Printable New York Form it 638 START UP NY Tax Elimination Credit 2020

What is the Printable New York Form IT 638 START UP NY Tax Elimination Credit

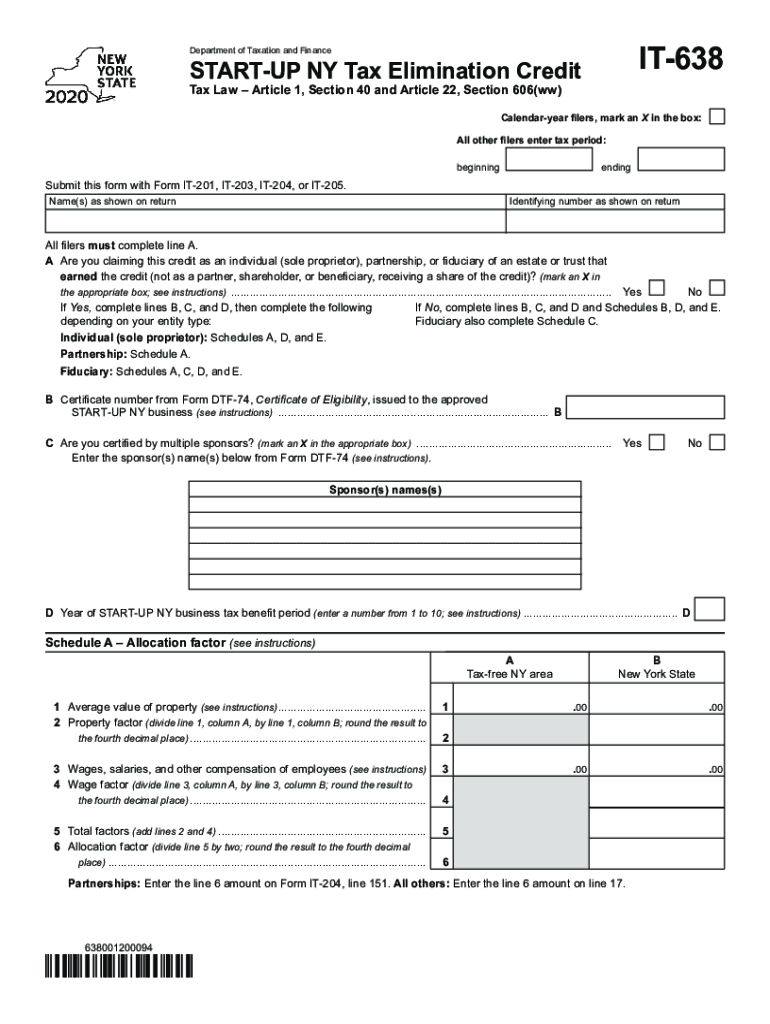

The Printable New York Form IT 638 is specifically designed for businesses participating in the START-UP NY program, which aims to promote economic growth in designated areas of New York State. This form allows eligible businesses to claim a tax elimination credit, significantly reducing their tax liabilities. The credit is available for new businesses that create jobs and invest in the state, providing a substantial incentive for economic development in targeted regions.

How to use the Printable New York Form IT 638 START UP NY Tax Elimination Credit

Using the Printable New York Form IT 638 involves several steps. First, ensure that your business meets the eligibility criteria outlined by the START-UP NY program. Next, gather all necessary documentation, including proof of job creation and investment in the designated area. Complete the form accurately, providing all required information about your business and its operations. Once completed, submit the form to the New York State Department of Taxation and Finance as instructed in the guidelines.

Steps to complete the Printable New York Form IT 638 START UP NY Tax Elimination Credit

Completing the Printable New York Form IT 638 involves a systematic approach:

- Review the eligibility criteria to confirm your business qualifies for the credit.

- Collect required documentation, such as proof of business location and employment records.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check your calculations and information for accuracy.

- Submit the form by the specified deadline to avoid penalties.

Eligibility Criteria

To qualify for the tax elimination credit through the Printable New York Form IT 638, businesses must meet specific eligibility criteria. These include being a new business entity, creating a minimum number of jobs, and operating within a designated START-UP NY zone. Additionally, businesses must demonstrate a commitment to investment in the local economy, aligning with the program's goals of fostering job growth and economic development.

Form Submission Methods

The Printable New York Form IT 638 can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, if preferred.

Legal use of the Printable New York Form IT 638 START UP NY Tax Elimination Credit

The legal use of the Printable New York Form IT 638 is governed by state tax laws and regulations. It is essential for businesses to adhere to these guidelines to ensure compliance and avoid potential penalties. The form must be filled out truthfully, and all claims for the tax elimination credit should be substantiated with appropriate documentation. Failure to comply with the legal requirements may result in audits or disqualification from the credit.

Quick guide on how to complete printable 2020 new york form it 638 start up ny tax elimination credit

Easily prepare Printable New York Form IT 638 START UP NY Tax Elimination Credit on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Printable New York Form IT 638 START UP NY Tax Elimination Credit on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Printable New York Form IT 638 START UP NY Tax Elimination Credit with ease

- Obtain Printable New York Form IT 638 START UP NY Tax Elimination Credit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and eSign Printable New York Form IT 638 START UP NY Tax Elimination Credit and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 638 start up ny tax elimination credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 638 start up ny tax elimination credit

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the 2020 638 feature in airSlate SignNow?

The 2020 638 feature in airSlate SignNow allows users to effectively manage and sign documents online. This functionality enhances the document workflow by streamlining the signing process, making it faster and more efficient for businesses.

-

How does pricing work for the 2020 638 offering?

The pricing for the 2020 638 features is designed to be budget-friendly, with various plans to suit different business needs. You can choose from monthly or annual subscriptions, and there are free trials available to help you evaluate the service.

-

What benefits do I get from using the 2020 638 solution?

Using the 2020 638 solution provides numerous benefits, including increased efficiency in document handling and reduced turnaround time. Additionally, it enhances collaboration among team members by allowing real-time editing and signing.

-

Can the 2020 638 feature be integrated with other tools?

Yes, the 2020 638 feature can be seamlessly integrated with several popular tools and applications. This allows for enhanced functionality and ensures a cohesive workflow by connecting your eSigning process with existing business systems.

-

Is the 2020 638 solution suitable for small businesses?

Absolutely! The 2020 638 solution is particularly beneficial for small businesses as it provides a cost-effective way to manage documents. Its user-friendly interface makes it easy for teams to adopt without extensive training.

-

What types of documents can be signed with the 2020 638 feature?

The 2020 638 feature supports a wide variety of documents, including contracts, agreements, and forms. This flexibility ensures that you can handle all your signing needs within a single platform.

-

How secure is the 2020 638 signing process?

The 2020 638 signing process offers robust security measures, including encryption and secure access controls. airSlate SignNow prioritizes your data safety, ensuring compliance with industry standards and regulations.

Get more for Printable New York Form IT 638 START UP NY Tax Elimination Credit

- Septic waiver disclosure form dpor virginiagov

- Residential property disclosure statement dulles area form

- Virginia building code or zoning ordinance violations disclosure form

- Defective drywall disclosure statement dpor form

- Non employment affidavit form

- West virginia real estate power of attorney form

- Monterey residential escrow report form

- Form 104b land owner petitionwpd

Find out other Printable New York Form IT 638 START UP NY Tax Elimination Credit

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document