Form 80 105 23 8 1 000 Rev 2023

What is the Form 80-105?

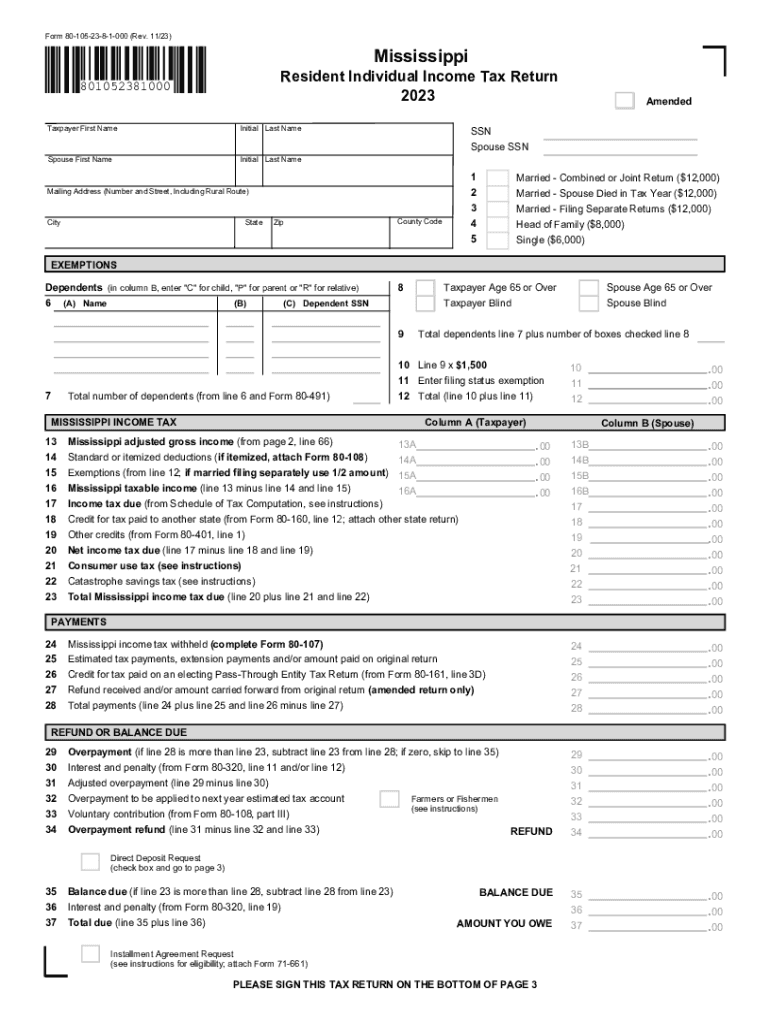

The Form 80-105 is a tax return form used by residents of Mississippi to report their income and calculate their tax liability for the tax year 2023. This form is essential for individuals to ensure compliance with state tax regulations. It gathers information about various income sources, deductions, and credits available to Mississippi taxpayers. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to obtain the Form 80-105

The Form 80-105 can be easily obtained through the Mississippi Department of Revenue's official website. Taxpayers can download a printable version of the form directly from the site. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure that the version being used is for the 2023 tax year to avoid any discrepancies.

Steps to complete the Form 80-105

Completing the Form 80-105 involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any relevant receipts.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Form 80-105

The Form 80-105 is legally required for Mississippi residents to report their income for state tax purposes. Filing this form accurately and on time helps taxpayers comply with state tax laws. Failure to file or inaccuracies in the form can lead to penalties, interest on unpaid taxes, and potential legal issues. It is essential to understand the legal implications of submitting this form to avoid complications.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 80-105. For the 2023 tax year, the deadline for submission is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates to ensure timely filing and avoid penalties.

Required Documents

To complete the Form 80-105, certain documents are necessary:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as rental income.

- Receipts for deductible expenses, like medical expenses or charitable contributions.

Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete form 80 105 23 8 1 000 rev

Effortlessly Prepare Form 80 105 23 8 1 000 Rev on Any Device

Digital document management has become increasingly favored by both enterprises and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Manage Form 80 105 23 8 1 000 Rev on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form 80 105 23 8 1 000 Rev with Ease

- Find Form 80 105 23 8 1 000 Rev and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure confidential information with features that airSlate SignNow specifically offers for that purpose.

- Craft your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and hit the Done button to save your edits.

- Select how you'd like to share your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 80 105 23 8 1 000 Rev while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 80 105 23 8 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 80 105 23 8 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing my 2020 Mississippi return with airSlate SignNow?

Filing your 2020 Mississippi return with airSlate SignNow is straightforward. Simply upload your tax documents securely, eSign them, and send them to the appropriate Mississippi tax authorities. Our platform ensures your documents are legally compliant and safely stored.

-

Are there any costs associated with eSigning my 2020 Mississippi return?

Yes, there are costs associated with using airSlate SignNow for your 2020 Mississippi return. However, our pricing is competitive and designed to provide a cost-effective solution for businesses. You can choose a plan that best fits your needs for seamless eSigning.

-

What features does airSlate SignNow offer for managing my 2020 Mississippi return?

airSlate SignNow offers a range of features, including secure document storage, customizable templates, and audit trails, specifically designed to help you manage your 2020 Mississippi return. These features ensure a streamlined and legally sound process for eSigning and sending documents.

-

Can I use airSlate SignNow to collaborate with my tax advisor on my 2020 Mississippi return?

Absolutely! With airSlate SignNow, you can easily collaborate with your tax advisor on your 2020 Mississippi return. You can share documents, collect signatures, and communicate effectively, ensuring that everything is in order before submission.

-

Is airSlate SignNow compliant with Mississippi state regulations for my 2020 return?

Yes, airSlate SignNow is compliant with Mississippi state regulations for eSigning your 2020 return. We adhere to the latest legal standards, providing you with confidence that your electronically signed documents meet all necessary requirements.

-

How does airSlate SignNow enhance the security of my 2020 Mississippi return?

airSlate SignNow enhances the security of your 2020 Mississippi return by utilizing advanced encryption and secure document storage. Our platform protects sensitive information through multiple layers of security, so you can eSign and submit your documents worry-free.

-

What types of documents can I eSign for my 2020 Mississippi return?

You can eSign various types of documents for your 2020 Mississippi return using airSlate SignNow, including tax forms, declarations, and supporting documents. Our platform allows you to handle all necessary paperwork in one convenient place, making the filing process seamless.

Get more for Form 80 105 23 8 1 000 Rev

- 8010str form

- Erecting a tenttemporary structure city of boston cityofboston form

- Certificate of good standing city of somerville somervillema form

- The 2015 2016 maryland official highway map maryland state form

- Maryland certification application county form

- Maine malt or wine label registration form

- Maine annual fundraising activity report form

- Mi transitory online form

Find out other Form 80 105 23 8 1 000 Rev

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile