Form it 638 START UP NY Tax Elimination Credit Tax Year 2023

Understanding the Form IT 638 START UP NY Tax Elimination Credit

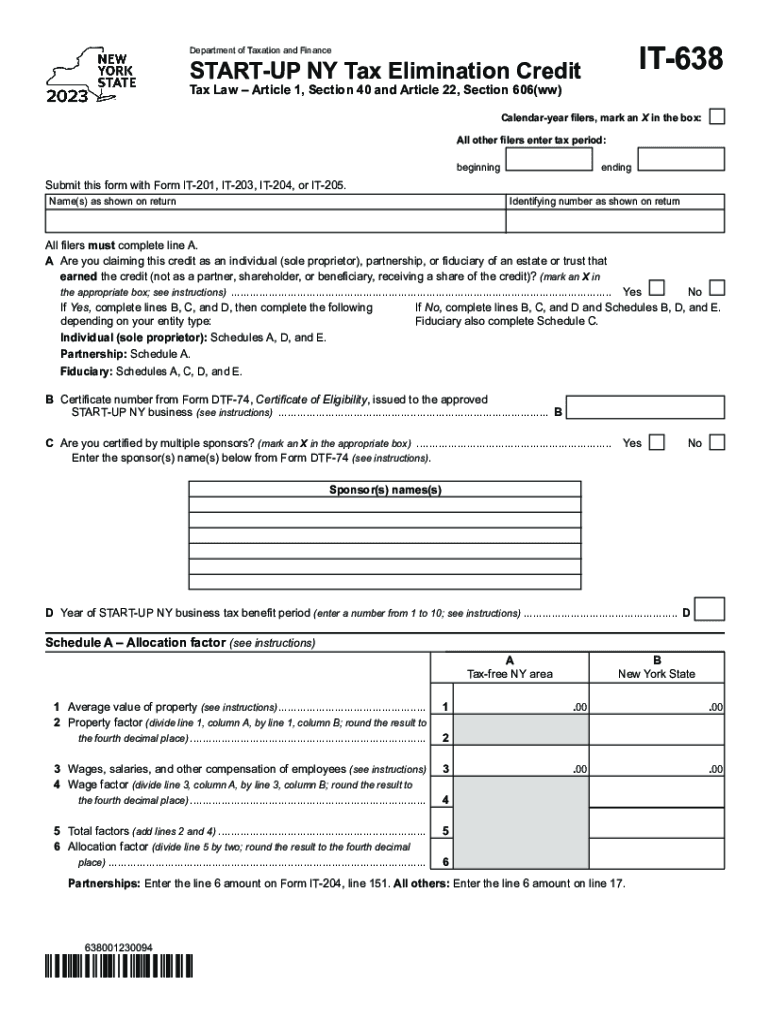

The Form IT 638 is designed for businesses in New York seeking to apply for the START UP NY Tax Elimination Credit. This credit is aimed at encouraging new businesses to establish operations in designated areas of the state. By utilizing this form, eligible businesses can potentially eliminate their corporate income tax liability for a specified period, promoting growth and job creation in New York.

Steps to Complete the Form IT 638

Completing the Form IT 638 involves several key steps:

- Gather necessary information about your business, including your Employer Identification Number (EIN) and details about your business location.

- Ensure you meet the eligibility criteria, which includes being a qualified business in a designated START UP NY zone.

- Fill out the form accurately, providing all required information about your business operations and tax status.

- Review the completed form for accuracy before submission to avoid delays in processing.

Eligibility Criteria for the Form IT 638

To qualify for the START UP NY Tax Elimination Credit, businesses must meet specific eligibility criteria. These include:

- Establishing a new business or expanding an existing one within a designated START UP NY zone.

- Creating new jobs within the state as a result of the business operations.

- Operating in a qualified industry, such as technology, manufacturing, or research.

Required Documents for Form IT 638 Submission

When submitting the Form IT 638, businesses must provide certain documents to support their application. These typically include:

- Proof of business registration in New York.

- Documentation demonstrating the creation of new jobs.

- Financial statements or tax returns to validate the business's income status.

Filing Deadlines for the Form IT 638

It is essential to be aware of the filing deadlines for the Form IT 638 to ensure timely submission. Typically, the form must be filed by:

- The due date of the corporate tax return for the tax year in which the credit is being claimed.

- Extensions may be available, but it is crucial to check with the New York State Department of Taxation and Finance for specific dates.

Application Process and Approval Time for Form IT 638

The application process for the Form IT 638 involves submitting the completed form along with all required documentation to the appropriate tax authority. After submission, businesses can expect:

- A review period during which the tax authority verifies the information provided.

- Notification of approval or denial, which can take several weeks depending on the volume of applications.

Quick guide on how to complete form it 638 start up ny tax elimination credit tax year

Complete Form IT 638 START UP NY Tax Elimination Credit Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form IT 638 START UP NY Tax Elimination Credit Tax Year on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form IT 638 START UP NY Tax Elimination Credit Tax Year without hassle

- Obtain Form IT 638 START UP NY Tax Elimination Credit Tax Year and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 638 START UP NY Tax Elimination Credit Tax Year and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 638 start up ny tax elimination credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 638 start up ny tax elimination credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax elimination, and how can airSlate SignNow help?

Tax elimination refers to strategies that aim to reduce your tax burden. With airSlate SignNow, businesses can streamline their document processes, enabling efficient management of compliance documents that relate to tax elimination strategies. This can save time and resources, allowing you to focus on maximizing your savings.

-

How does airSlate SignNow ensure secure signing for tax-related documents?

airSlate SignNow employs advanced encryption and industry-leading security protocols to ensure that your tax elimination documents are signed securely. This means that sensitive financial information is protected, giving you peace of mind while taking advantage of tax elimination strategies.

-

What features does airSlate SignNow offer for document management related to tax elimination?

airSlate SignNow provides features such as customizable templates, automated workflows, and comprehensive tracking that enhance document management for tax elimination. These tools simplify the process of preparing and organizing tax-related documents, making it easier to implement your tax elimination plans.

-

Is airSlate SignNow a cost-effective solution for businesses looking at tax elimination?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses pursuing tax elimination. Our pricing plans offer flexibility and scalability, ensuring that you can manage your document workflows without overspending while optimizing opportunities for tax savings.

-

What integrations does airSlate SignNow offer to support tax elimination processes?

airSlate SignNow seamlessly integrates with popular accounting and CRM software, streamlining your tax elimination processes even further. These integrations allow for easy access to client information and financial records, making documentation related to tax elimination quicker and more efficient.

-

Can I use airSlate SignNow for international tax elimination documents?

Absolutely! airSlate SignNow can be used for international tax elimination documents, allowing you to send and sign documents globally. Our solution supports multiple languages and currencies, making it an ideal tool for businesses dealing with cross-border tax strategies.

-

How does eSigning speed up the tax elimination process?

eSigning with airSlate SignNow accelerates the tax elimination process by allowing documents to be signed instantly, without the need for physical paperwork. This electronic signature solution minimizes delays, ensuring that you can implement your tax elimination strategies more rapidly and efficiently.

Get more for Form IT 638 START UP NY Tax Elimination Credit Tax Year

- Property 17 form

- Get the idaho will instructions mutual wills for married form

- Second will is for wife form

- Property 18 form

- Or state in both which will is to control form

- Property 10 form

- In the event i name a person in this article and said person predeceases me the form

- Signed by husband testator form

Find out other Form IT 638 START UP NY Tax Elimination Credit Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors