Form it 203 GR ATT a Schedule a New York State Group 2024-2026

What is the Form IT 203 GR ATT A Schedule A New York State Group

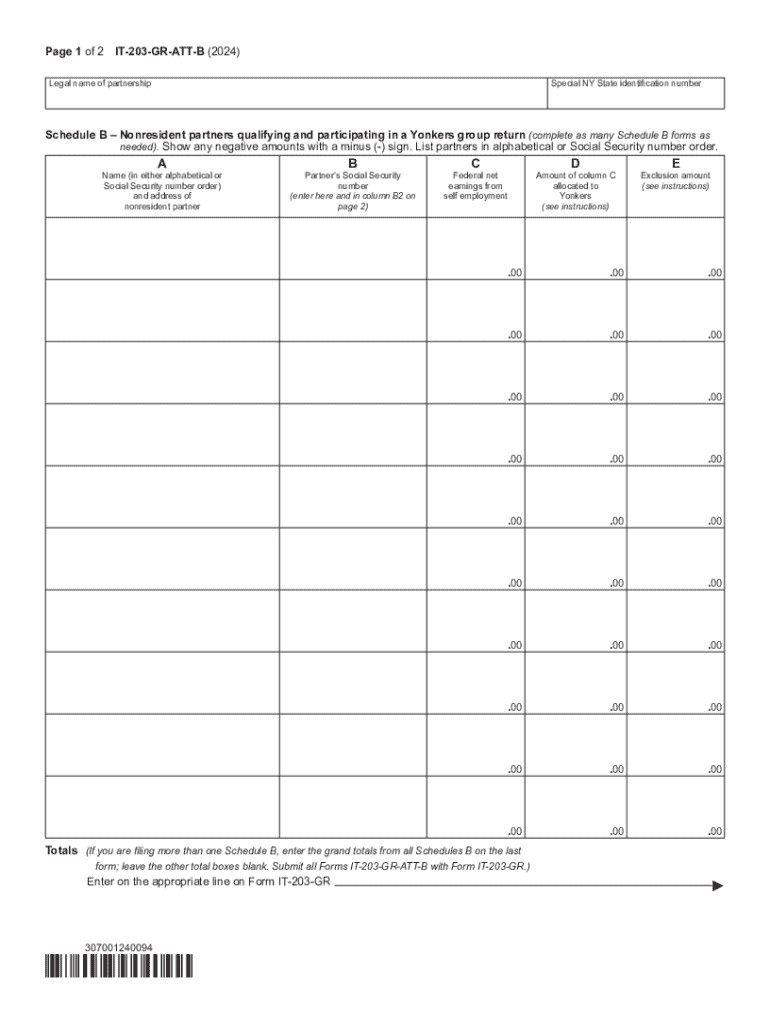

The Form IT 203 GR ATT A Schedule A is a tax form used by non-residents and part-year residents of New York State to report income and calculate their tax liability. This form is specifically designed for individuals who are part of a group that is filing a combined return. The IT 203 GR ATT A allows taxpayers to allocate their income, deductions, and credits among the members of the group, ensuring that each individual is taxed appropriately based on their share of the group's income.

How to use the Form IT 203 GR ATT A Schedule A New York State Group

To effectively use the Form IT 203 GR ATT A, individuals must first gather all relevant income information and documentation for the tax year. This includes W-2 forms, 1099 forms, and any other income statements. Taxpayers should then fill out the form by entering personal information, detailing income sources, and allocating deductions and credits as applicable. It is crucial to ensure that all entries are accurate to avoid potential issues with the New York State Department of Taxation and Finance.

Steps to complete the Form IT 203 GR ATT A Schedule A New York State Group

Completing the Form IT 203 GR ATT A involves several key steps:

- Gather necessary documents, including income statements and prior tax returns.

- Fill out personal identification information at the top of the form.

- Report total income from all sources, ensuring to include only the income earned while part of the group.

- Allocate deductions and credits among group members based on agreed-upon percentages.

- Review the completed form for accuracy before submission.

Key elements of the Form IT 203 GR ATT A Schedule A New York State Group

Several key elements must be addressed when filling out the Form IT 203 GR ATT A:

- Personal Information: This includes names, addresses, and Social Security numbers of all group members.

- Income Reporting: All income earned by group members must be reported accurately.

- Deductions and Credits: Each member's share of allowable deductions and credits must be clearly outlined.

- Signature: The form must be signed by all members to validate the submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form IT 203 GR ATT A. Generally, the form must be submitted by the due date for the tax return of the group, which is typically April fifteenth for most taxpayers. However, if additional time is needed, an extension can be filed, allowing for an extended deadline. Always check for any updates or changes in deadlines from the New York State Department of Taxation and Finance.

Eligibility Criteria

Eligibility to use the Form IT 203 GR ATT A is limited to non-residents and part-year residents of New York State who are part of a group filing a combined return. Each member of the group must have income that is reportable in New York, and the group must agree on the allocation of income, deductions, and credits. It is important to ensure that all members meet these criteria to avoid complications during the filing process.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr att a schedule a new york state group

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att a schedule a new york state group

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 203 GR ATT A Schedule A New York State Group?

Form IT 203 GR ATT A Schedule A New York State Group is a tax form used by New York State residents to report specific income and deductions. It is essential for accurately calculating your state tax obligations. Understanding this form can help ensure compliance and optimize your tax situation.

-

How can airSlate SignNow help with Form IT 203 GR ATT A Schedule A New York State Group?

airSlate SignNow simplifies the process of completing and eSigning Form IT 203 GR ATT A Schedule A New York State Group. Our platform allows users to fill out the form digitally, ensuring accuracy and saving time. With our user-friendly interface, you can easily manage your tax documents.

-

What are the pricing options for using airSlate SignNow for Form IT 203 GR ATT A Schedule A New York State Group?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are an individual or a large organization, you can choose a plan that fits your budget while accessing features for managing Form IT 203 GR ATT A Schedule A New York State Group. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for Form IT 203 GR ATT A Schedule A New York State Group?

Our platform provides features such as document templates, eSignature capabilities, and secure cloud storage specifically for Form IT 203 GR ATT A Schedule A New York State Group. These features streamline the process, making it easier to complete and submit your tax forms efficiently.

-

Is airSlate SignNow secure for handling Form IT 203 GR ATT A Schedule A New York State Group?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and secure servers to protect your data while you work on Form IT 203 GR ATT A Schedule A New York State Group. You can trust us to keep your sensitive information safe.

-

Can I integrate airSlate SignNow with other software for Form IT 203 GR ATT A Schedule A New York State Group?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for Form IT 203 GR ATT A Schedule A New York State Group. This allows you to connect with tools you already use, making document management seamless.

-

What are the benefits of using airSlate SignNow for Form IT 203 GR ATT A Schedule A New York State Group?

Using airSlate SignNow for Form IT 203 GR ATT A Schedule A New York State Group provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform helps you complete your tax forms faster and with fewer errors, ultimately saving you time and effort.

Get more for Form IT 203 GR ATT A Schedule A New York State Group

Find out other Form IT 203 GR ATT A Schedule A New York State Group

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online