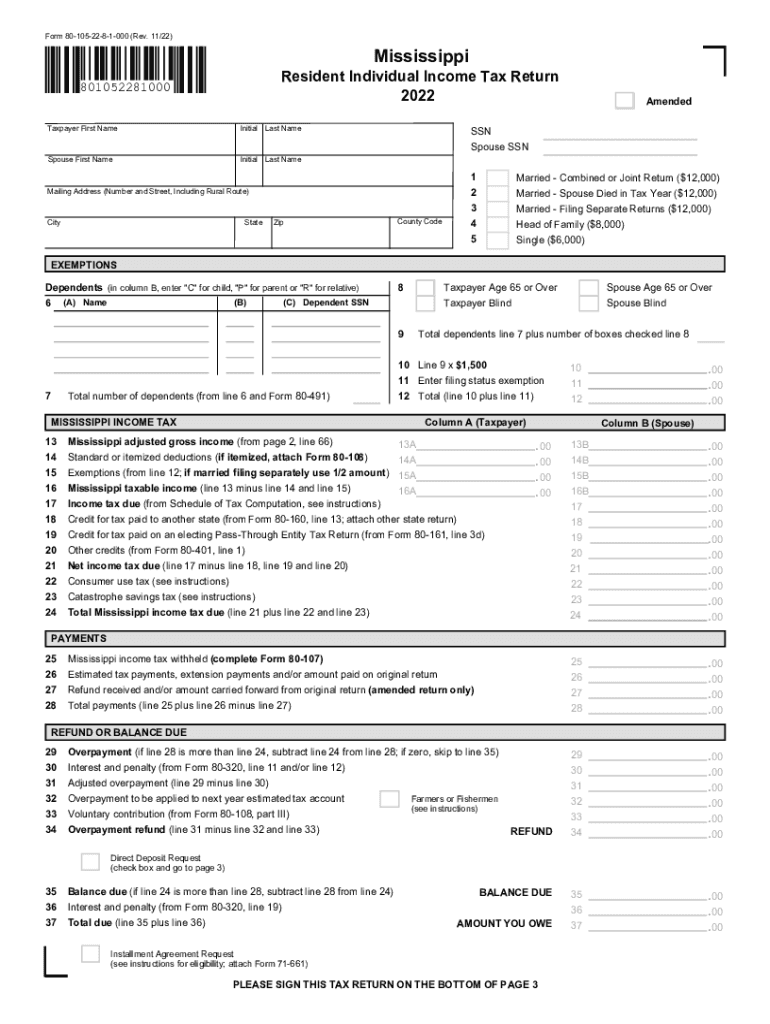

Individual Income Tax Interest and Penalty Worksheet 2022

What is the Individual Income Tax Interest and Penalty Worksheet?

The Individual Income Tax Interest and Penalty Worksheet is a crucial document for taxpayers in Mississippi who may have incurred interest or penalties on their state income tax. This worksheet helps individuals calculate the amount of interest and penalties owed due to underpayment or late payment of taxes. Understanding this worksheet is essential for ensuring compliance with Mississippi tax laws and avoiding further penalties.

How to Use the Individual Income Tax Interest and Penalty Worksheet

To effectively use the Individual Income Tax Interest and Penalty Worksheet, taxpayers should follow these steps:

- Gather all relevant tax documents, including your 2022 Mississippi return and any notices from the Department of Revenue.

- Identify the period for which you are calculating interest and penalties, typically based on the due date of your tax return.

- Follow the instructions on the worksheet to input your tax liability, payments made, and any applicable credits.

- Calculate the interest and penalties based on the rates provided in the worksheet.

Steps to Complete the Individual Income Tax Interest and Penalty Worksheet

Completing the Individual Income Tax Interest and Penalty Worksheet involves several key steps:

- Enter your total tax liability for the year on the designated line.

- Document any payments made towards your tax liability, including estimated payments and credits.

- Calculate the difference between your tax liability and payments to determine any outstanding balance.

- Use the interest and penalty rates provided in the worksheet to compute the total amount owed.

Legal Use of the Individual Income Tax Interest and Penalty Worksheet

The Individual Income Tax Interest and Penalty Worksheet is legally recognized as a valid method for calculating owed amounts in Mississippi. It complies with state tax regulations, ensuring that taxpayers can accurately report their liabilities. Proper completion of this worksheet can help mitigate penalties and demonstrate a taxpayer's commitment to compliance.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the Individual Income Tax Interest and Penalty Worksheet. The due date for filing the Mississippi income tax return typically falls on April 15. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Penalties for Non-Compliance

Failure to complete the Individual Income Tax Interest and Penalty Worksheet accurately or to pay the calculated amounts can result in significant penalties. Mississippi imposes interest on unpaid taxes, which accrues daily. Additionally, taxpayers may face further penalties for late filings or underpayment, emphasizing the importance of timely and accurate tax reporting.

Quick guide on how to complete individual income tax interest and penalty worksheet

Complete Individual Income Tax Interest And Penalty Worksheet effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed files, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the features needed to create, modify, and eSign your documents swiftly and without delays. Manage Individual Income Tax Interest And Penalty Worksheet on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Individual Income Tax Interest And Penalty Worksheet with ease

- Find Individual Income Tax Interest And Penalty Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the document or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Individual Income Tax Interest And Penalty Worksheet and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax interest and penalty worksheet

Create this form in 5 minutes!

How to create an eSignature for the individual income tax interest and penalty worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing for 2022 MS Income solutions?

AirSlate SignNow offers competitive pricing tailored to businesses handling 2022 MS income. Different plans are available depending on the features you need, such as document eSigning and collaboration tools. You can choose a monthly or annual subscription that best suits your budget and business requirements.

-

How does airSlate SignNow enhance productivity for managing 2022 MS income documents?

AirSlate SignNow streamlines the process of managing documents related to 2022 MS income by allowing users to send, eSign, and share files quickly and securely. The platform automates workflows and reduces the need for paper-based processes, which saves time and enhances overall productivity. Users can easily track their documents and obtain the necessary signatures without delays.

-

What features does airSlate SignNow offer for handling 2022 MS income?

AirSlate SignNow provides a variety of features specifically designed for handling 2022 MS income documentation, such as customizable templates, secure cloud storage, and multi-party signing. Furthermore, the platform supports real-time collaboration, allowing multiple users to work on the same document simultaneously, which streamlines the review and approval process.

-

Is it easy to integrate airSlate SignNow with other software for 2022 MS income management?

Yes, airSlate SignNow offers seamless integrations with various applications commonly used for managing 2022 MS income, such as CRM systems, productivity tools, and cloud storage services. This ensures that you can connect your workflow easily and access all necessary tools from one platform. The integration process is user-friendly and supported by comprehensive documentation.

-

What benefits does airSlate SignNow provide for businesses managing 2022 MS income?

Using airSlate SignNow for managing 2022 MS income offers several benefits, including increased efficiency, improved accuracy, and enhanced security. Businesses can reduce turnaround time on documents and minimize errors associated with manual processing. Additionally, the platform uses advanced encryption to protect sensitive income data and ensures compliance with relevant regulations.

-

Can airSlate SignNow help with mobile document management for 2022 MS income?

Absolutely! AirSlate SignNow includes a mobile-friendly interface that allows users to manage documents related to 2022 MS income on the go. The mobile app enables you to send, sign, and store documents from your smartphone or tablet, making it perfect for professionals who need to act quickly while away from their desks.

-

What security measures does airSlate SignNow have for 2022 MS income transactions?

AirSlate SignNow employs high-level security measures to safeguard documents associated with 2022 MS income. This includes data encryption, multi-factor authentication, and secure access controls to ensure that only authorized users have access to sensitive information. Regular security audits are conducted to maintain compliance with industry standards.

Get more for Individual Income Tax Interest And Penalty Worksheet

- Texas liens 497327287 form

- Quitclaim deed form download

- Warranty deed from individual to individual texas form

- Warranty deed from two individuals to two individuals texas form

- Enhanced life estate or lady bird quitclaim deed from individual to two individuals or husband and wife texas form

- Texas warranty deed form

- Retainage form

- Gift deed form 497327294

Find out other Individual Income Tax Interest And Penalty Worksheet

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe