form IT 203 GR ATT B Schedule B

This form is legally mandated for partnerships with nonresident partners who earn income in Yonkers. Proper completion and timely submission of the form are crucial to avoid penalties and ensure compliance with New York tax regulations. Noncompliance can lead to fines and interest on unpaid taxes, making it essential for partnerships to understand their obligations under state law.

Key Elements of the Form IT 203 GR ATT B Schedule B

The key elements of this form include:

- Partnership identification information, including name and EIN.

- Details of each nonresident partner, including their share of income.

- Calculation of total income and tax liability.

- Signature section for authorized representatives of the partnership.

Filing Deadlines for the Form IT 203 GR ATT B Schedule B

The filing deadline for the Form IT 203 GR ATT B typically aligns with the federal tax return deadline, which is usually April fifteenth. However, partnerships may be eligible for extensions, allowing additional time to file. It is important for partnerships to stay informed about any changes to deadlines to ensure timely submission and avoid penalties.

Quick guide on how to complete form it 203 gr att b schedule b yonkers group return for nonresident partners tax year

Complete Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly and without interruptions. Manage Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year effortlessly

- Locate Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr att b schedule b yonkers group return for nonresident partners tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att b schedule b yonkers group return for nonresident partners tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year?

The Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year is a tax document designed for partnerships to report income, deductions, and other relevant information for nonresident partners in Yonkers. This form ensures compliance with local tax regulations while providing tax benefits for nonresident partners.

-

How can airSlate SignNow help with the Form IT 203 GR ATT B Schedule B?

airSlate SignNow provides a user-friendly platform for electronically signing and managing the Form IT 203 GR ATT B Schedule B. With our solution, you can streamline the process of obtaining signatures and ensure that your tax documents are securely stored and easily accessible.

-

What are the pricing plans for using airSlate SignNow for the Form IT 203 GR ATT B Schedule B?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes looking to manage the Form IT 203 GR ATT B Schedule B. These plans are designed to be cost-effective, providing features that simplify the eSigning process while ensuring compliance with local regulations.

-

Can I integrate airSlate SignNow with other software for managing the Form IT 203 GR ATT B Schedule B?

Yes, airSlate SignNow seamlessly integrates with a variety of software platforms to help you manage the Form IT 203 GR ATT B Schedule B more efficiently. Whether you're using accounting, CRM, or project management tools, our integrations enhance workflow and ensure all your tax documents are synchronized.

-

What features does airSlate SignNow offer for the Form IT 203 GR ATT B Schedule B?

airSlate SignNow offers a range of features tailored for the Form IT 203 GR ATT B Schedule B, including customizable templates, real-time tracking, and secure cloud storage. These features not only simplify document management but also enhance the security and compliance for your tax-related processes.

-

How does airSlate SignNow ensure the security of the Form IT 203 GR ATT B Schedule B?

Security is a top priority for airSlate SignNow. We utilize encryption, secure access controls, and regular audits to protect all signed documents, including the Form IT 203 GR ATT B Schedule B, ensuring that sensitive information remains confidential and secure.

-

Is airSlate SignNow suitable for small businesses handling the Form IT 203 GR ATT B Schedule B?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses managing the Form IT 203 GR ATT B Schedule B. Our platform scales with your needs, helping you save time and reduce administrative burdens, regardless of your business size.

Get more for Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

Find out other Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online