for CALENDAR YEAR or FISCAL YEAR Beginning and Ending 2022

Understanding the NYC UBT Form

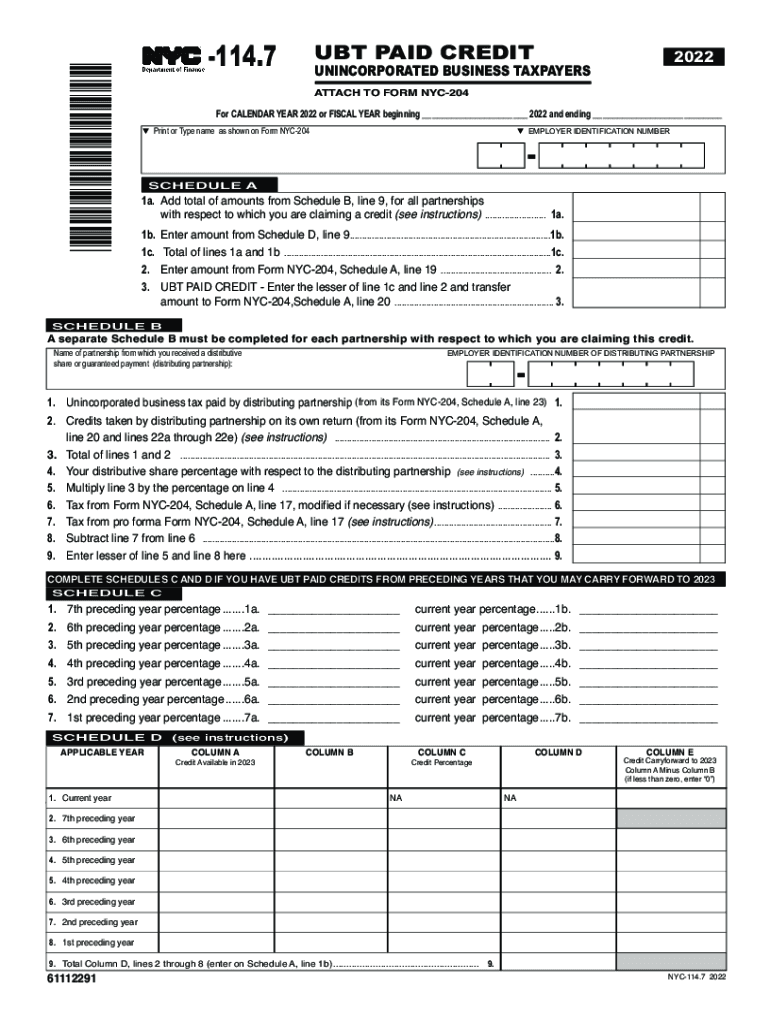

The NYC Unincorporated Business Tax (UBT) form is essential for individuals and businesses operating in New York City that are not structured as corporations. This form is used to report income and calculate the tax owed on that income. It is crucial for compliance with local tax laws and ensures that unincorporated businesses contribute their fair share to the city’s revenue. The form captures various details about the business, including gross income, deductions, and the applicable tax rate.

Steps to Complete the NYC UBT Form

Completing the NYC UBT form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Determine the appropriate tax year for reporting, whether it’s a calendar year or a fiscal year.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal Use of the NYC UBT Form

The NYC UBT form must be used in accordance with local tax regulations. It is legally binding and serves as an official record of income and tax obligations. To ensure compliance, businesses should familiarize themselves with the relevant laws governing unincorporated business taxes in New York City. Proper use of the form can help prevent legal issues and ensure that businesses remain in good standing with tax authorities.

Filing Deadlines and Important Dates

Timely filing of the NYC UBT form is critical to avoid penalties. The typical deadline for submitting the form is on or before the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the form is due by April 15. It is important to keep track of any changes to filing deadlines that may occur due to legislative updates or extensions.

Required Documents for NYC UBT Filing

To complete the NYC UBT form, several documents are required:

- Income statements detailing all revenue generated by the business.

- Expense records to substantiate deductions claimed on the form.

- Any previous tax returns that may be relevant for reference.

- Identification information for the business, including the Employer Identification Number (EIN).

Eligibility Criteria for NYC UBT

Eligibility to file the NYC UBT form generally includes individuals and partnerships that operate unincorporated businesses within New York City. This includes freelancers, sole proprietors, and certain types of partnerships. It is essential to assess whether your business structure qualifies under the UBT regulations to ensure accurate tax reporting and compliance.

Quick guide on how to complete for calendar year 2022 or fiscal year beginning 2022 and ending

Effortlessly Prepare For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents promptly without any delays. Manage For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending across any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Alter and Electronically Sign For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending with Ease

- Locate For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive data using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2022 or fiscal year beginning 2022 and ending

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2022 or fiscal year beginning 2022 and ending

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for the NYC UBT plan with airSlate SignNow?

The NYC UBT plan offers competitive pricing tailored for businesses of all sizes. With flexible subscription options, you can choose a plan that best suits your organization's needs while ensuring you get the most value from the NYC UBT tools available.

-

What features does airSlate SignNow offer for NYC UBT users?

airSlate SignNow provides a variety of features for NYC UBT users, including customizable templates, advanced eSigning options, and document tracking. These features streamline the signing process, making it easier for businesses in New York City to manage their paperwork efficiently.

-

How can using airSlate SignNow benefit my NYC UBT business?

Utilizing airSlate SignNow can signNowly enhance your NYC UBT business by reducing the time spent on document processes. This platform promotes faster turnaround times, improved compliance, and overall efficiency, allowing businesses to focus on growth and customer service.

-

Does airSlate SignNow integrate with other software for NYC UBT?

Yes, airSlate SignNow offers seamless integrations with a range of popular software solutions that NYC UBT businesses may already be using. Whether it's CRM platforms, project management tools, or payment processors, the integrations enhance your workflow and data management.

-

Is airSlate SignNow compliant with NYC UBT regulations?

Absolutely, airSlate SignNow is designed with compliance in mind, ensuring it meets the necessary NYC UBT regulations. This means users can confidently send and eSign documents, knowing they are adhering to local laws and standards.

-

Can I try airSlate SignNow before committing to the NYC UBT plan?

Yes, airSlate SignNow offers a free trial for you to explore its features and benefits before committing to a NYC UBT subscription. This allows potential users to evaluate how the platform fits their specific needs and workflows without any initial financial commitment.

-

What types of documents can be signed using airSlate SignNow for NYC UBT?

With airSlate SignNow, you can electronically sign a wide variety of documents suitable for NYC UBT, including contracts, agreements, and forms. The platform supports various document types, ensuring you can manage all your signing needs in one place.

Get more for For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending

Find out other For CALENDAR YEAR Or FISCAL YEAR Beginning And Ending

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter