AMENDED TAX RETURN Comptroller of Maryland 2021

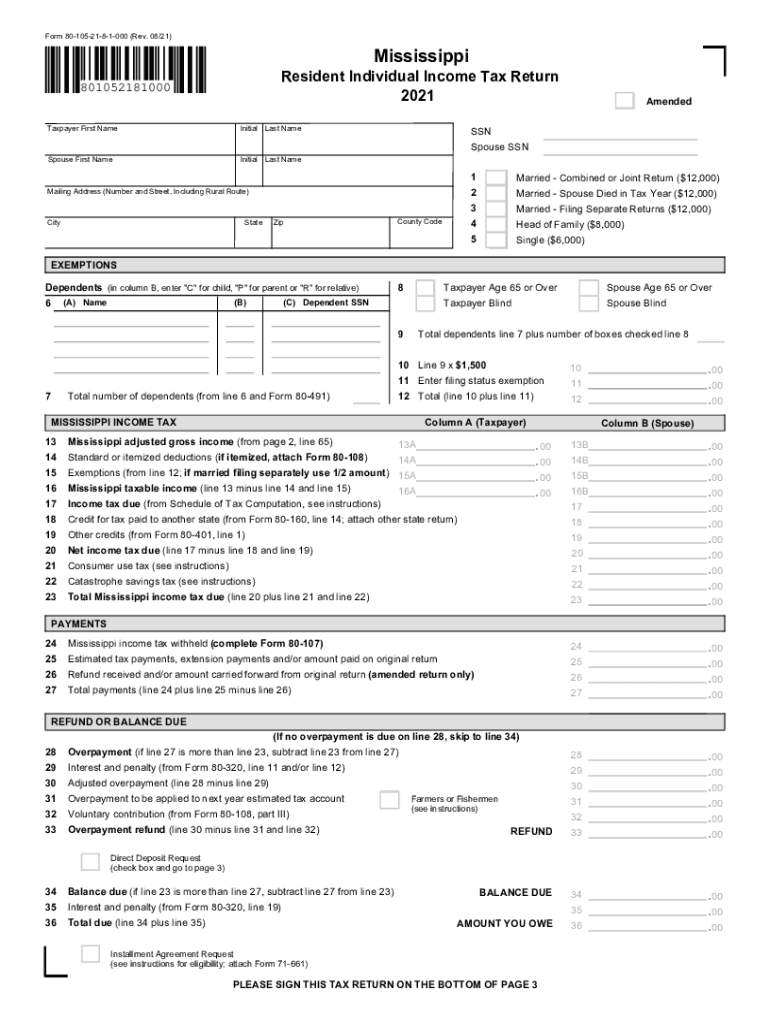

What is the 2020 80 105 form?

The 2020 80 105 form is a tax document used by residents of Mississippi to report their individual income tax. This form is essential for individuals who need to amend their tax returns or provide additional information to the Mississippi Department of Revenue. It allows taxpayers to correct any errors or omissions from their original filings, ensuring compliance with state tax regulations.

Steps to complete the 2020 80 105 form

Completing the 2020 80 105 form involves several key steps:

- Gather all necessary documentation, including your original tax return and any supporting documents related to the changes you wish to make.

- Clearly indicate the changes on the form, ensuring that each correction is well-documented.

- Double-check all entries for accuracy to avoid further amendments or penalties.

- Sign and date the form to validate your submission.

Legal use of the 2020 80 105 form

The 2020 80 105 form is legally recognized for amending tax returns in Mississippi. To ensure its legal standing, the form must be completed accurately and submitted within the designated time frames set by the Mississippi Department of Revenue. Adhering to these guidelines helps prevent any potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

Timely filing of the 2020 80 105 form is crucial. The deadline for submitting amended returns typically aligns with the original tax return deadlines. It is important to check the Mississippi Department of Revenue's website or contact them directly for specific dates related to the 2020 tax year to ensure compliance and avoid penalties.

Required Documents

When completing the 2020 80 105 form, you will need to gather specific documents to support your amendments:

- Your original tax return for the year 2020.

- Any W-2s, 1099s, or other income statements relevant to the amendments.

- Documentation that justifies the changes, such as receipts or additional forms.

Penalties for Non-Compliance

Failure to file the 2020 80 105 form correctly or on time can result in penalties imposed by the Mississippi Department of Revenue. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the implications of non-compliance and ensure that all tax obligations are met promptly.

Quick guide on how to complete amended tax return comptroller of maryland

Effortlessly prepare AMENDED TAX RETURN Comptroller Of Maryland on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and physically signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any delays. Manage AMENDED TAX RETURN Comptroller Of Maryland on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Easily modify and eSign AMENDED TAX RETURN Comptroller Of Maryland without hassle

- Obtain AMENDED TAX RETURN Comptroller Of Maryland and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or a shared link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes requiring the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign AMENDED TAX RETURN Comptroller Of Maryland to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct amended tax return comptroller of maryland

Create this form in 5 minutes!

How to create an eSignature for the amended tax return comptroller of maryland

The way to generate an e-signature for your PDF file in the online mode

The way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the 2020 80 105 form?

The 2020 80 105 form is a document often required for various business and legal transactions. It facilitates essential information exchange and streamlines the signing process. Using airSlate SignNow, you can easily prepare, send, and electronically sign this form.

-

How can airSlate SignNow help with the 2020 80 105 form?

AirSlate SignNow provides a user-friendly platform to manage your 2020 80 105 form effortlessly. You can upload the form, send it for signatures, and track its status all in one place. This integration helps save time and ensures your documents are legally binding.

-

What features does airSlate SignNow offer for managing the 2020 80 105 form?

AirSlate SignNow offers various features for the 2020 80 105 form, including document templates, customizable workflows, and real-time tracking. The platform also allows you to set reminders and follow-ups, ensuring timely completion of the signing process. These features enhance efficiency and compliance in your document management.

-

Is there a cost associated with using airSlate SignNow for the 2020 80 105 form?

Yes, airSlate SignNow has various pricing plans tailored to fit different business needs, including features suitable for managing the 2020 80 105 form. The subscription is cost-effective compared to traditional signing methods, often saving businesses money in the long run. You can choose a plan that best aligns with your volume of documents.

-

Can I integrate airSlate SignNow with other applications for the 2020 80 105 form?

Absolutely! AirSlate SignNow offers seamless integrations with popular HR, CRM, and project management tools, allowing you to automate workflows involving the 2020 80 105 form. This ensures that data flows seamlessly between your applications, saving time and reducing errors during document management.

-

How secure is the signing process for the 2020 80 105 form?

The signing process for the 2020 80 105 form through airSlate SignNow is highly secure. The platform uses advanced encryption and security measures to protect your documents and signatures. This commitment to security ensures that all transactions are confidential and compliant with legal standards.

-

Can I track the status of my 2020 80 105 form using airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features for your 2020 80 105 form. You can see when the document has been viewed and signed, ensuring transparency in the signing process. This feature helps you stay informed and manage your documents effectively.

Get more for AMENDED TAX RETURN Comptroller Of Maryland

- Resolution directing hearing on proposed approval of combination redevelopment plan and tax increment financing plan mississippi form

- Resolution approving a combination redevelopment plan and tax increment financing plan mississippi form

- Mississippi tif form

- Complaint mississippi 497314764 form

- Amended answer mississippi 497314765 form

- Motion summary judgment pdf form

- Mississippi motion summary judgment 497314767 form

- Mississippi trespass form

Find out other AMENDED TAX RETURN Comptroller Of Maryland

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document