MI 2210, MICHIGAN Underpayment of Estimated Income Tax 2024-2026

What is the MI 2210, Michigan Underpayment of Estimated Income Tax

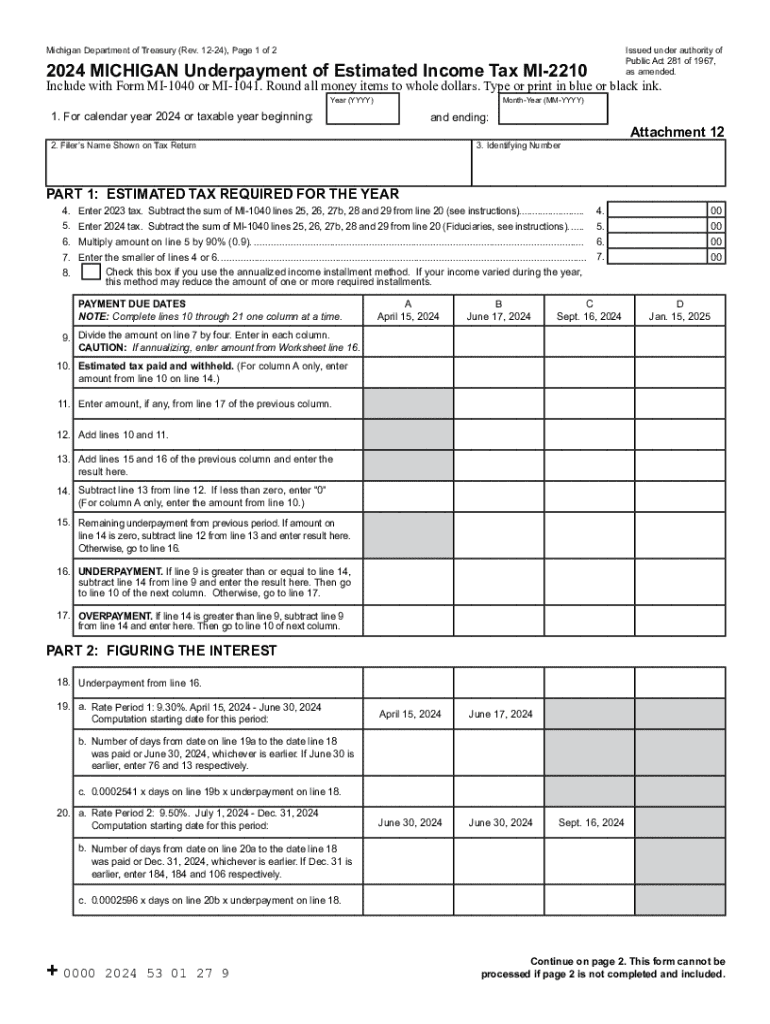

The MI 2210 form is utilized by Michigan taxpayers to determine whether they have underpaid their estimated income tax for the year. This form is essential for individuals who did not pay enough tax throughout the year, either through withholding or estimated payments. It helps taxpayers calculate any penalties they may owe for underpayment, ensuring compliance with state tax regulations.

How to Use the MI 2210, Michigan Underpayment of Estimated Income Tax

To effectively use the MI 2210 form, taxpayers should first gather their income information and any relevant tax documents. The form guides users through the process of calculating their estimated tax payments and determining if they owe a penalty. It is important to follow the instructions carefully, ensuring all calculations are accurate to avoid unnecessary penalties.

Steps to Complete the MI 2210, Michigan Underpayment of Estimated Income Tax

Completing the MI 2210 involves several key steps:

- Gather all income and tax documents, including W-2s and 1099s.

- Calculate your total income for the year.

- Determine your total tax liability based on your income.

- Review your estimated tax payments made throughout the year.

- Fill out the MI 2210 form, following the instructions for each section.

- Submit the completed form to the Michigan Department of Treasury.

Key Elements of the MI 2210, Michigan Underpayment of Estimated Income Tax

Key elements of the MI 2210 include sections for reporting income, tax liability, and estimated payments. Taxpayers must also provide information on any penalties calculated based on their underpayment. The form requires accurate reporting to ensure that taxpayers are held accountable for their tax obligations while also allowing for any necessary adjustments.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the MI 2210 form. Typically, the form should be filed by the same deadline as the annual tax return, which is usually April fifteenth. If additional time is needed, taxpayers may request an extension, but they should still estimate and pay any owed taxes by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the MI 2210 form or to pay the appropriate estimated taxes can result in penalties. The Michigan Department of Treasury may impose fines based on the amount of underpayment and the duration of the non-compliance. It is crucial for taxpayers to understand these potential penalties to avoid unexpected financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct mi 2210 michigan underpayment of estimated income tax

Create this form in 5 minutes!

How to create an eSignature for the mi 2210 michigan underpayment of estimated income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI 2210 form and why is it important?

The MI 2210 form is a Michigan tax form used to calculate underpayment penalties for individuals. It is important for taxpayers to understand this form to avoid unnecessary penalties and ensure compliance with state tax laws.

-

How can airSlate SignNow help with the MI 2210 form?

airSlate SignNow simplifies the process of completing and submitting the MI 2210 form by allowing users to eSign documents securely and efficiently. This ensures that your tax forms are submitted on time and with the necessary signatures.

-

Is there a cost associated with using airSlate SignNow for the MI 2210 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that streamline the completion and submission of the MI 2210 form, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the MI 2210 form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These features make it easy to manage the MI 2210 form and other important documents efficiently.

-

Can I integrate airSlate SignNow with other software for the MI 2210 form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with the MI 2210 form. This integration allows for better data management and streamlined processes.

-

What are the benefits of using airSlate SignNow for the MI 2210 form?

Using airSlate SignNow for the MI 2210 form offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are handled efficiently and securely, allowing you to focus on your business.

-

How secure is airSlate SignNow when handling the MI 2210 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the MI 2210 form. You can trust that your sensitive information is safe while using our platform.

Get more for MI 2210, MICHIGAN Underpayment Of Estimated Income Tax

Find out other MI 2210, MICHIGAN Underpayment Of Estimated Income Tax

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later