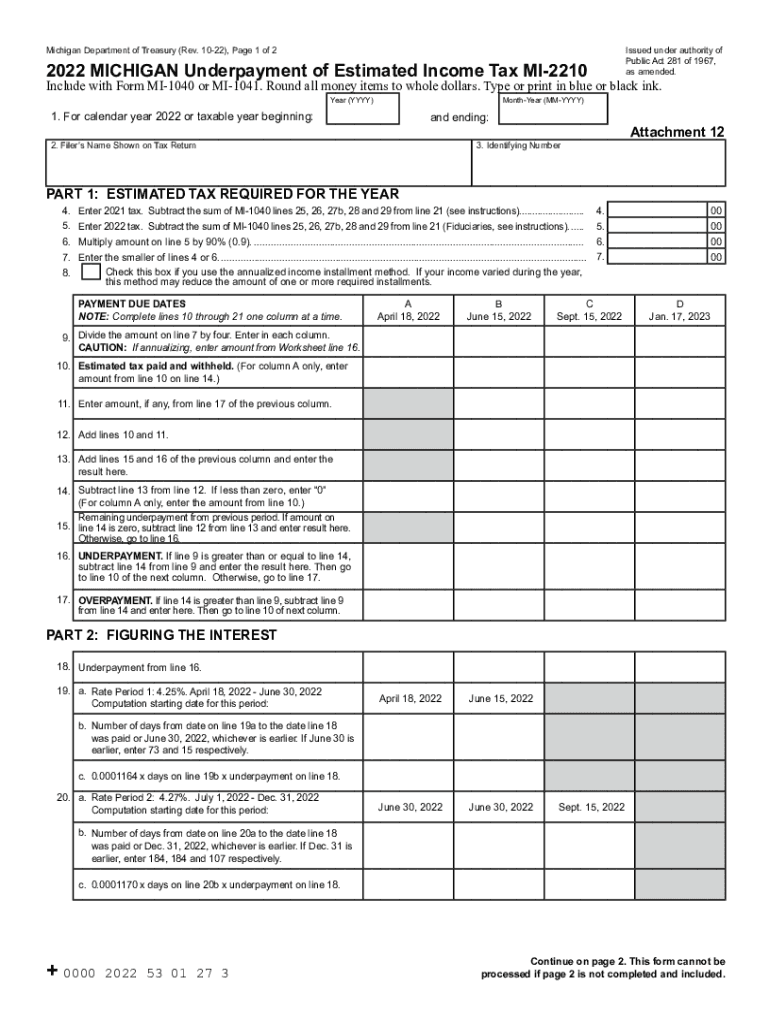

Income Subject to Tax Withholding; Estimated Payments 2022

Understanding the Income Subject to Tax Withholding

The income subject to tax withholding includes various types of earnings that are taxed at the source before they are received by the taxpayer. This can encompass wages, salaries, bonuses, and other forms of compensation. In Michigan, understanding what constitutes taxable income is essential for accurately completing the Michigan MI underpayment tax forms.

Additionally, estimated payments may be required if taxpayers expect to owe a certain amount in taxes at the end of the year. This typically applies to self-employed individuals or those with significant income not subject to withholding. Knowing the specifics of what income is subject to withholding helps ensure compliance with state tax laws.

Steps to Complete the Income Subject to Tax Withholding

Completing the income subject to tax withholding requires careful attention to detail. Here are the steps to follow:

- Gather all relevant income documents, including W-2 forms, 1099 forms, and any other records of income received.

- Determine the total amount of income that is subject to withholding. This includes all taxable earnings for the year.

- Calculate the estimated tax liability based on the applicable Michigan income tax rates.

- Complete the appropriate forms, ensuring that all income is accurately reported.

- Review the completed forms for accuracy before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Michigan MI underpayment tax to avoid penalties. Generally, tax returns are due on April fifteenth for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, estimated tax payments are typically due quarterly, with specific dates set by the Michigan Department of Treasury.

