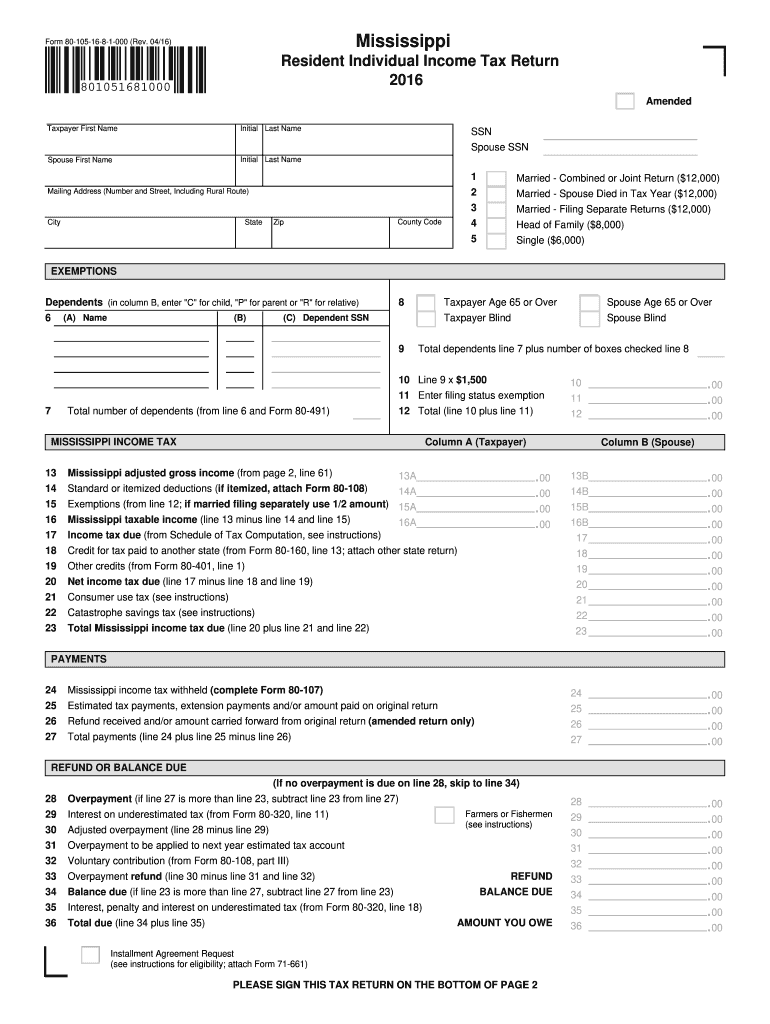

Mississippi Resident Individual Income Tax Return 2016

What is the Mississippi Resident Individual Income Tax Return

The Mississippi Resident Individual Income Tax Return, often referred to as the form 80, is a critical document for individuals residing in Mississippi who need to report their income and calculate their tax obligations. This form is utilized by residents to declare their earnings, claim deductions, and determine the amount of tax owed to the state. It is essential for ensuring compliance with state tax laws and contributes to the funding of public services within Mississippi.

Steps to complete the Mississippi Resident Individual Income Tax Return

Completing the Mississippi Resident Individual Income Tax Return involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand the requirements and any updates for the tax year.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include both earned and unearned income.

- Claim eligible deductions and credits, which can reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Mississippi Resident Individual Income Tax Return

The Mississippi Resident Individual Income Tax Return is legally binding and must be filed accurately to avoid penalties. Submitting this form signifies that the information provided is true and correct to the best of the taxpayer's knowledge. Failing to comply with tax laws can result in fines, interest on unpaid taxes, and potential legal action from the state. Therefore, it is crucial to understand the legal implications of filing the form and to ensure all information is reported honestly.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Mississippi Resident Individual Income Tax Return to avoid late penalties. Typically, the deadline for filing this return is April 15 of each year, aligning with the federal tax deadline. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable for taxpayers to mark their calendars and prepare their documents in advance to meet these important dates.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Mississippi Resident Individual Income Tax Return. Taxpayers can choose to file online using approved e-filing software, which is often the fastest and most convenient option. Alternatively, forms can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to select the option that best fits the taxpayer's needs.

Required Documents

To successfully complete the Mississippi Resident Individual Income Tax Return, certain documents are required. These typically include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation for any deductions or credits claimed, such as receipts or statements.

Having these documents organized and readily available will facilitate a smoother filing process.

Quick guide on how to complete mississippi resident individual income tax return 2016

Complete Mississippi Resident Individual Income Tax Return effortlessly on any gadget

Online document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Mississippi Resident Individual Income Tax Return across any platform with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign Mississippi Resident Individual Income Tax Return without stress

- Obtain Mississippi Resident Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Mississippi Resident Individual Income Tax Return and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mississippi resident individual income tax return 2016

Create this form in 5 minutes!

How to create an eSignature for the mississippi resident individual income tax return 2016

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is form 80 105 2016 used for?

Form 80 105 2016 is primarily used for various document verification processes. This form helps in the efficient management and authentication of critical documents, ensuring an easy workflow for businesses. Using airSlate SignNow, users can seamlessly integrate this form into their digital signing processes.

-

How can I access form 80 105 2016 on airSlate SignNow?

Accessing form 80 105 2016 on airSlate SignNow is straightforward. Simply log in to your account, navigate to the templates section, and you can easily find or upload the necessary form for your signing needs. This ensures a smooth experience when sending out documents for eSignature.

-

What are the pricing options for using form 80 105 2016 with airSlate SignNow?

airSlate SignNow offers various pricing plans that accommodate different business needs. Each plan includes the ability to use form 80 105 2016 and other essential features, ensuring cost-effective solutions for document management. You can review the pricing options on our website for more detailed information.

-

What features does airSlate SignNow offer for form 80 105 2016?

AirSlate SignNow offers extensive features for managing form 80 105 2016, including eSignature options, document templates, and workflow automation. These features simplify the process of sending, signing, and tracking documents. With these tools, users can enhance productivity while ensuring compliance.

-

Can I integrate form 80 105 2016 with other applications?

Yes, airSlate SignNow allows for seamless integration of form 80 105 2016 with various third-party applications like Google Drive and Dropbox. This enhances your document management capabilities, allowing users to work within their preferred platforms. Integrations help maintain consistency and efficiency in workflows.

-

What are the benefits of using airSlate SignNow for form 80 105 2016?

Using airSlate SignNow for form 80 105 2016 provides numerous benefits, including increased efficiency, security, and cost savings. The platform simplifies the signing process, reducing turnaround times. Additionally, airSlate SignNow’s secure document handling ensures that your sensitive information remains protected.

-

How does airSlate SignNow ensure the security of form 80 105 2016?

AirSlate SignNow employs advanced security measures to protect form 80 105 2016 during the eSigning process. This includes encryption, secure access controls, and compliance with industry standards. Users can confidently share and sign documents, knowing their information is safeguarded.

Get more for Mississippi Resident Individual Income Tax Return

Find out other Mississippi Resident Individual Income Tax Return

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word