Form it 638 START UP NY Tax Elimination Credit Tax Year 2022

Understanding the Form IT 638 START UP NY Tax Elimination Credit

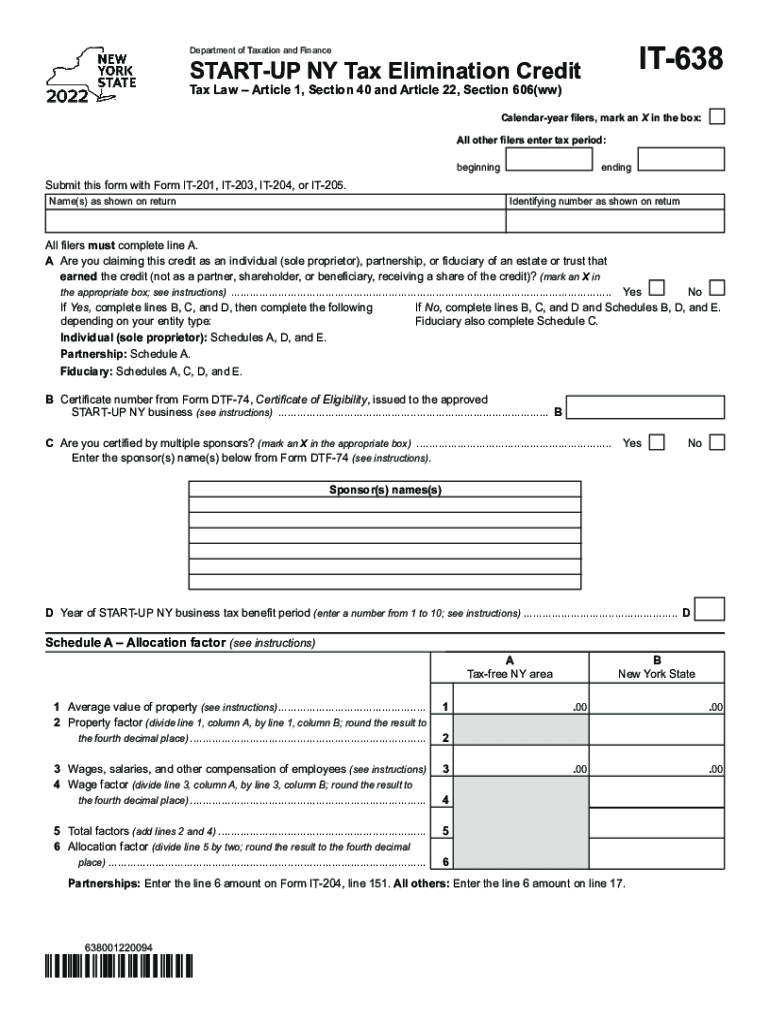

The Form IT 638 is a crucial document for businesses seeking the START UP NY Tax Elimination Credit in New York. This form is designed to facilitate tax elimination for eligible businesses that meet specific criteria set forth by the state. The credit aims to incentivize new businesses to establish operations in designated areas, ultimately contributing to economic growth and job creation. By understanding the purpose and implications of this form, businesses can better navigate the tax landscape and maximize their benefits.

Steps to Complete the Form IT 638

Completing the Form IT 638 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including its location, type, and the nature of your operations. Next, fill out the form accurately, providing details such as your business's federal Employer Identification Number (EIN) and the specific tax year for which you are applying. After completing the form, review it thoroughly to avoid any errors that could delay processing. Finally, submit the form through the appropriate channels, which may include online submission or mailing it to the designated office.

Eligibility Criteria for the Form IT 638

To qualify for the START UP NY Tax Elimination Credit, businesses must meet certain eligibility criteria. These include being a new business entity, operating in a designated tax-free zone, and creating a minimum number of jobs within a specified timeframe. Additionally, businesses must not have previously operated in New York State. It is essential to review these criteria carefully to ensure compliance and to maximize the potential benefits of the tax elimination program.

Required Documents for the Form IT 638

When submitting the Form IT 638, businesses must provide supporting documentation to verify their eligibility. Required documents typically include proof of business formation, such as articles of incorporation or organization, and any relevant tax identification numbers. Additionally, businesses may need to submit evidence of job creation, such as payroll records or employment agreements. Ensuring that all required documents are included with the form can help expedite the approval process.

Filing Deadlines for the Form IT 638

Timely submission of the Form IT 638 is critical to securing the START UP NY Tax Elimination Credit. Businesses should be aware of specific filing deadlines, which can vary based on the tax year and the nature of the credit. Generally, forms must be submitted by a certain date following the end of the tax year for which the credit is being claimed. Keeping track of these deadlines can help businesses avoid penalties and ensure they receive their credits promptly.

Legal Use of the Form IT 638

The Form IT 638 must be used in accordance with New York State tax laws and regulations. This includes ensuring that all information provided is accurate and that the business meets all eligibility requirements. Misuse of the form or providing false information can lead to penalties, including the denial of the credit or other legal repercussions. Therefore, it is important for businesses to understand the legal implications of submitting this form and to maintain compliance throughout the process.

Form Submission Methods for the IT 638

Businesses can submit the Form IT 638 through various methods, depending on their preferences and the requirements set by the New York State Department of Taxation and Finance. Options typically include online submission through the state’s tax portal, mailing a physical copy of the form, or in-person submission at designated offices. Each method has its own advantages, such as speed or the ability to receive immediate confirmation of receipt, so businesses should choose the one that best suits their needs.

Quick guide on how to complete form it 638 start up ny tax elimination credit tax year

Complete Form IT 638 START UP NY Tax Elimination Credit Tax Year effortlessly on any gadget

Digital document management has gained traction with companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the needed form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Form IT 638 START UP NY Tax Elimination Credit Tax Year on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to alter and eSign Form IT 638 START UP NY Tax Elimination Credit Tax Year with ease

- Obtain Form IT 638 START UP NY Tax Elimination Credit Tax Year and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from a device of your preference. Alter and eSign Form IT 638 START UP NY Tax Elimination Credit Tax Year and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 638 start up ny tax elimination credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 638 start up ny tax elimination credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax elimination and how can airSlate SignNow help?

Tax elimination refers to the strategies businesses use to minimize or completely erase their tax liabilities. airSlate SignNow can facilitate this process by streamlining document management, helping you efficiently manage tax-related documents and ensuring compliance, which is vital for effective tax elimination.

-

How does airSlate SignNow enhance tax elimination strategies?

airSlate SignNow enhances tax elimination strategies by offering secure and efficient eSigning for tax forms, agreements, and important financial documentation. This not only saves time but also minimizes errors that could lead to tax complications, providing a clear path for your tax elimination efforts.

-

What are the costs associated with using airSlate SignNow for tax elimination?

airSlate SignNow offers cost-effective plans that cater to various business needs, making tax elimination accessible for all. With transparent pricing and no hidden fees, you can choose a plan that fits your budget while leveraging the tools necessary for effective tax management.

-

Can I integrate airSlate SignNow with my existing tax software?

Yes, airSlate SignNow easily integrates with popular tax software and platforms to provide seamless document management. This integration supports your tax elimination process by ensuring all your necessary documents are readily available and securely signed when needed.

-

What features does airSlate SignNow offer that aid in tax elimination?

airSlate SignNow offers features such as customizable templates, secure eSignatures, and document tracking, which are essential for effective tax elimination. These tools allow you to quickly create and manage tax forms while ensuring they are compliant and securely signed.

-

How secure is airSlate SignNow for handling tax-related documents?

Security is a priority for airSlate SignNow, especially when it comes to sensitive tax-related documents. We employ state-of-the-art encryption and compliance with industry standards to ensure that your data remains safe, aiding in your overall tax elimination strategies.

-

Is airSlate SignNow user-friendly for those new to tax elimination processes?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for individuals new to tax elimination processes to navigate. Our intuitive interface helps users create and manage tax documents efficiently, regardless of their technical skill level.

Get more for Form IT 638 START UP NY Tax Elimination Credit Tax Year

- Lease purchase agreements package south dakota form

- Satisfaction cancellation or release of mortgage package south dakota form

- Premarital agreements package south dakota form

- Painting contractor package south dakota form

- Framing contractor package south dakota form

- Foundation contractor package south dakota form

- Plumbing contractor package south dakota form

- Brick mason contractor package south dakota form

Find out other Form IT 638 START UP NY Tax Elimination Credit Tax Year

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free