Required Documents for Filing

When filing the Michigan MI underpayment tax, certain documents are necessary to ensure a smooth process. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any other income sources

- Previous year's tax return for reference

Having these documents prepared in advance can help streamline the filing process and reduce the risk of errors.

Penalties for Non-Compliance

Failure to comply with Michigan tax laws regarding underpayment can result in significant penalties. Taxpayers may face fines and interest on any unpaid taxes. Additionally, the state may impose further penalties for late filings or underreporting income. Understanding these consequences underscores the importance of accurate and timely filing.

Digital vs. Paper Version of Forms

Taxpayers have the option to file their Michigan MI underpayment tax forms either digitally or via paper submission. Digital filing offers several advantages, including faster processing times and the ability to track the status of the submission. Conversely, paper filing may be preferred by those who are more comfortable with traditional methods. Regardless of the chosen method, ensuring that forms are completed accurately is paramount.

Quick guide on how to complete income subject to tax withholding estimated payments

Finalize Income Subject To Tax Withholding; Estimated Payments effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Income Subject To Tax Withholding; Estimated Payments on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Income Subject To Tax Withholding; Estimated Payments effortlessly

- Obtain Income Subject To Tax Withholding; Estimated Payments and then click Get Form to begin.

- Employ the tools we provide to complete your document.

- Highlight crucial sections of the documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors requiring new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign Income Subject To Tax Withholding; Estimated Payments and ensure top-notch communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income subject to tax withholding estimated payments

Create this form in 5 minutes!

How to create an eSignature for the income subject to tax withholding estimated payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'michigan mi underpayment' issue and how can airSlate SignNow assist?

The 'michigan mi underpayment' issue refers to concerns about insufficient payment amounts related to tax documents. airSlate SignNow allows you to quickly eSign and send documents to ensure compliance and accuracy in your financial documentation, addressing any potential underpayment issues effectively.

-

How does airSlate SignNow ensure compliance with 'michigan mi underpayment' regulations?

airSlate SignNow provides features that help businesses stay compliant with all relevant regulations, including those concerning 'michigan mi underpayment.' Our platform integrates with tax software to streamline document management, ensuring you meet your regulatory obligations.

-

What are the key features of airSlate SignNow for resolving 'michigan mi underpayment' concerns?

Key features of airSlate SignNow include customizable templates, secure eSigning, and automated reminders, which are vital for managing 'michigan mi underpayment' situations. These tools help ensure that documents are signed timely and correctly, reducing the risk of underpayment.

-

Is there a pricing model for airSlate SignNow that fits small businesses dealing with 'michigan mi underpayment'?

Yes, airSlate SignNow offers various pricing plans tailored for small businesses. Our cost-effective solutions are designed to help businesses address issues like 'michigan mi underpayment' without breaking the bank, providing essential features at competitive rates.

-

Can airSlate SignNow be integrated with other business tools for managing 'michigan mi underpayment'?

Absolutely! airSlate SignNow seamlessly integrates with various business tools, such as CRM and accounting software, making it easy to manage 'michigan mi underpayment' documents. These integrations ensure smooth workflows and efficient handling of financial documentation.

-

What are the benefits of using airSlate SignNow to handle 'michigan mi underpayment' notifications?

Using airSlate SignNow for 'michigan mi underpayment' notifications provides numerous benefits, including faster response times and improved collaboration. By automating the eSigning process, your team can focus on resolving issues rather than managing paperwork.

-

How quickly can I set up airSlate SignNow to address 'michigan mi underpayment' issues?

Setting up airSlate SignNow is quick and user-friendly, allowing you to start addressing 'michigan mi underpayment' issues within minutes. With simple onboarding processes, you can swiftly implement our solutions and enhance your document management strategy.

Get more for Income Subject To Tax Withholding; Estimated Payments

- Tn warranty deed form

- Warranty estate form

- Life estate remainder form

- Interrogatories 497326654 form

- Tn interrogatories 497326655 form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant tennessee form

- Deed life estate 497326657 form

- Tennessee warranty deed 497326658 form

Find out other Income Subject To Tax Withholding; Estimated Payments

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA